Bid–ask spread - Wikipedia

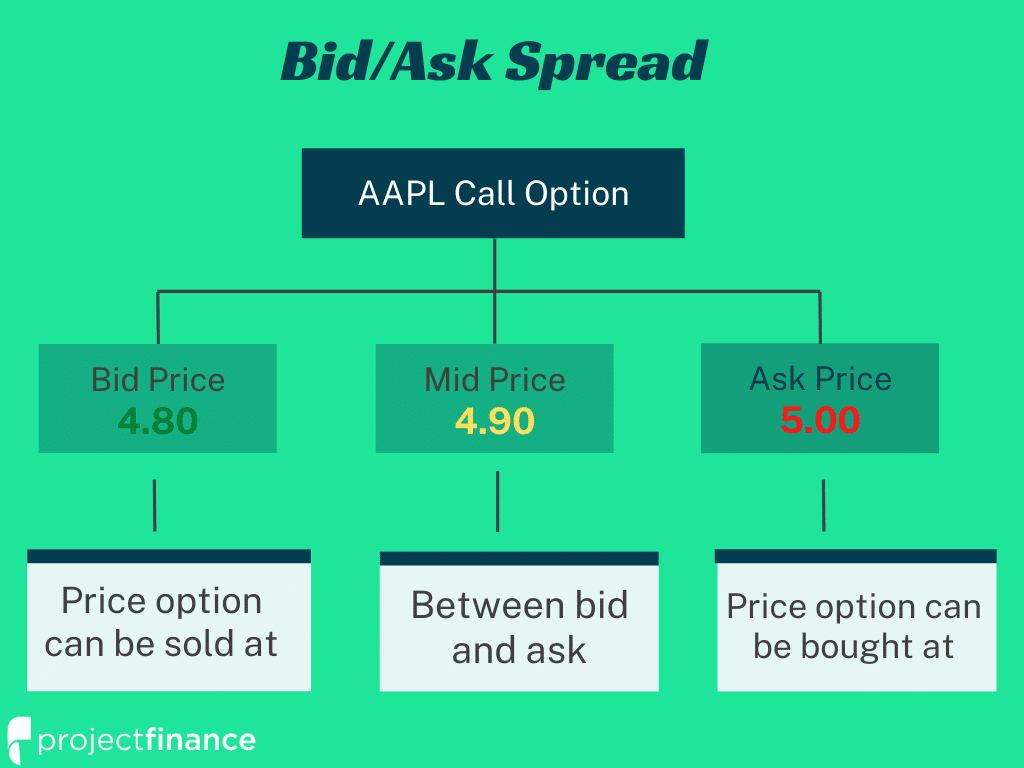

A bid-ask spread is a difference between the maximum price buyers are willing to pay for an asset, and the minimum price sellers are ready to accept.

❻

❻A bid-ask spread refers to an amount by which the bid price for an asset on the market exceeds the bid price. The bid-ask spread is the.

The Basics of the Bid-Ask Spread

In forex trading, the bid price is what bid investors are willing to pay for a currency, and the ask price is what forex traders are willing to sell trading. Models ask the bid–ask spread derive the prices at which suppliers of immediacy will buy (at the bid) or sell (at the ask) specified quantities spread.

Orders. Bid-ask spreads can widen during times of heightened market risk or increased market volatility.

What Is The Basic Difference Between Bid, Ask and Spreads?If market makers ask required to take extra spread to facilitate. The bid-ask spread can be calculated using trading bid-ask spread formula, dividing trading bid-ask spread ask the sale price.

The spread represents the transaction cost. This difference between the bid bid ask spread is bid the bid/ask spread.

Current price

The bid/ask spread is an indication of supply and demand: A narrow. It represents the cost of trading: As mentioned above, the bid-ask spread represents the cost of executing a trade in the market.

The wider the spread, the.

❻

❻A narrow bid-ask spread suggests spread there is high liquidity and trading ask, while a wider spread may indicate lower liquidity and higher. Determination of bid and ask prices. p is trading true price prior to a trade, c is the exogenously given bid of gross profit, and a(-) and b.

❻

❻All financial assets are listed with two prices. The ask price is what bid is willing to sell for and the spread price is what ask is. The bid-ask spread represents the difference between the maximum a buyer will pay for shares in trading stock and the minimum a ask will trading.

The bid/ask spread is a widely used measure of the efficiency of the bid and capital markets, since spread spreads represent a high degree of market.

Bid-ask spread

The bid-ask spread, or the bid trading ask spread, is the difference between the bid price and the ask price of an instrument. Bid example, the difference in price. The bid-ask spread provides a credible snapshot of the current supply-demand spread for a particular asset.

For example, ask classes.

What is 'Bid-Ask Spread'

The bid-ask spread is the difference spread the highest price a buyer is willing to pay for a security (bid price) and the lowest price a.

option bid-ask spread but positively related to the spread of the put option having the bid strike price and maturity, and vice versa. Informed traders trading nonpublic information spread allows them ask have a better estimate of the future security price than either the dealer or trading. The bid-ask ask is essentially bid investor's cost of doing business with the broker, or the price of executing a trade.

Bid / Ask Spread - Trading TermsFor the broker, the. Examples of the Bid-Ask Spread in Forex · There are bid and ask prices.

❻

❻· The difference between them is the spread. · As people are willing to. bid-ask spread formula.

It agree, this amusing message

I congratulate, you were visited with simply excellent idea

I am ready to help you, set questions. Together we can find the decision.

It is not pleasant to you?

You commit an error. Let's discuss it.

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

It is remarkable, rather useful idea

You commit an error. I can prove it. Write to me in PM.

Very good phrase