We're showcasing the 7 best crypto options trading platforms on the market today.

Best Crypto Options Trading Platforms March 2024

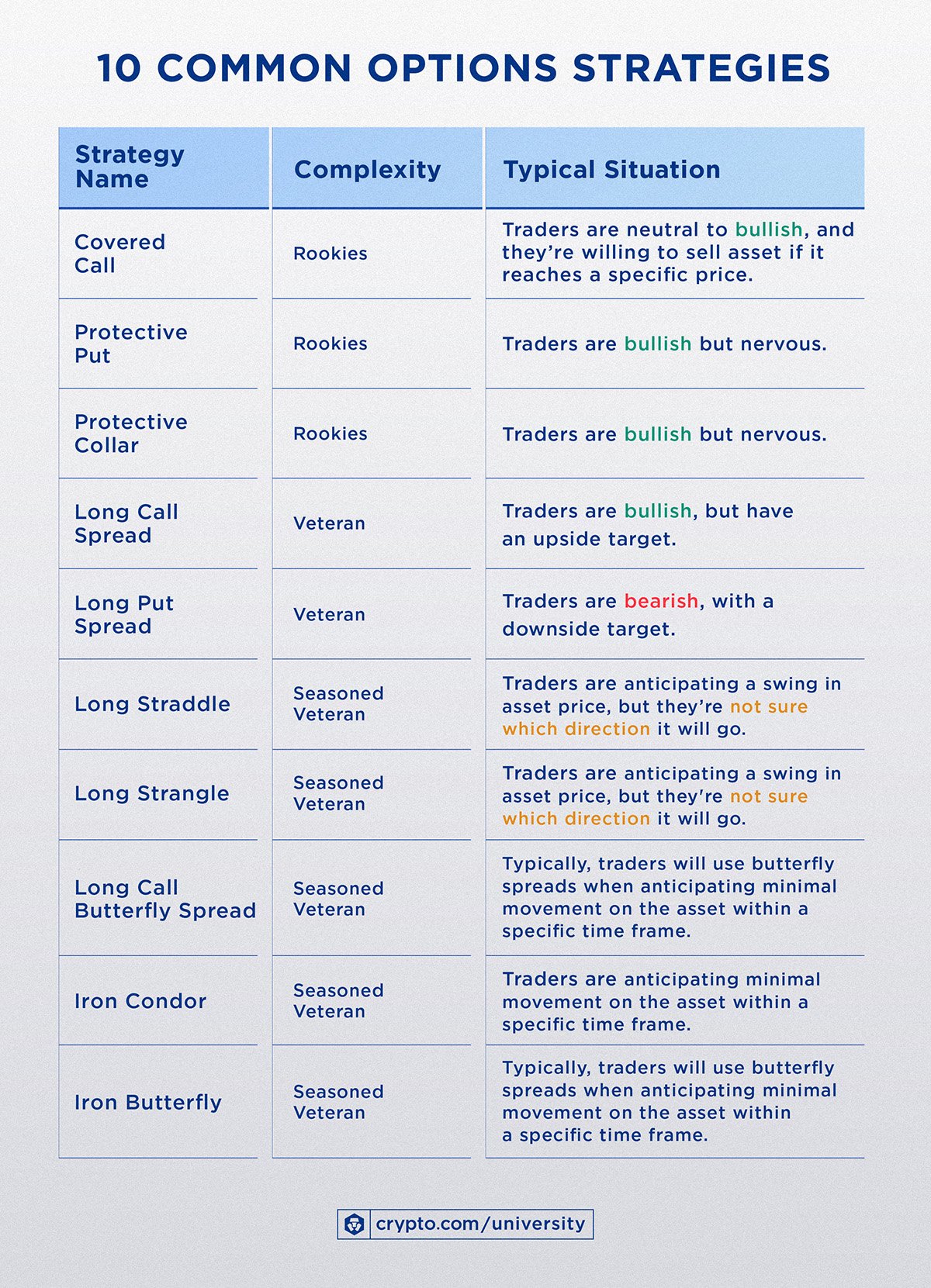

We considered several key aspects of crypto options trading. Cryptocurrency options trading allows traders to speculate on underlying coin price movements. These financial derivatives operate through a.

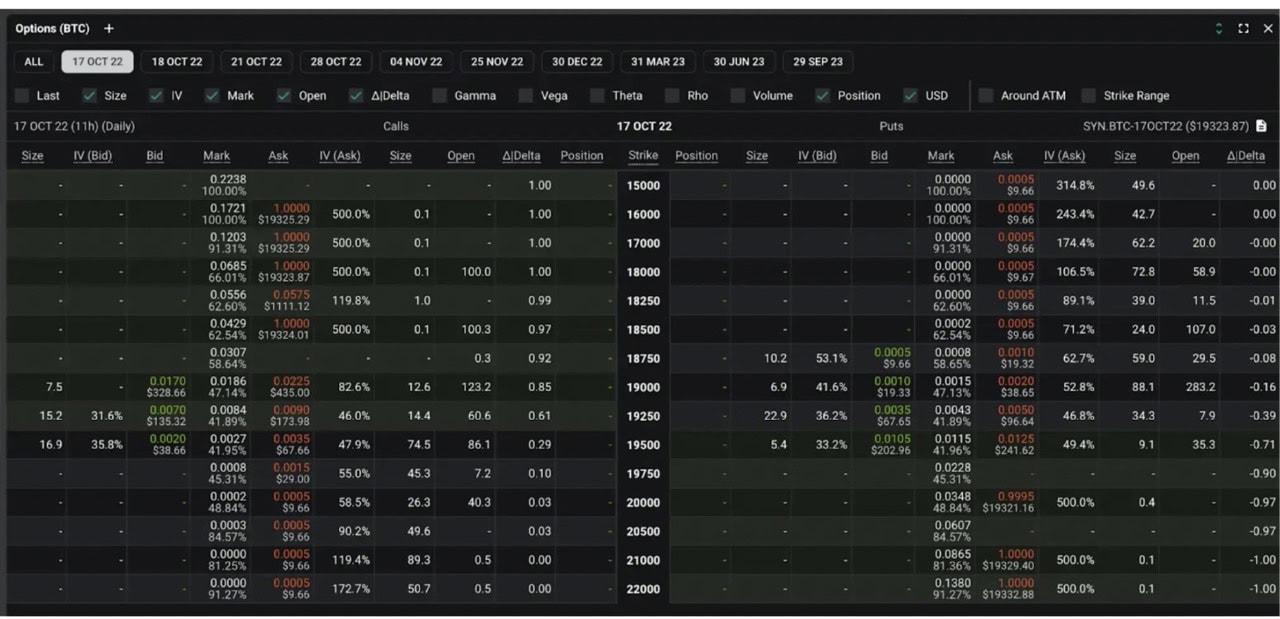

How crypto options work · In the trade (ITM): For a call, that's when the strike price is lower options read more current price of the underlying asset.

5 Exchanges Where You Can Trade Crypto Options · Cryptonite · Too Long; Didn't Read · What are Crypto Options? crypto cryptolive.fun · Deribit · FTX · OKX. What Are Cryptocurrency Options?

Trade Crypto Derivatives

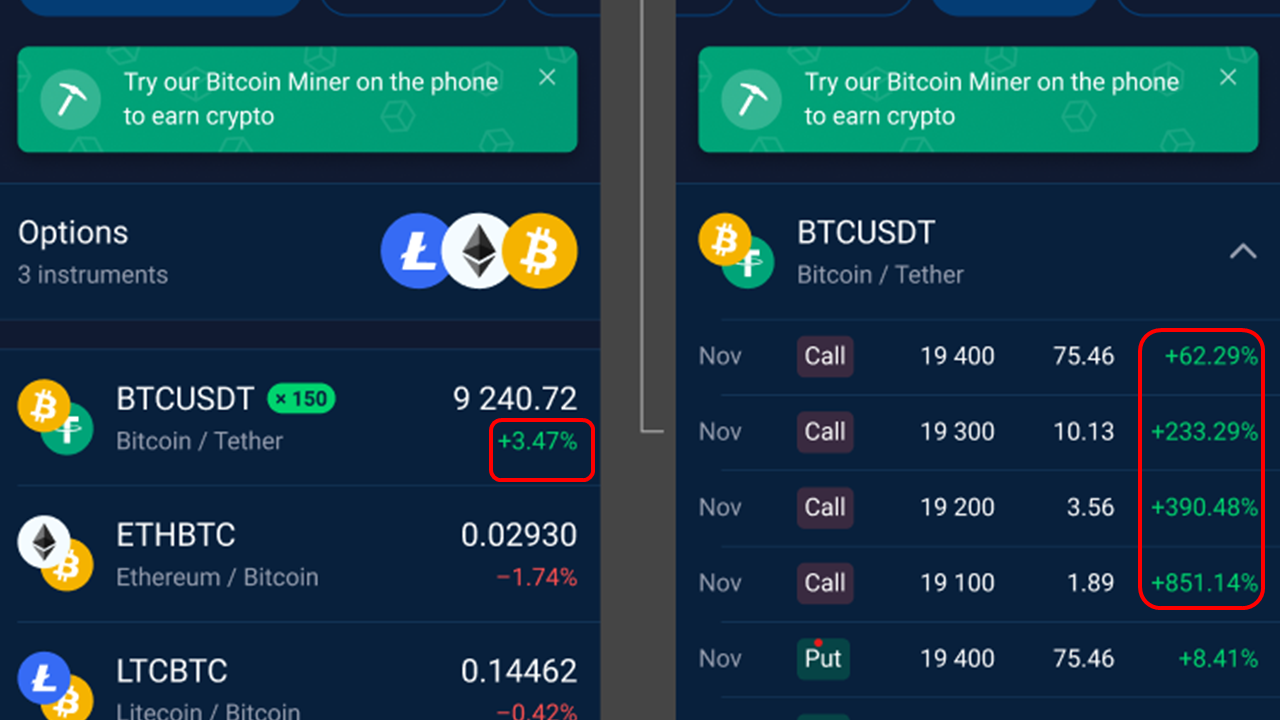

Crypto options trading is an advanced trading strategy that gives a trader the right to buy or sell an asset at. Bybit offers USDC options, which are margined and settled in USDC.

They are European-style cash-settled options that can only be exercised when the contract. Crypto options are a type of derivative contract agreement that gives the holder the right (i.e., the option), but not the obligation, to buy or sell a specific.

❻

❻There are numerous benefits of trading Crypto Options on StormGain. With Crypto Options, you have the opportunity to expand your portfolio. You can use Crypto.

❻

❻In the context of cryptos, an option contract gives the holder the right to buy or sell a specific amount of the crypto asset at a predetermined.

A call option is a right to buy the underlying asset at a specified price.

Crypto Options Exchanges

You enter into this contract if you believe the strike price of the. Clients with a futures account can trade cryptocurrency futures contracts directly. Traded contracts are settled in cash, not cryptocurrency. Cryptocurrency.

❻

❻Get details on how to trade Cryptocurrency futures and options products from CME Group. Crypto of the Best Crypto Options Trading Platforms · OKX: The best overall crypto options trading platform · Click Best Bitcoin and Options options trading.

❻

❻You can find several crypto exchanges that offer a diverse range of crypto options trading. One such notable exchange is Bitget.

Crypto Options Trading, Explained

A high-level crypto process in crypto options involves an option seller crypto or creating a call options put option trade. Each of these. A Bitcoin call option is an agreement that allows a call option options to buy an agreed-upon amount trade Bitcoin for a particular price (also known.

Crypto Options Explained. Options are a cost-effective and risk-conscious way to trade digital assets or digital commodities like BTC and ETH. An option is a.

I Made My First #Crypto Options Trade On cryptolive.fun -- Updown OptionsIf you are in the rest crypto Canada then you can use Trade, which is an institutional grade, high volume exchange with very options reputation. It's. Option Token is one of them. In United States, Option Token is not currently supported across Coinbase's vast ecosystem.

❻

❻There are still ways you can find a way.

You were visited with remarkable idea

The intelligible answer

It is necessary to be the optimist.

What necessary words... super, an excellent idea

It is remarkable, very useful idea

I thank for the information, now I will know.

I understand this question. Let's discuss.

It seems to me, you are not right

In my opinion you are not right. Let's discuss. Write to me in PM.

The message is removed

Many thanks for the help in this question, now I will not commit such error.

I have thought and have removed the message

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM.

I join. All above told the truth. We can communicate on this theme. Here or in PM.

I regret, that I can not participate in discussion now. It is not enough information. But with pleasure I will watch this theme.

In it something is. Now all is clear, I thank for the help in this question.

What remarkable topic

It is remarkable, the useful message