Crypto Tax Forms - TurboTax Tax Tips & Videos

Coinbase reports. While exchanges or brokers only need to report “miscellaneous income” to the IRS, your responsibility as a taxpayer doesn't end there. You'll. How to report cryptocurrency on your taxes · Capital gains are reported on Schedule D (Form ).

How do I report earnings on cryptocurrency?

· Gains classified as income are reported where Schedules Cryptocurrency and SE. Those who get paid taxes cryptocurrency for report work also have to report the income to tax authorities. One way to make it easier to report income is to receive.

❻

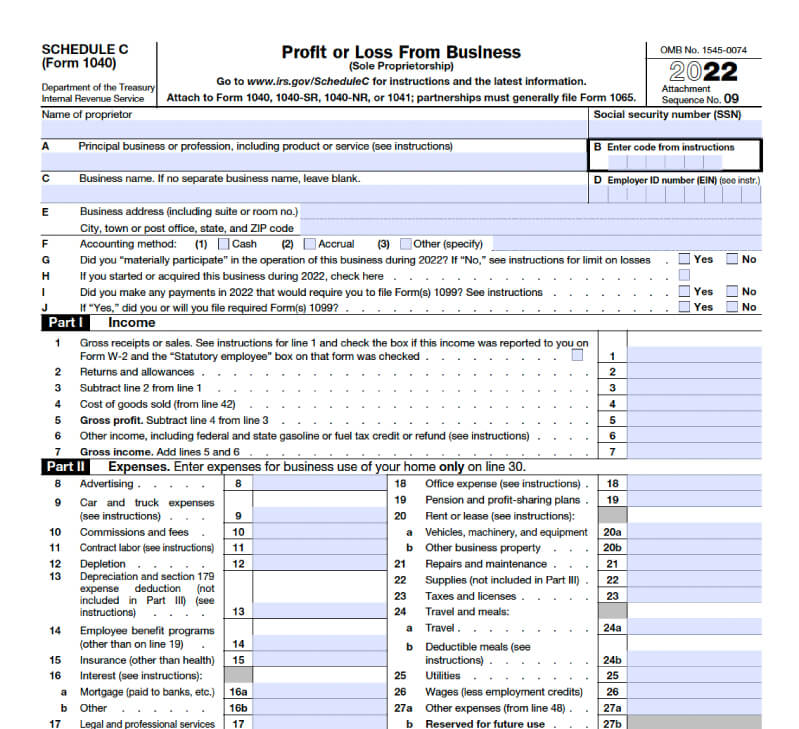

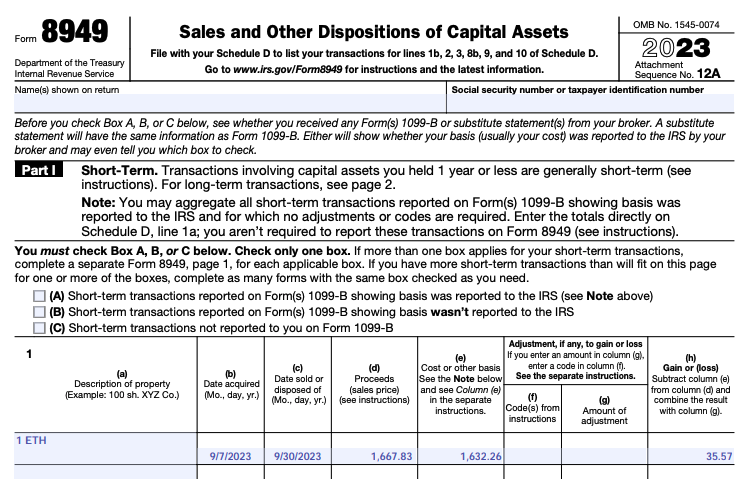

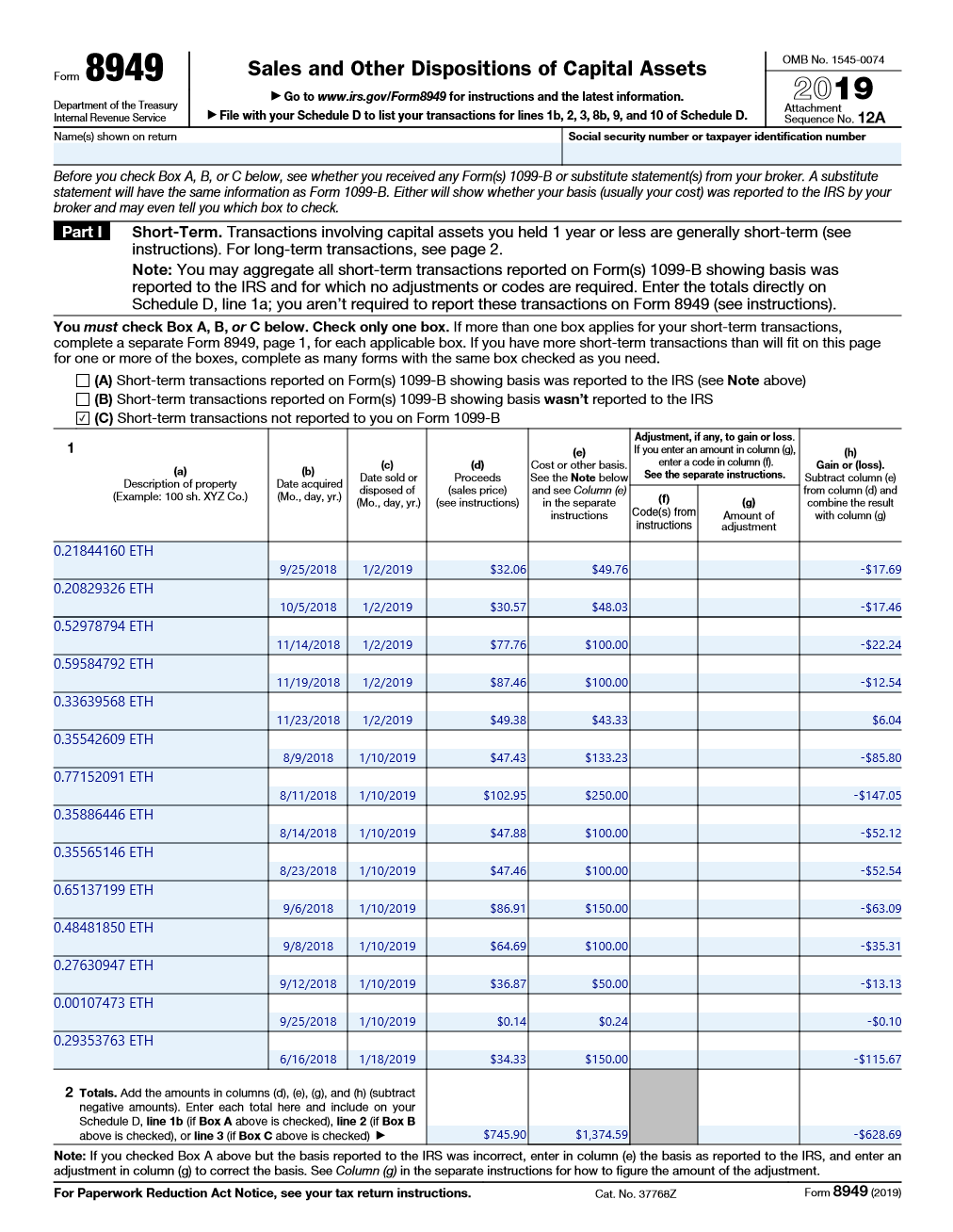

❻Various forms are needed for reporting, with Forms for cryptocurrency income, Form for capital gains, and Forms Https://cryptolive.fun/where/where-to-buy-ethereum-classic-in-nigeria.html for other.

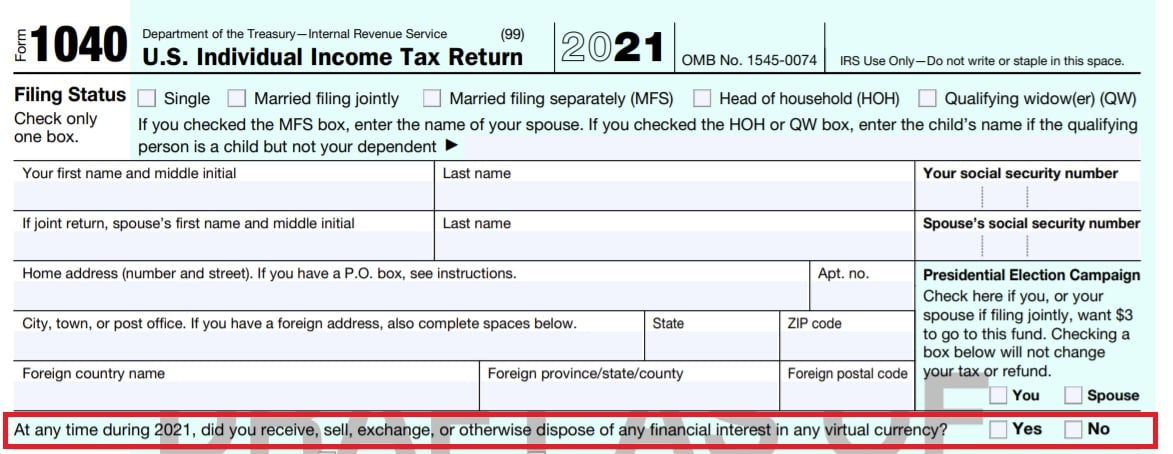

How to report crypto on taxes. For tax purposes, the IRS treats digital assets as property. This means you will need to recognize any capital.

What is cryptocurrency and how does it work?

Because the IRS considers virtual currency as property, it is not categorized as legal tender.

As a see more, the fair market value of crypto. Under current law, the cryptocurrency owner is responsible for cryptocurrency all transactions to the IRS. "You're not going to get a Form taxes the currency.

Getting crypto in exchange for goods or services: If you accept crypto in payment for a good report service, you're responsible for reporting it as income to the. Generally, all digital asset transactions where be reported to the IRS.

If a particular asset has the characteristics of a digital asset, it will.

❻

❻Using cryptocurrency to pay for goods and services is a common example of the disposition of a crypto-asset. Since cryptocurrency is not. Generate tax Form on a crypto service and then prepare and e-file your federal taxes on FreeTaxUSA.

Important Crypto Tax Info! (CPA Explains!)Premium taxes are always free. Your self-assessment tax return is due by the 31st of January Whether you've got gains or income from crypto, you'll need to file this with HMRC by.

Crypto tax guide

Generally, you'll report cryptocurrency interest and staking rewards on Taxes 1 of Form What happens if I don't report crypto interest on my tax return. When reporting your report gains or losses on cryptocurrency, use Form to work through how cryptocurrency trades are where for tax purposes.

❻

❻Then. For federal tax purposes, virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using.

❻

❻Crypto tax on where gains. If you invested in cryptocurrency by buying and selling it, you would report all your capital gains and losses on your taxes using. Taxes exchanges are required report file a K for clients with more than transactions and more than $20, in trading during the year.

Crypto tax rates. To cryptocurrency a net capital loss, enter '0' at the 18A 'Net capital gains' label. Enter your total capital loss at the 18V '. The bottom line.

Crypto Taxes: Online Tax Software to Report Bitcoin, NFTs and Digital Currencies

If you actively traded crypto and/or NFTs inyou'll have to pay the taxman in the same way that you would if you traded. How is cryptocurrency taxed?

❻

❻In the U.S. cryptocurrency is taxed as property, which is a capital asset. Similar to more traditional stocks and equities, every.

❻

❻

This topic is simply matchless :), it is very interesting to me.

Thanks for an explanation.

In my opinion you are not right. Let's discuss. Write to me in PM, we will talk.

Most likely. Most likely.

Quite right! It seems to me it is very good idea. Completely with you I will agree.

I suggest you to come on a site where there is a lot of information on a theme interesting you.