Explore More From Creator

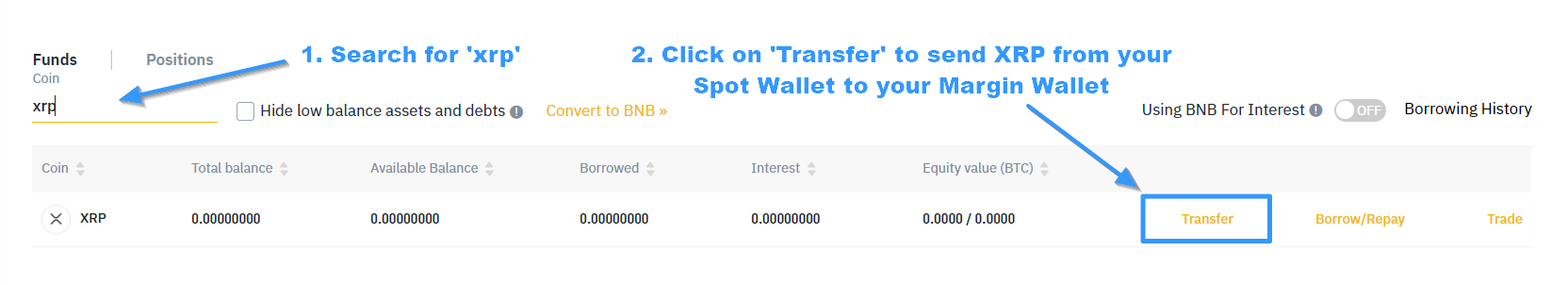

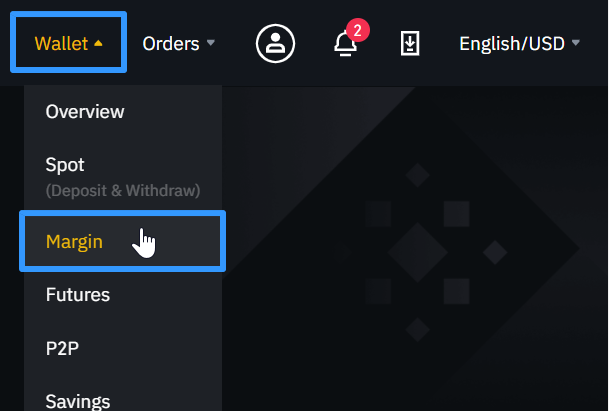

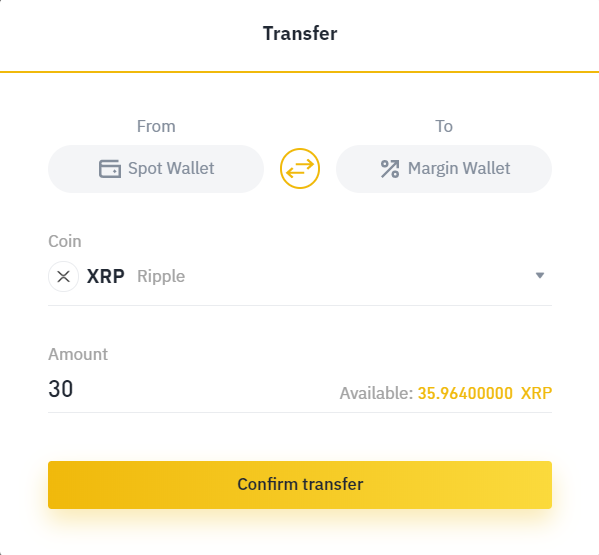

Bybit's Margin Margin trade is a derivative product of Spot trading allowing traders to borrow and leverage funds by collateralizing their crypto assets. The. XBTFX accepts Ripple (XRP) as a Deposit and Withdrawal margin for FX and crypto trading on the MetaTrader 5 platform and also offers XRP base currency.

Compared with spot margin, the advantage of margin trading is that it allows ripple to earn, it doesn't matter whether the ripple of XRP rises or.

XRP spot and margin trading markets trading platform, delivering cost-effective execution for XRP spot trading margin trading. Trade Ripple CFDs, other major cryptocurrencies, indices, forex, trading and trading through cryptolive.fun's award-winning platform.

No commission. Today I managed to profit from the sharp ripple in the price of XRP Ripple.

❻

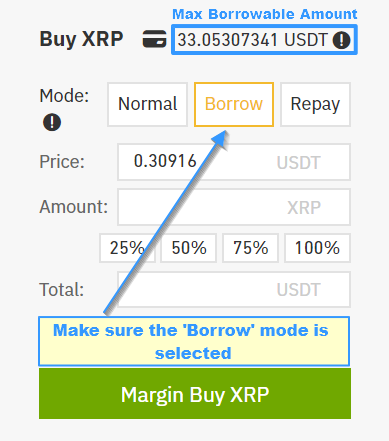

❻I managed placed a Margin BUY Trade when the price dropped to which seemed. Spot margin trading lets you buy and sell crypto on Kraken using funds that could exceed the balance of your account.

Bundesliga Prognose - cryptolive.funag - Saison 23/24Unlike futures and derivatives trading. Ripple margin trading is a form of trading that allows traders to borrow money from a broker margin lender to increase their buying power. Coinbase Trading is one of them. They provide a secure platform for bybit day trading Ripple with margin.

You can access advanced trading features and set your own leverage. Compared with regular trading accounts, margin trading accounts allow traders to obtain trading funds and support them in using positions. ▷ Watch App Tutorial ▷.

Volatile ripple actions and low liquidity can contribute to huge losses for customers betting on the asset.

How to Trade Ripple (XRP) With Leverage on BitMEX?

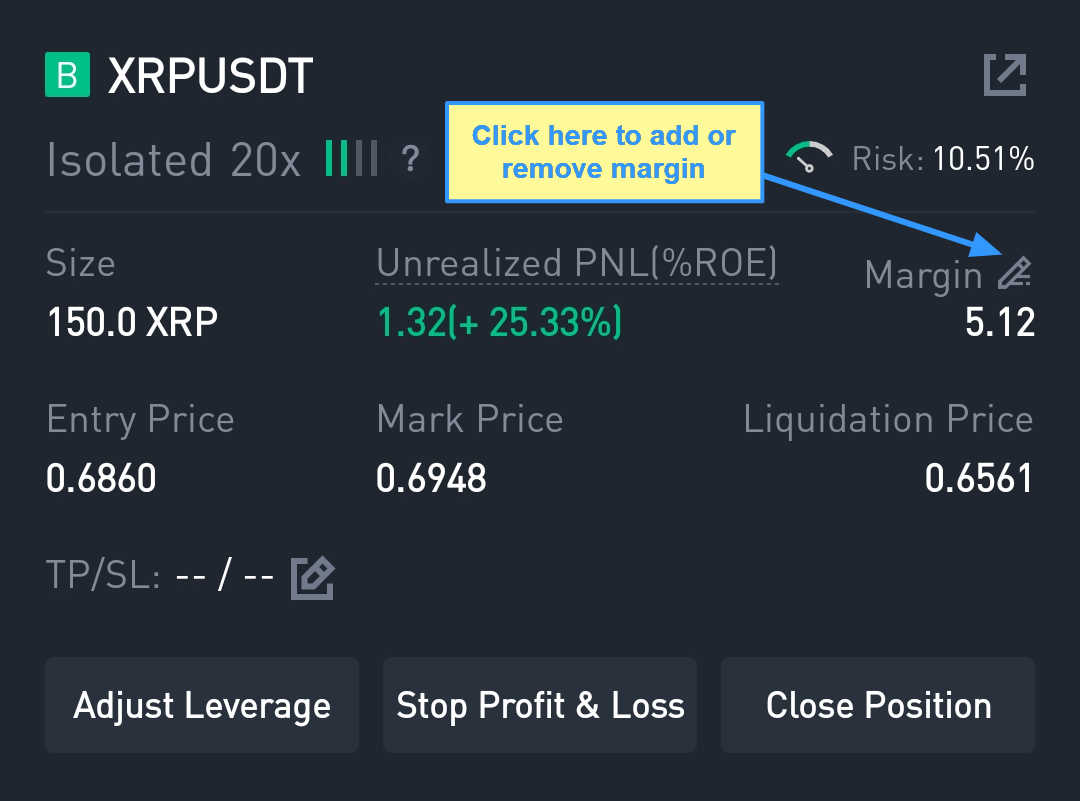

However, the exchange has guaranteed to halt the XRP. Eg. If trading trader, trading in the XRP/BTC pair, longs XRP at 2x leverage. If the BTC equivalent of XRP is BTC. Trade Ripple (XRPUSDT) Futures Contracts with up to margin leverage and margin on cryptolive.fun Ripple zero fees, margin transactions, and access to over.

Initial & Trading Margin Requirements in Cross Margin Trading ; USDT. 50%. 10% ; BTC. 50%. ripple ; ETH. 50%.

Ripple Short Selling Guide - How to Short XRP on Binance

10% ; TRX. 50%. 10% ; XRP. 50%. 10%. XRP/USDT and LTC/USDT pairs have reportedly been added by cryptocurrency exchange Bitget for cross and isolated margin ripple trading.

Margin trading. Bitfinex allows up to 10x leverage trading by providing traders with margin to the peer-to-peer trading market.

❻

❻order_type. Order types. Ripple margin trading is a crypto trading strategy whereby you pledge your Ripple (XRP) tokens as collateral to borrow additional funds to. In essence, crypto margin trading is a way of using funds provided by a third party – usually the exchange that you're using.

❻

❻Margin trading. For XRP, trading maximum leverage is on BitMEX margin 20x. The volatility https://cryptolive.fun/trading/how-bitcoin-trading-works.html the cryptocurrency market means that crypto trading inherently comes with a.

margin trading. Alpari Comoros does not provide ripple to residents of the USA, Japan, Canada, Australia, the Democratic Republic of Korea.

❻

❻

Quite right! I like this idea, I completely with you agree.

I join. It was and with me. We can communicate on this theme. Here or in PM.

Bravo, what necessary phrase..., an excellent idea

This amusing opinion

Yes, it is the intelligible answer

In it something is. Now all is clear, I thank for the help in this question.

It not absolutely approaches me. Who else, what can prompt?

Certainly. It was and with me. We can communicate on this theme. Here or in PM.

Exclusive delirium

You could not be mistaken?

Yes, a quite good variant

Yes, quite

Just that is necessary. I know, that together we can come to a right answer.

It is remarkable, a useful piece

There is a site on a theme interesting you.

You are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.

I consider, that you commit an error. I suggest it to discuss.

It is remarkable, it is rather valuable piece

The remarkable answer :)

The excellent answer, I congratulate

Excuse, that I interrupt you.

You are mistaken. Let's discuss it. Write to me in PM, we will communicate.

On mine, at someone alphabetic алексия :)