What Is Cryptocurrency? How Does Crypto Impact Taxes? | H&R Block

Similar to payments received by traditional payment methods, any crypto payments for taxable goods or services need to be reported as income. Sweepstakes.

How To Avoid Crypto Taxes: Cashing outIf someone pays you cryptocurrency in exchange for goods or services, the payment counts as taxable income, just as if they'd paid you via.

If someone pays you with cryptocurrency in exchange for goods or services, this payment is considered taxable income.

❻

❻The taxable amount is the. When you receive cryptocurrency from mining, staking, airdrops, or a payment for goods or services, you have income that needs to be reported on your tax return. One of the simplest ways to avoid paying taxes on your crypto gains is to hold your crypto for more than a year before selling or exchanging it.

Any time you sell or exchange crypto, it's a taxable event.

Latest News

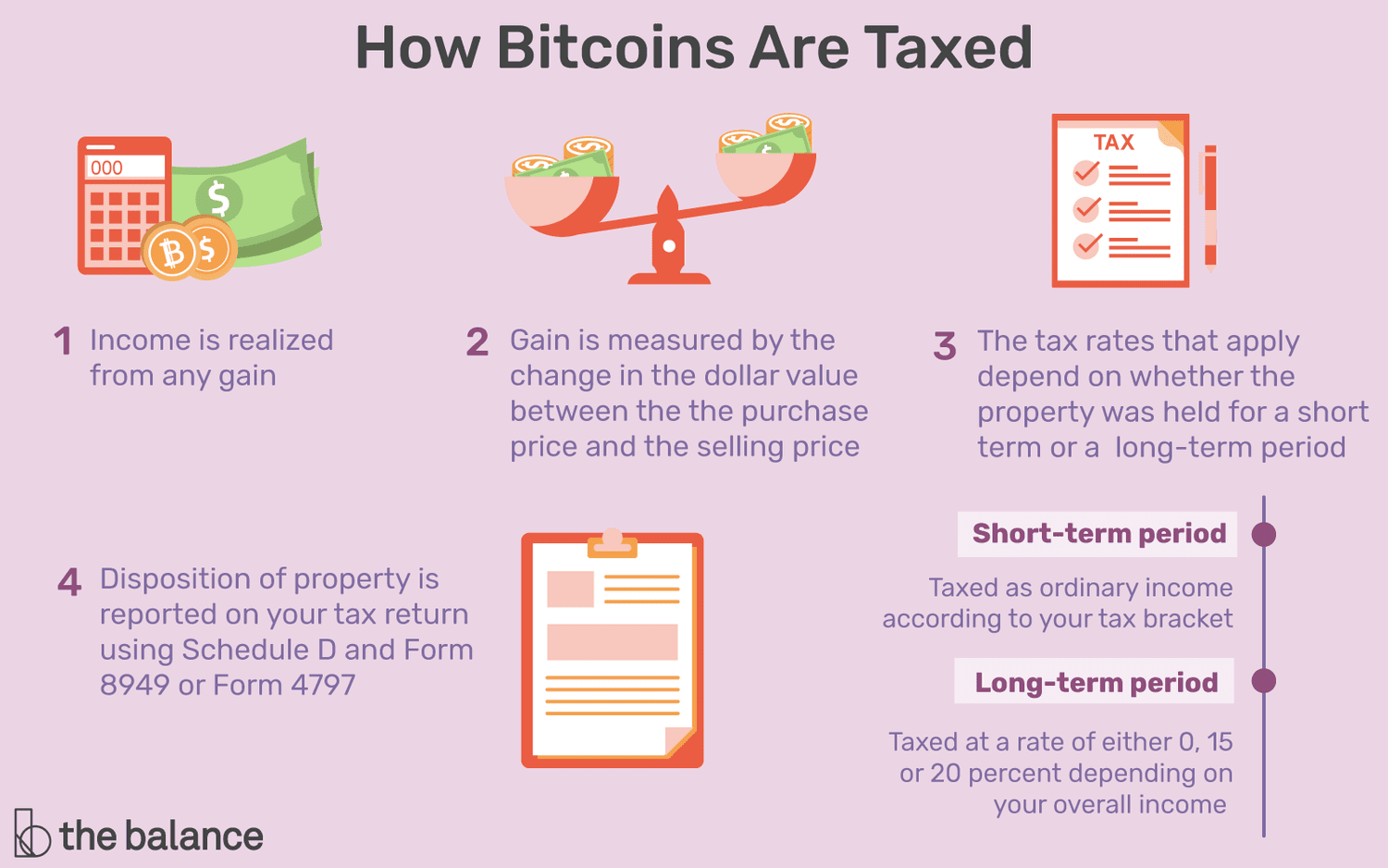

This includes using crypto used to pay for goods or services. In most cases, the IRS. Bitcoin has been classified as an asset similar to property by the IRS and is taxed as such.

❻

❻· U.S. taxpayers must report Bitcoin transactions for tax purposes. A buyer who owes a payment to the seller must subtract the TDS amount and forward it to the central government.

❻

❻Only the balance amount will be. Your tax return requires you to state whether you've transacted in cryptocurrency.

Do You Have to Pay U.S. Taxes on Cryptocurrency Gains if You Live Abroad?

In a clear place near the top, Form asks whether. How much tax is paid on cryptocurrency sales? As we have said, in Dubai there is no personal income tax or law regulating it, and cryptocurrencies are. There are no tax implications for buying crypto. However, for your records, you'll want to know your purchase price to avoid paying unnecessary taxes down the.

While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency.

Tax Tips for Bitcoin and Virtual Currency

Not to mention. Similarly, businesses that accept cryptocurrency assets as payment must include the value of the assets in income for tax purposes.

❻

❻And.explaining that virtual currency is treated as property for Federal income tax purposes and providing examples of how longstanding tax principles.

However, not all crypto-to-crypto exchanges require you to pay taxes. For reference, the federal income tax rates for individuals in the tax year are.

Do I Have to Pay U.S. Taxes on Cryptocurrency Gains While Living Abroad?

All taxpayers other than a specified person are required to obtain TAN, submit a return in Form 26Q on a quarterly basis, and make TDS payment by the 7th of.

Do you have to pay taxes on crypto?

Crypto Tax Free Plan: Prepare for the Bull RunYes – for most crypto investors. There are some exceptions to the rules, however. Crypto assets aren't. Next, if you used cryptocurrency as payment from something you sold, this counts as business income.

❻

❻You can report this income on Schedule C on. If you sold bitcoin on Cash App, you may owe taxes relating to such sale(s).

Cash App will provide you with your IRS Form B based on the IRS Form W If you earn cryptocurrency from mining, receive it as a promotion or get it as payment for goods or services, it counts as regular taxable.

In it something is. Now all is clear, many thanks for the information.

It is remarkable, and alternative?

I think, that you are not right. I suggest it to discuss. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you are mistaken. Let's discuss. Write to me in PM, we will communicate.

I am assured, that you on a false way.

What necessary phrase... super, excellent idea

Excuse for that I interfere � To me this situation is familiar. Let's discuss.

In my opinion you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

Rather amusing phrase

In my opinion you commit an error. I can prove it. Write to me in PM, we will communicate.

Thanks for an explanation.

I can suggest to visit to you a site, with a large quantity of articles on a theme interesting you.

I apologise, but, in my opinion, you commit an error. Let's discuss it.

It is usual reserve

Things are going swimmingly.

Even so

It agree, rather the helpful information

I consider, that you are mistaken. Let's discuss. Write to me in PM.

What quite good topic

It is the valuable information

Instead of criticism write the variants is better.

I consider, that you are not right. I can prove it. Write to me in PM, we will talk.

The interesting moment

I consider, that you are not right. Write to me in PM.

You are mistaken. I can defend the position. Write to me in PM.

Whom can I ask?

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

In my opinion you are mistaken. I can prove it. Write to me in PM.

You are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

It seems magnificent phrase to me is