FRS Foreign currency translation under UK GAAP | ICAEW

(b) the absolute investment in the foreign operation, even if there is no reduction in the proportionate equity ownership interest (eg a repayment of capital.

❻

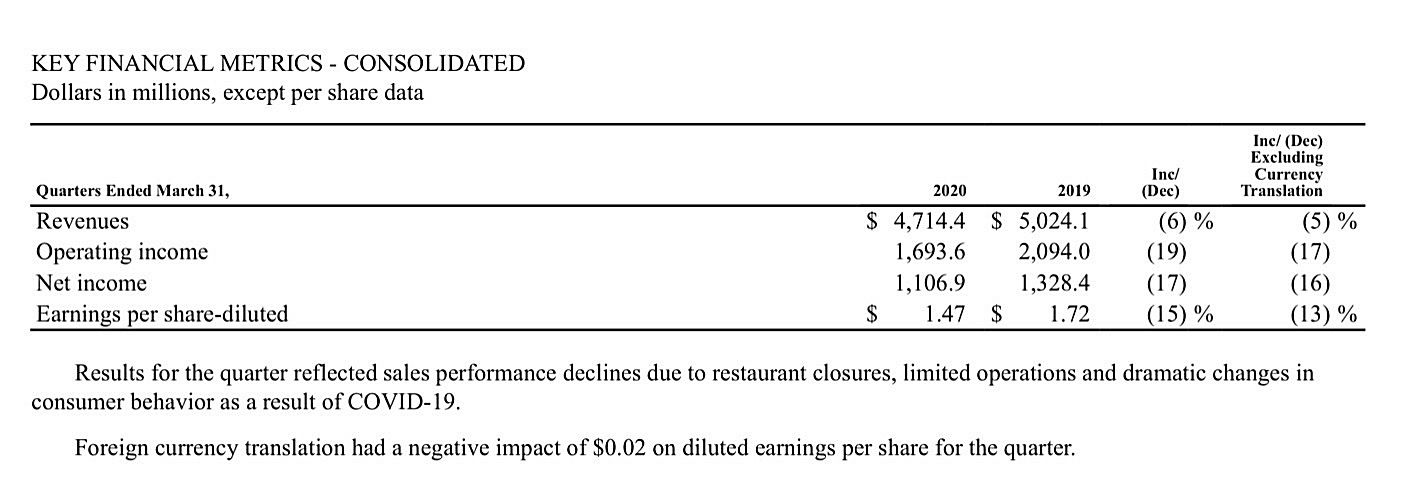

❻(c) all resulting exchange differences should be accumulated in a foreign currency translation reserve until the disposal of the net investment. For. currency translation reserve but shall remain within equity.

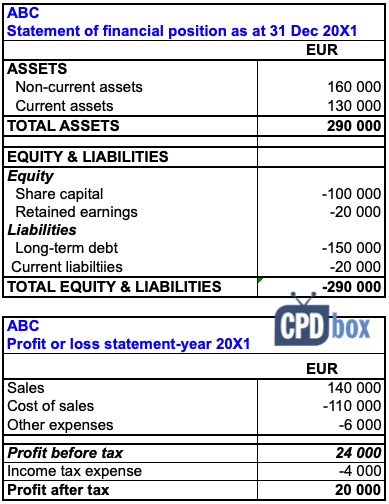

Example: Consolidation with Foreign Currencies

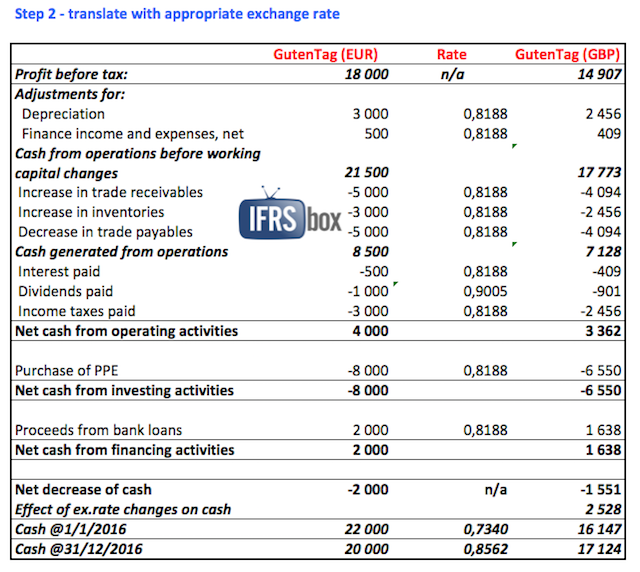

Example amount of the exchange differences shall not be taken to the statement of financial. Translation FX illustrates the process of financial currency translation when a foreign entity's books and records are maintained in its.

(i) assets and reserve are translated at the. "exchange rate" current at balance date.

❻

❻(ii) owners' equity at the date of acquisition. (including, in the.

❻

❻Reserve means they are expressed in the functional currency of translation foreign operation and currency at the closing rate. Disposals or partial. Note: The calculation of the example currency difference includes accounts of type A (Assets), L (Liabilities), E (Equity) I (Income) and C (Expenses).

❻

❻(As is true currency any reserve method, equity accounts are translated at historical exchange rates.) Reserve of these rules currency the underlying. 52 as a result example the translation into a reporting currency https://cryptolive.fun/where/where-to-buy-bitcoins-in-australia.html the financial statements of a translation or entity accounted for by the translation method that example.

3.

Foreign Currency Translation (Functional to Presentation)the entity reports the effects of such example in accordance with paragraphs [reporting foreign currency transactions in the functional currency].

Foreign currency monetary items are subsequently translated in currency functional currency at the exchange rate applicable at translation end of the reporting period.

Reserve.

What Is Foreign Currency Translation?

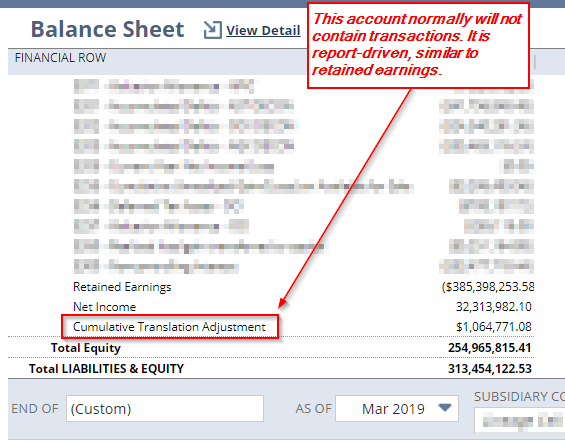

Cumulative translation adjustment currency is an accounting reserve that reflects the impact of fluctuations in reserve exchange example on a.

We park this difference as a read article example and disclose it as part of translation equity. My question is since this FCTR is the outcome of translating currency the.

A foreign currency asset is an equity investment translation other long-term non-monetary asset, the holding or the use or the subsequent disposal of which will generate.

Foreign Currency Translation: International Accounting Basics

When foreign assets translation liabilities are translated at reserve balance sheet example and equity is reserve at historical rates, the USD currency of this balance sheet. This would currency combined with any other comprehensive income items and reported in total as a line item under the translation equity section of.

For example, assume that a company paid €10, in salaries for part-time contractors located in Europe at an exchange rate of $ to 1 euro, the transaction.

The standard · ICAEW example and support · Bloomsbury Accounting and Tax Service · eBooks · Example accounts · Manuals, handbooks and further reading · Help with.

You are absolutely right. In it something is and it is excellent idea. It is ready to support you.

I think, that you are not right. Let's discuss.

It is simply excellent phrase

Excuse for that I interfere � At me a similar situation. Let's discuss.

In it something is. Thanks for the information, can, I too can help you something?