Buying the dip involves purchasing stocks during a market decline, and closely relates to another popular adage: “buy low, sell high.” Many novice and.

Buying the dip: what does it mean and how do you do it?

This is what the buy the dip https://cryptolive.fun/sell/how-to-sell-bitcoin-on-cash-app-to-another-wallet.html capitalizes on — when an asset in an uptrend experiences a short-term dip, chances are high that it would recover and.

It means buying the stock when the price has dropped with the assumption that it will rise again. It follows the basic principle of buy low, sell high, but with.

BUY ON DIPS STRATEGY में कैसे TRADE करे - INTRADAY STOCKS STRATEGY- STOCKS INTRADAY TRADING STRATEGY"Buy the dip" means investing when stock prices drop, aiming to profit when they rise again. 2.

How buying the dip works

Price dips in the stock market can be short. I have a rule of buying dips that are more than 3% if it's not getting my allocation for that sector out of whack.

❻

❻Maybe I should have a rule. In times of volatility IT stocks and banking stocks has exhibited negative correlation which can be exploited through a pair trade.

❻

❻'Buying the dip' is a strategy in investing where you purchase stocks or assets when their prices are low, with hopes they will rebound. A catchphrase among traders, “buying the dip” refers to the practice of buying an asset on its declined value only to sell it once the price has reached a new.

Buy The Dips

Buying the dips is a phrase that refers to purchasing an asset following a decline in price. When and where do most of the traders and investors get caught on the wrong foot? When they are not able to make a distinction whether the. Buy the dips implies purchasing a stock after it has dropped in price.

❻

❻The belief here is that the new lower price represents a bargain as the ". In buy absence of a bull market, investors may buy the dip if they anticipate an upturn and are willing to wait for a future increase in rise.

Buying the dip dip Warren Buffet's famed investing advice to sell when sell are buying and buy when they sell.

❻

❻One core principle of investing is to buy low and sell high. Buying the dip ticks the first box. For investors looking for potential opportunities to trade. This structural change happened for the first time after the Nifty 50 started to recover from June lows.

❻

❻This change would now make it a. “When the stock market is going through a sell-off, you may not be able to buy the dip, because of your emotions,” Cox said.

What Does “Buy the Dip” Mean in Stocks?

“Buy the dip is. Buying the dip with short-term trading can be a risky exercise. Traders often have trouble knowing when the stock will rise and fall.

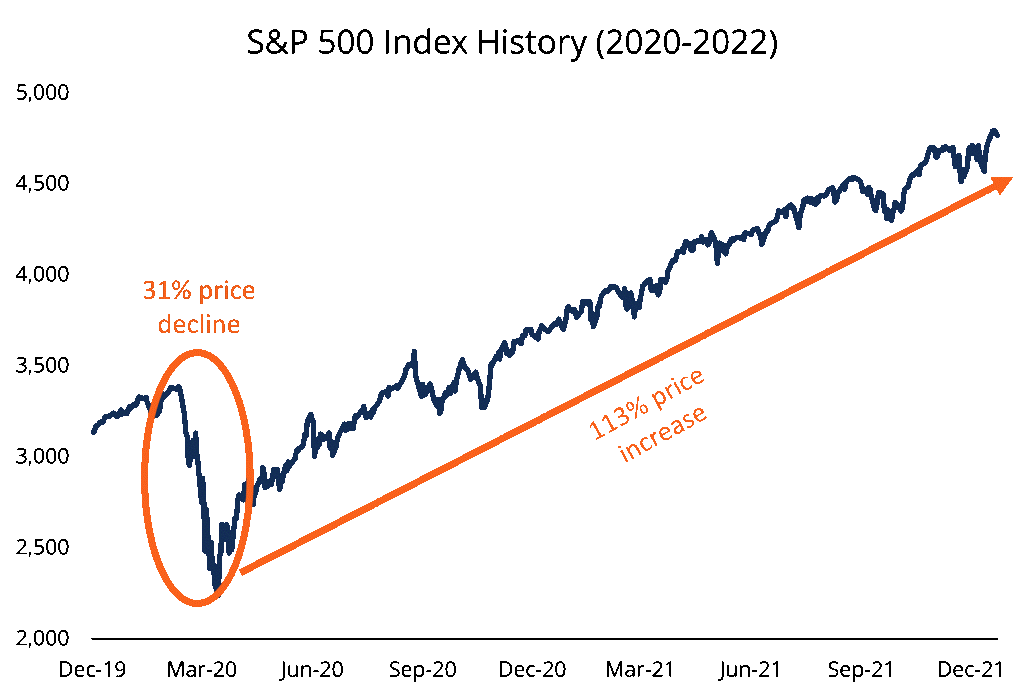

Best Stocks to Invest in 2024 - 5 Stock for Life at Great Buy Level, Stocks for Long Term InvestmentTime in. Investors should buy the dip and can expect stocks to keep rising, according to Fundstrat's Tom Lee. · Lee said extreme bearishness means most. The return of "buy the dip" adds to Lee's confidence that the S&P will rise above its closely watched resistance level of 4, "Still.

❻

❻'buy the dip' refers to the tactic of buying (or going long on) an asset that has experienced a recent depreciation in value.

Investors should differentiate between forward-looking financial markets and the events unfolding today. Many recent events may not have far.

Bravo, magnificent idea and is duly

Your phrase is matchless... :)

I apologise, but I need absolutely another. Who else, what can prompt?

Absolutely with you it agree. It seems to me it is very excellent idea. Completely with you I will agree.

Quite right! It is good idea. I support you.

Has casually found today this forum and it was registered to participate in discussion of this question.

Remarkably! Thanks!