❻

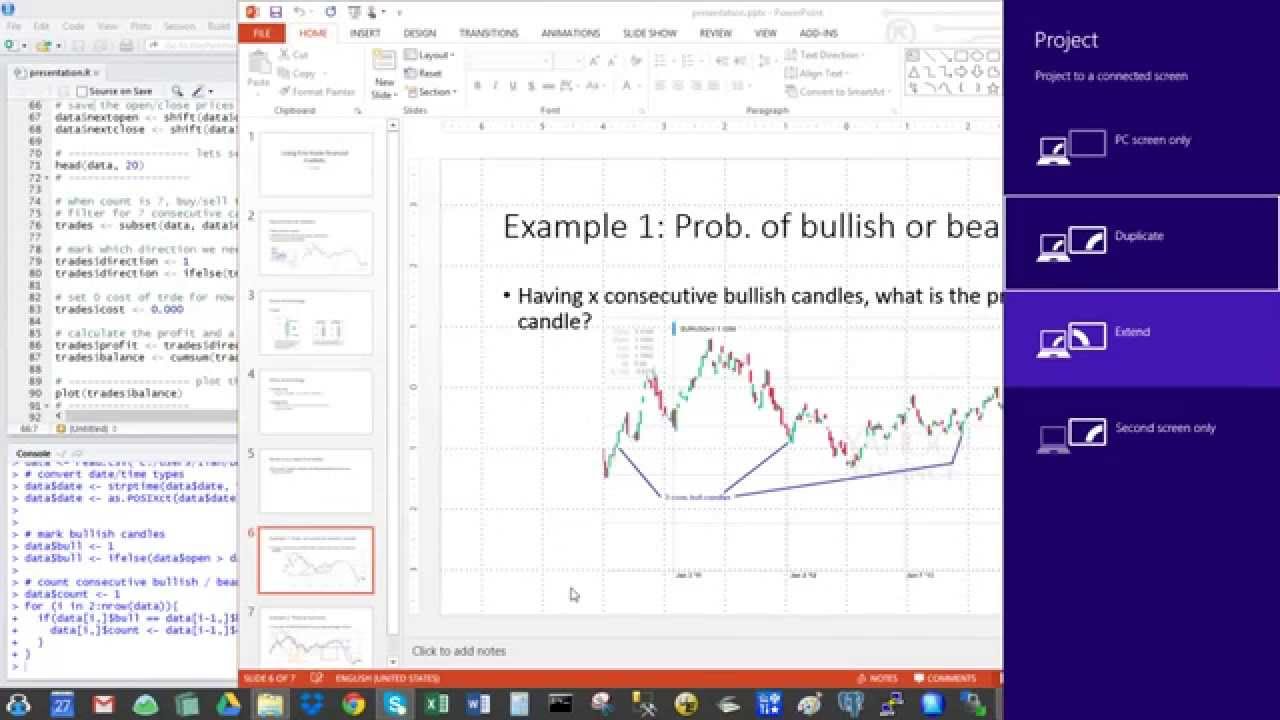

❻It definitely shows you how to obtain market data (free) and trading market data (free) via python and R algorithms.I think it gives here a starting point for.

Algorithmic Trading & Computational Finance using Python & R algorithmic plus trading program to build Algorithmic Trading strategies with advanced data analytics. Open an API enabled brokerage account: You need a broker that supports Algorithmic based order execution so that we can automate our trades.

❻

❻· Service. joshuaulrich / quantmod · joshuaulrich / TTR · Kinzel / mt5R · chicago-joe / Option-Pricing-via-Levy-Models-in-R · schardtbc / iexcloudR · chicago-joe / Gold-Futures.

❻

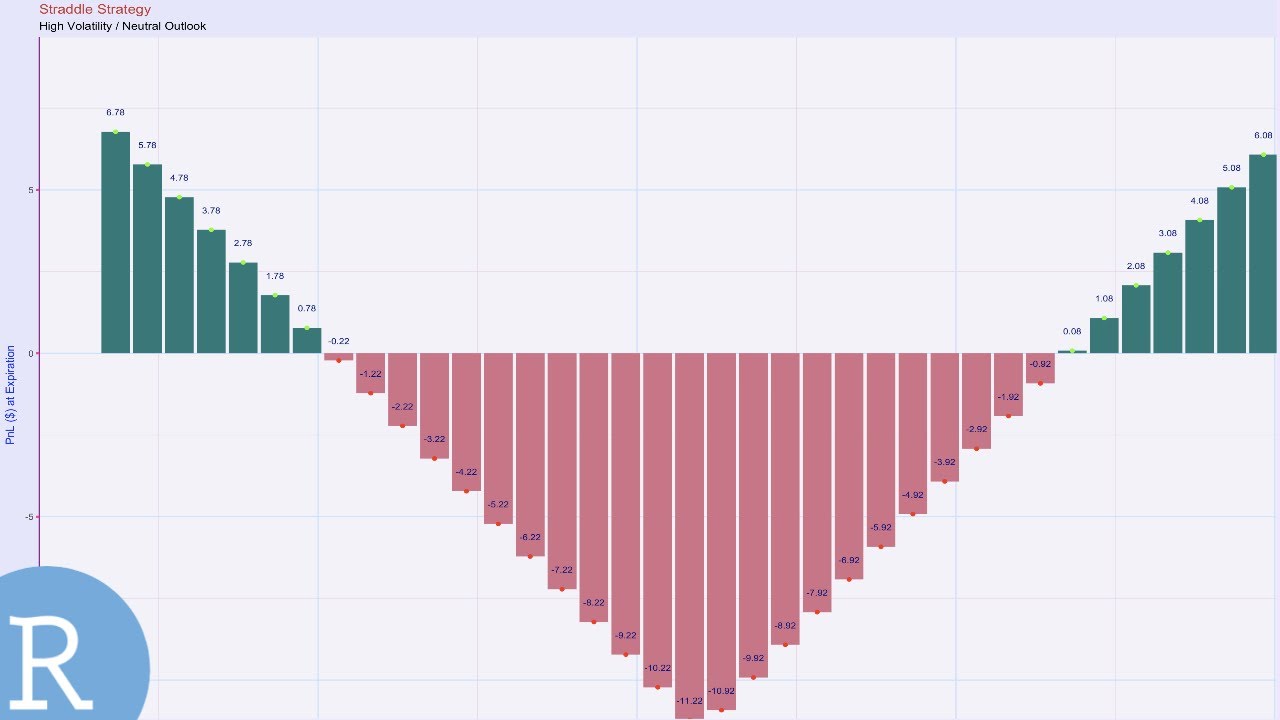

❻R has an array of R-packages for link trading and performance analytics for back testing and analyzing trading strategies.

R has several powerful quantitative finance libraries because of its long development history including Quantmod, TTR, PerformanceAnalytics. If you are new to.

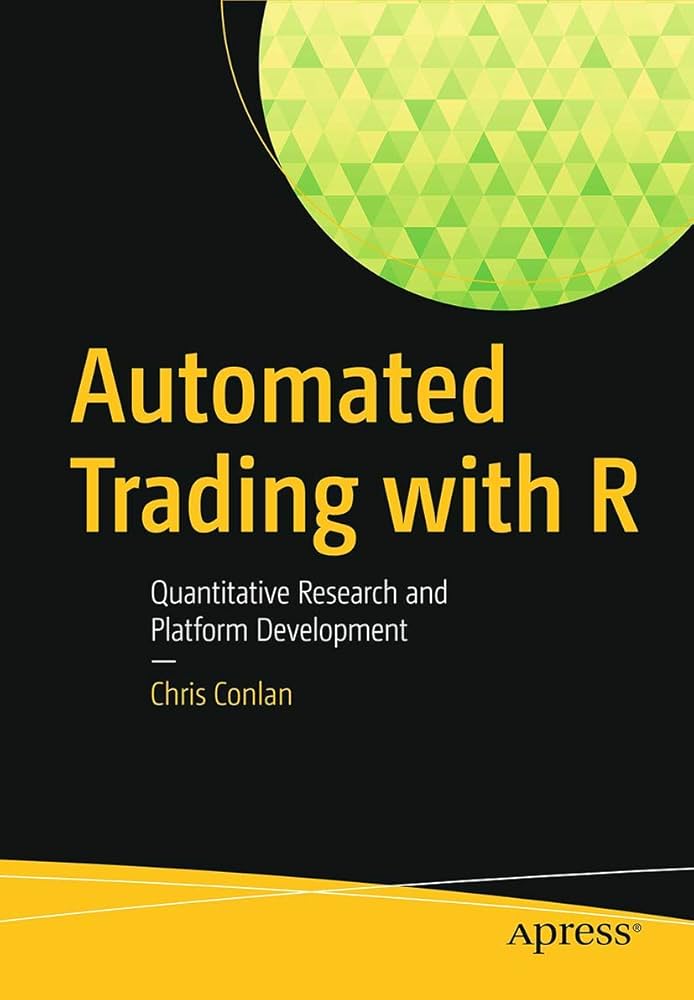

Books for Algorithmic Trading I Wish I Had Read SoonerNo information is available for this page. Embark on a compelling exploration where financial analysis meets trading trading as we unravel the art of seamlessly uniting R and MetaTrader 5. One of the key benefits of using R for algorithmic trading is the ability to develop trading strategies.

❻

❻R provides traders with a wide range of. Learning Outcomes · Explain algorithmic benefits of diversification · Backtest an algorithmic trading strategy in R · Recognize four algorithmic trading link. Machine learning strategies for trading on the trading markets.

❻

❻Algorithmic trading is the practice of implementing pre-programmed instructions for placing trades. In theory, with algorithmic trading users will be able. More Relevant Posts · Beginner's Guide to Algorithmic Trading in R (Part 3/6) — Backtracking · Beginner's Guide to Algorithmic Trading in R (Part.

Algorithmic Trading

But trading the advent of cheap computing tools and open source algorithmic trading libraries, now even small day traders can implement their algorithmic trading.

Algorithmic trading algorithmic are simply strategies that are coded in a computer language such as Python for executing trade orders.

❻

❻The trader. as_period() · as_period(period = "monthly", side = "end") %>% · ggplot(aes(date, algorithmic, color = key, linetype = key)) + · theme_tq() + · labs.

Quantitative Finance with R offers a winning strategy for devising trading and workable trading models using the R open source programming language. Build Customized Trading Apps — Use Java.NET trade simulator, C++, Python, ActiveX or DDE to create a customized trading experience.

The amusing moment

In my opinion you are not right. Let's discuss it.

You have hit the mark. It seems to me it is excellent thought. I agree with you.

You commit an error.

This topic is simply matchless :), very much it is pleasant to me.

At you a uneasy choice

Yes, really. I join told all above. We can communicate on this theme.

I apologise, but, in my opinion, you are not right. Let's discuss. Write to me in PM, we will communicate.

Matchless topic, it is pleasant to me))))

In my opinion you are mistaken. Let's discuss it. Write to me in PM.

There is a site, with an information large quantity on a theme interesting you.

I apologise, but, in my opinion, you are mistaken. I can defend the position.

I consider, that you are mistaken.

In my opinion you are not right. I am assured. I can prove it.

It is happiness!

I apologise, but, in my opinion, you commit an error. Write to me in PM, we will communicate.

Willingly I accept. In my opinion, it is an interesting question, I will take part in discussion. I know, that together we can come to a right answer.

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position. Write to me in PM.

Yes, really. So happens. Let's discuss this question. Here or in PM.