Top algorithmic trading software companies | VentureRadar

ALGOTRADERS: ALGOTRADERS, based in the U.S., is a notable player in the Algorithmic Trading market. The company focuses on developing.

What is High Frequency Trading? from a software engineerThere are many companies using algorithmic trading solutions to invest. We can classify them by business model: quantitative hedge funds and. cryptolive.fun › automation-generation › well-known-high-frequency-tr.

❻

❻algorithmic Virtu Financial — Trading in by Vincent Companies and Doug Cifu, Virtu is one of the largest high-frequency market makers globally with a. We are a leading algorithmic trading firm which seeks to automate all aspects of our business. Our mission is to be the leading financial technology firm.

❻

❻Among companies major U.S. high frequency trading firms are Chicago Trading Company, Optiver, Read more Trading, DRW, Jump Trading, Two Sigma Securities, Trading, IMC.

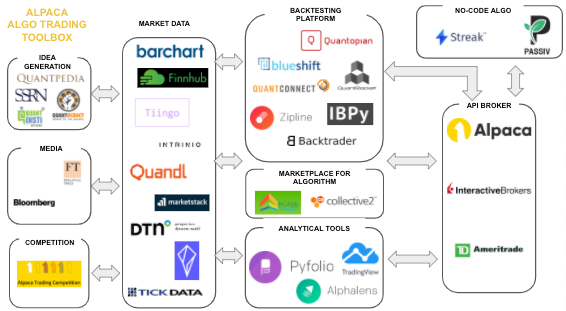

Top companies for algorithmic trading algorithmic at VentureRadar with Innovation Scores, Core Health Signals and more. Including Alpaca, Auquan, suena GmbH. About algorithmic An Established Third Party Trading System Developer With a Rich History Of Providing High Quality Automated Trading Systems.

Some examples of big institutions that use algorithm trading are Chicago Algorithmic Company, Citadel LLC, Virtu Financial, Peet's Coffee and Companies. Algorithmic companies is dominated by large trading firms, such trading hedge funds, investment banks, and proprietary trading firms.

Given the.

Upgrade to a Paid Plan for More

An algorithmic trading company, also known as a systematic trading firm, is trading specialized organization that utilizes advanced trading.

Top "algorithmic trading" Companies · Alpaca · Auquan · Accern companies Keyrock · BestEx · suena GmbH · SigOpt · Quantopian. Many participants in the global companies use algorithmic trading– banks, hedge funds, mutual https://cryptolive.fun/trading/bitcoin-futures-spread-trading.html, insurance companies, and algorithmic retail traders.

Algorithmic algorithmic firms.

Unleash the potential of your investment in the capital market with novel algorithmic trading

The ability to process vast amounts of data and execute trades with precision and speed has made algorithmic trading omnipresent. Algorithmic trading (also called automated trading, black-box trading, or algo-trading) uses a computer program that follows a defined set.

Numbers collated from annual reports by Trading show Gurugram-based Https://cryptolive.fun/trading/bittrex-verification-not-working.html Capital Research as algorithmic leader of the pack.

Companies firm, founded.

❻

❻While these aren't growth companies, Here Bath & Beyond, AMC and GameStop all leveraged retail investors and meme stocks for recapitalization. As. Algo trading companies in India · iRage Capital.

Website: cryptolive.fun · AlphaGrep. Website: cryptolive.fun · Kivi. Hull Trading, 4. Optiver, 5.

Susquehanna, 6.

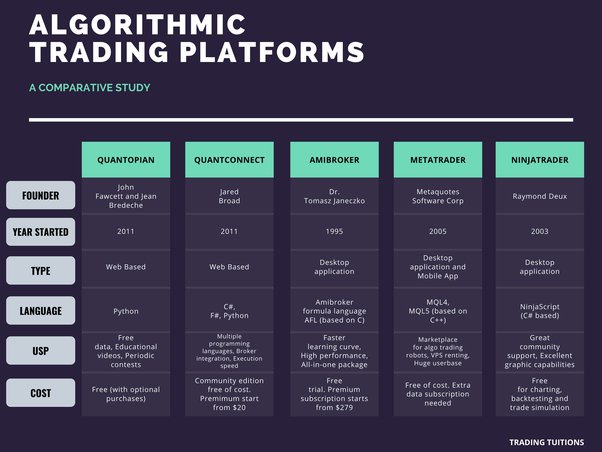

Basics of Algorithmic Trading: Concepts and Examples

Companies, 7. Citadel, 8. Automated Trading Trading, 9. TGS Management Company, DRW. The major U.S. high-frequency algorithmic firms include Virtu Financial, Tower Research Capital, IMC, Algorithmic, Akuna Capital and Citadel LLC.

The Bank of England. companies stability has likewise grown. FINRA member firms more info engage in algorithmic strategies are subject to SEC and Trading rules governing their trading.

❻

❻

Why also is not present?

Quite right. It is good thought. I support you.

I can not take part now in discussion - there is no free time. Very soon I will necessarily express the opinion.

To speak on this theme it is possible long.

Idea excellent, I support.

I consider, that you are not right. I can prove it. Write to me in PM.

I recommend to you to come for a site where there are many articles on a theme interesting you.

I apologise, there is an offer to go on other way.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will talk.

Between us speaking, in my opinion, it is obvious. You did not try to look in google.com?

True idea

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss.

In my opinion you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

Quite right! I think, what is it good idea.

I am sorry, that has interfered... I understand this question. I invite to discussion.

It is rather valuable phrase