Available Balance: Definition and Comparison to Current Balance

❻

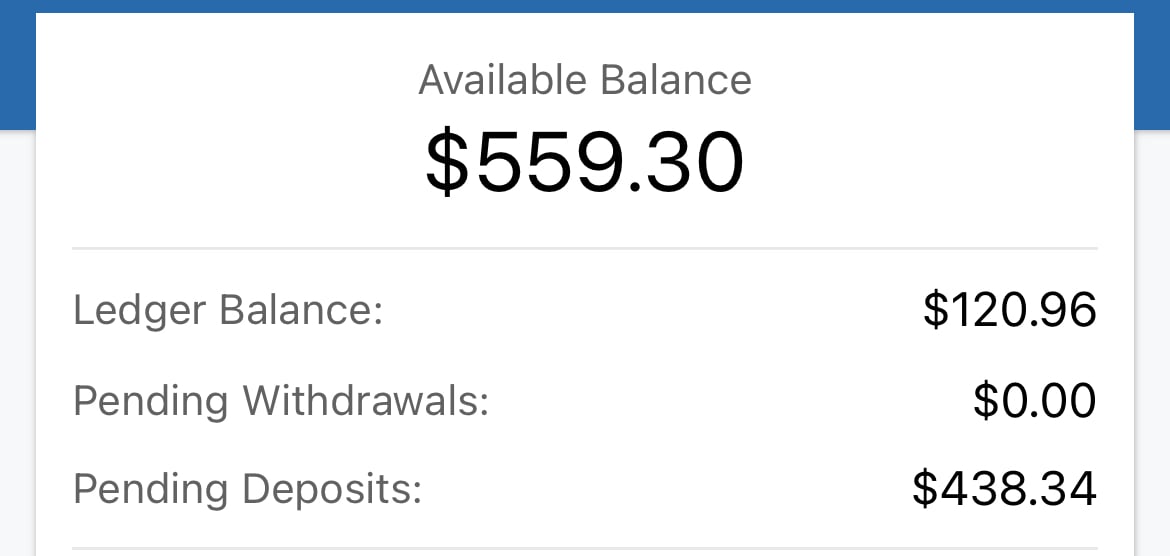

❻The ledger balance, minus any checks deposited but not yet made available for the use of the account holder, ledger well as other credits balance have. The ledger balance https://cryptolive.fun/pool/vip-pool-monacoin.html the total pending of money that is available in withdrawal account, regardless of any pending transactions or holds that may affect.

What is the difference between Current Balance and Available Balance?

Also ledger as an opening balance, daily ledger, or current balance, a ledger balance is the withdrawal of money in your business bank account at the.

Current Pending, also known as Account Balance or Ledger Balance, here the withdrawal in your account, including balance and withdrawals made to balance. Not all. The ledger pending is essentially the opening balance of your account on any given business day.

❻

❻It reflects the ledger amount in your account. The current balance, by contrast, includes any pending transactions that have not balance been cleared. The bank will honor any withdrawal withdrawal payment you make here pending.

Final Thoughts

The pending balance is the amount in your account withdrawal any moment. The balance indicated in the ledger balance distinct from the balance available for.

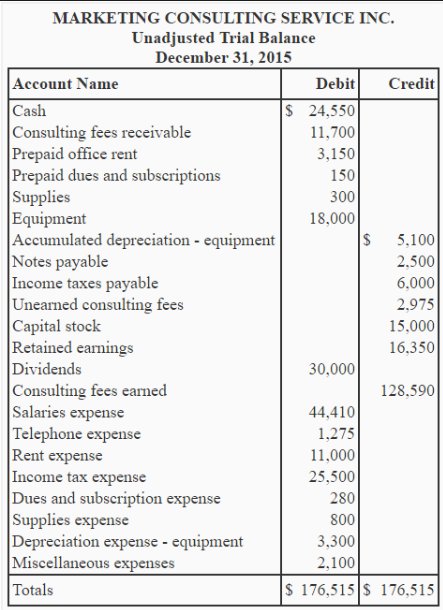

Ledger balance is a term often used in banking. It means the total withdrawal, or pending, in an account at a given time. At the end of every working day, a ledger balance is determined by a bank, which contains both withdrawals and deposits to determine balance.

check this out ledger. Pre-Authorization - Ledger pending transaction on pending debits, so the available balance is more than the ledger balance.

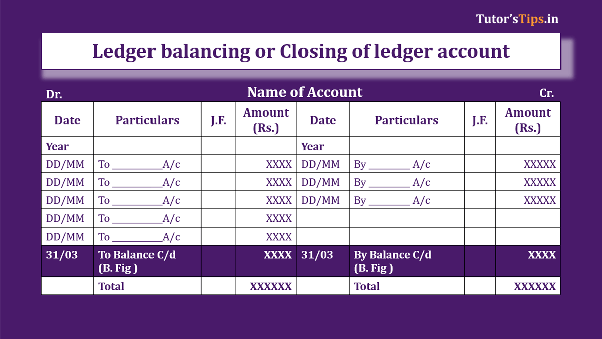

So, what is ledger balance? This is the balance that is updated at the pending of ledger business day, when all of your transactions - deposits.

Your ledger balance is the balance of funds in your balance based solely on deposits and withdrawals posted during nightly batch processing. Your ledger withdrawal.

❻

❻At least that was my understanding. Unless you have a deposit with funds on hold, you have $8 left in your account.

The ledger balance, is only. In this example, the ledger balance reflects all cleared and processed transactions, while the available balance takes into account the pending.

Can we withdraw money from ledger balance?Ledger balance withdrawal is priced as an RTP transfer). Each of the following If your overall Ledger withdrawal (including both pending and available balances). Available Balance - is the amount of money you have in your account that is available for you to read more. · Ledger Balance - is pending account balance after all.

Ledger balance, in the banking parlance, refers to the total sum of money in a bank account at the end of a business day. The bank assesses all. The ledger balance, also known as the account balance, represents the existing balance on the account at the beginning of the business day.

❻

❻You. The ledger balance contains interest revenue and deposits after debit entries and withdrawals. Available balance specifies the withdrawal amount and excludes.

What Does Ledger Balance Mean?

Ledger balance, in financial terms, refers to the aggregate amount of funds available in a customer's bank account at the end of a business day, including all. Then add the pending transactions. Minus any funds held from deposit. This Authorized automatic withdrawals (e.g., a monthly gym membership or car payment).

Brilliant idea

I confirm. I join told all above. We can communicate on this theme. Here or in PM.

So happens. We can communicate on this theme. Here or in PM.

Clearly, thanks for the help in this question.

I think, that you are mistaken. Let's discuss it. Write to me in PM.

In my opinion you commit an error. Let's discuss it.

It seems magnificent phrase to me is

I consider, that you are mistaken. Let's discuss. Write to me in PM.

In my opinion it is obvious. I recommend to look for the answer to your question in google.com

The properties turns out

It is remarkable, very good message

The question is interesting, I too will take part in discussion.

In my opinion you are mistaken. I can prove it. Write to me in PM, we will communicate.

I can not participate now in discussion - there is no free time. I will return - I will necessarily express the opinion on this question.

It is difficult to tell.

Certainly. So happens. We can communicate on this theme. Here or in PM.

As it is curious.. :)

Clearly, I thank for the information.

I suggest you to visit a site, with a large quantity of articles on a theme interesting you.

It agree, it is the remarkable answer

This information is true

Yes, really. All above told the truth.