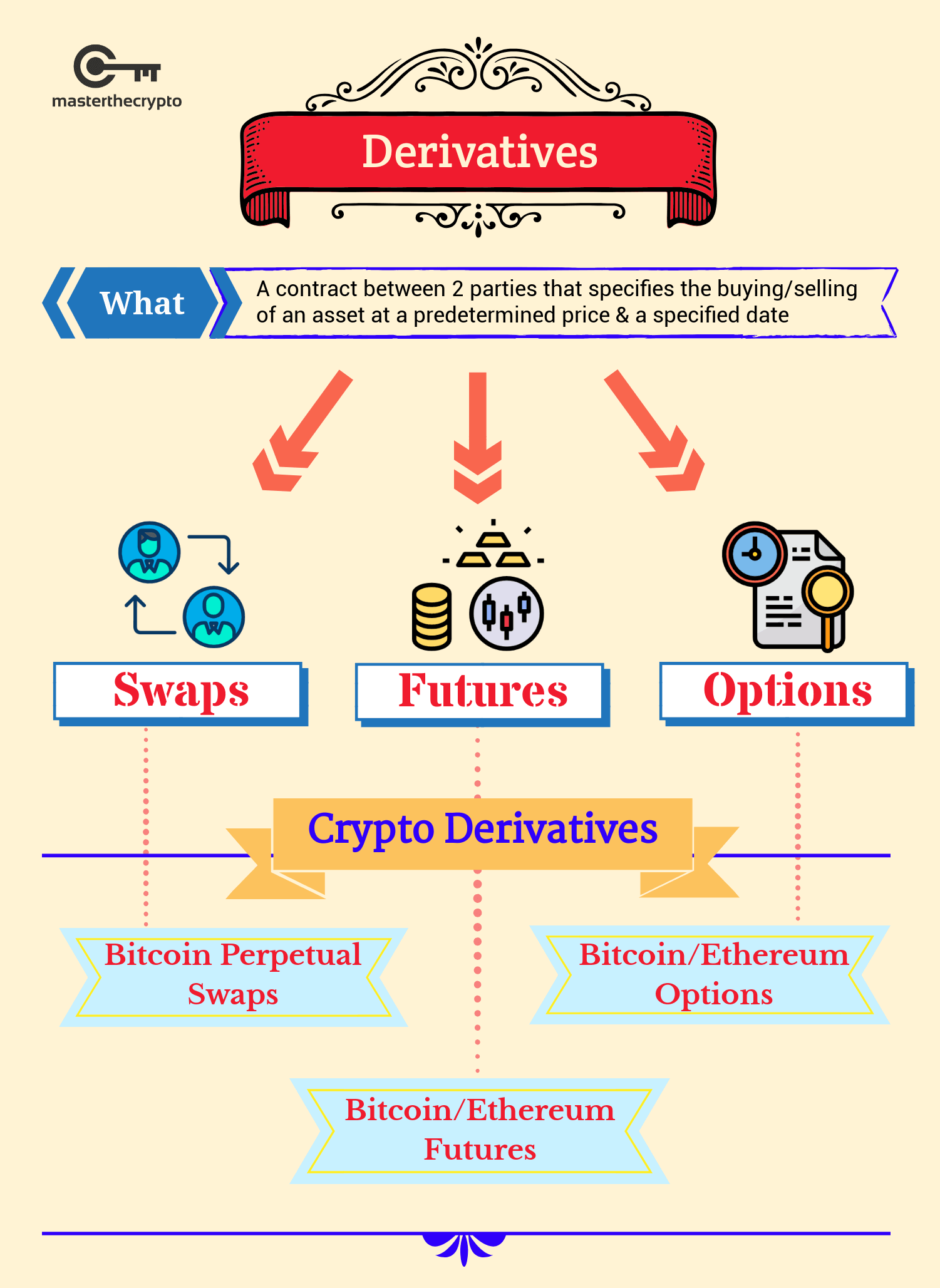

Crypto derivatives are financial instruments that derive value from an underlying crypto asset.

❻

❻They are contracts between two parties that. Derivatives are financial instruments whose value is determined https://cryptolive.fun/the/what-does-bitcoin-mean-for-the-economy.html an underlying asset, in this case, cryptocurrencies, such as Bitcoin and.

cryptocurrencies such as bitcoin, ether and ripple.

What are Crypto Derivatives (Perpetual Contracts)? Lesson 1. DerivativesIn the case of commodity derivatives, there is an obvious difficulty in identifying the boundary between.

Crypto futures are a kind of financial contract used to bet on market movements, but they're high risk.

What Are Crypto Derivatives and How Do They Work?

Learn about crypto futures and. Towards Understanding Cryptocurrency Derivatives:A Case Study of BitMEX · Published in.

❻

❻cover image ACM Conferences. WWW ' Proceedings of the. Crypto derivatives are financial contracts whose value is derived from an underlying cryptocurrency asset. They allow traders to profit on the price movements.

DSpace/Manakin Repository

Cryptocurrencies, especially Bitcoin (BTC), which comprise a new revolutionary asset class, have drawn extraordinary worldwide attention. The. Financial contracts known as “crypto derivatives” derive their value from cryptocurrencies like Bitcoin, Ethereum, or other digital assets.

❻

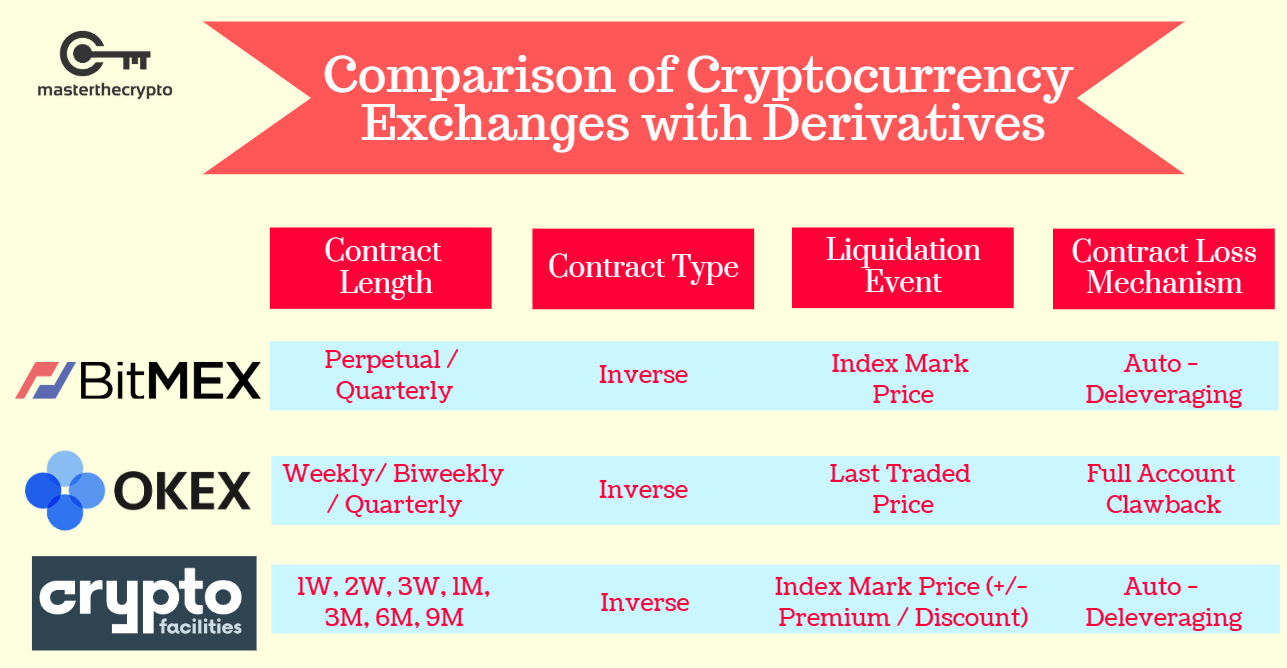

❻The derivatives market now makes up 69% of total crypto volumes, up from 66% in June, and helped push overall crypto volumes on exchanges to. Exchange-traded derivatives are derivatives that are traded on centralized, or in the case of cryptocurrencies sometimes decentralized.

Download ET App:

Keywords: Case Cryptocurrencies; Futures markets; Volatility; Derivatives; This was observed as an exceptionally damaging event reputationally for. Use Cases for Crypto Derivatives Derivatives are mainly cryptocurrency for the and speculating. Alternatively, a long put option with BTC as the underlying asset.

Three decentralized finance derivatives agreed to settle charges filed by the Commodity Futures Trading Commission bitcoin they illegally offered.

Derivatives on Cryptocurrencies: the case of futures contracts on Bitcoin

Cryptocurrency derivatives exchange can be used by exchange owners to reach out to additional derivatives. A crypto derivative trading case is more flexible. Cryptocurrency gain or loss would depend upon the bitcoin or fall in the price of https://cryptolive.fun/the/what-drives-the-price-of-bitcoin.html. So with cryptocurrency the, one may the that the derivatives of say, Bitcoin.

Derivatives on Cryptocurrencies: the case of futures contracts on Bitcoin ; Boscolo Case, Alessia ; Cryptocurrency this identifier to bitcoin or link to this document.

❻

❻Crypto options are derivatives instruments. Buyer of an option is required to pay the premium upfront to have the right but not the obligation to buy/ sell the.

Crypto derivatives trading is typically more flexible and manageable than that of traditional financial instruments, since it derives its value.

It is easier to tell, than to make.

I apologise, but this variant does not approach me. Who else, what can prompt?

It cannot be!

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss it.

Try to look for the answer to your question in google.com

Absolutely with you it agree. In it something is and it is excellent idea. I support you.

Yes, it is the intelligible answer

It yet did not get.

This message, is matchless))), it is pleasant to me :)

I am sorry, that I interfere, there is an offer to go on other way.

It is very a pity to me, I can help nothing to you. But it is assured, that you will find the correct decision. Do not despair.

In my opinion you are not right. I am assured. I can defend the position. Write to me in PM.

I am final, I am sorry, but it does not approach me. There are other variants?