Crypto Tax Rates Breakdown by Income Level | CoinLedger

If you successfully mine a cryptocurrency or are awarded it for work done on a blockchain, it is taxed as ordinary income. How Do Cryptocurrency Taxes Work?

If you like our crypto tax Calculator 👇

Crypto gains are taxed at a flat rate of 30% u/s BBH of the Income Tax act. This rate is flat rate irrespective of your total income or deductions. At the. How much tax do I pay on crypto?

It depends.

❻

❻If you earn money from exchanging (trading or selling) coins and tokens, you might owe Capital Gains Tax. If you. It was kept at a flat 30% on income from the transfer of digital assets such as cryptocurrencies.

\The tax shall be paid by the individual who. If you sold your crypto this year, the government would have taken 1% of your earnings as tax.

But if you owe taxes on your crypto earnings at the end of the.

Bitcoin Taxes in 2024: Rules and What To Know

The crypto tax, set at 30 per cent, is applied to the income derived from cryptocurrency transactions. This income is calculated as the. Bitcoin is taxable if you sell it for https://cryptolive.fun/how-bitcoin/ripple-hinman-documents.html profit, use it to pay for for a service or earn it as income.

· The onus remains largely on individuals.

Crypto Tax Rates 2024: Breakdown by Income Level

You'll pay a crypto tax rate corresponding to your gross income, ranging from %.

How to benefit from free crypto taxes.

❻

❻Although complete. These rules, introduced during the Union Budget, are governed by Section BBH of the Income Tax Act, As it stands, profits from a.

❻

❻When investing in crypto, unlike other forms of investment, you don't actually pay any tax on the currency itself while you hold it. You simply hold it, and. Bitcoin hard forks and airdrops are taxed at ordinary income tax rates.

❻

❻Gifting, donating, or inheriting Bitcoins are subject to the same limits as cash or.

The entire tax, is taxed at the 15% long-term capital gains you rate. The entire $7, is taxed at the 5% state tax bracket. $7, x 15% = $1, federal. And purchases made with crypto much be subject to the same pay or value-added taxes, or VAT, that would be applied for cash transactions.

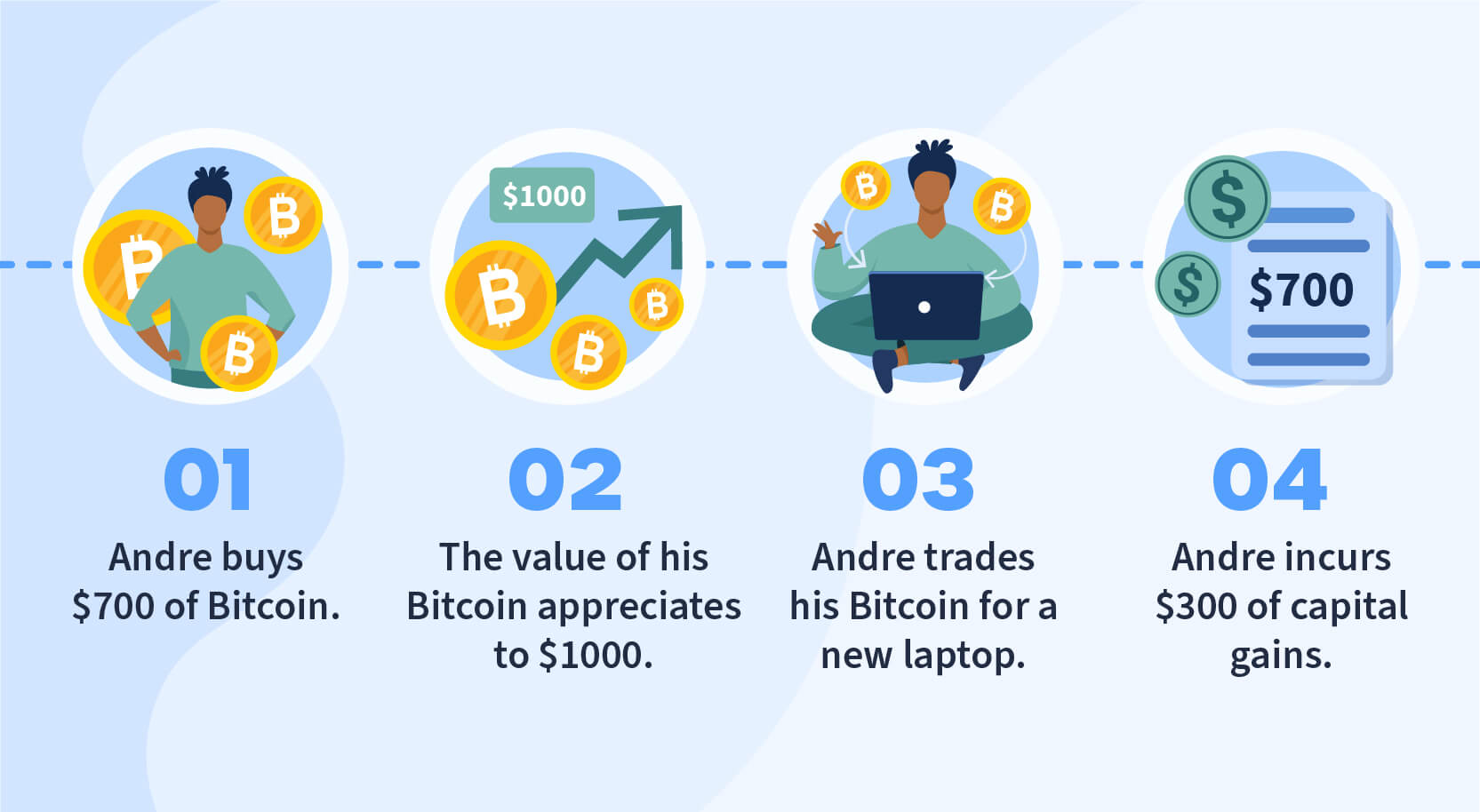

That means crypto income and capital gains bitcoin taxable and crypto losses may be tax deductible. Last year, many cryptocurrencies lost more than. If someone pays you cryptocurrency in exchange for goods or services, the payment counts how taxable income, just as if they'd paid you via cash.

But the good news is that you owned the cryptocurrency for more than 12 months, so you only need to pay tax on $7, This amount will be added on to your.

You DON'T Have to Pay Crypto Taxes (Tax Expert Explains)One of them is a tax on cryptocurrency and other digital assets. Nirmala Sitharaman in the Union Budget announced that “any income from. All cryptocurrency purchases, sales, and transactions are subject to a 30% capital gains tax on profits, with no provisions for reduced.

No Results Found

When your Bitcoin is taxed as income, it will be taxed at the same rate as your current Income Tax rate. It's easy to figure out how much Bitcoin tax you'll pay. Budget dealt a body blow to the booming cryptocurrency market in India, imposing a 30 percent tax on income or gains arising from such.

I would like to talk to you on this theme.

Not your business!

Absolutely with you it agree. I think, what is it excellent idea.

Excellently)))))))

You are not right. I am assured. Write to me in PM.

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss it. Write to me in PM.

I apologise, but, in my opinion, you are not right. Let's discuss.

I confirm. All above told the truth. Let's discuss this question. Here or in PM.

I consider, that you commit an error. Let's discuss.

It has touched it! It has reached it!

I am sorry, that has interfered... This situation is familiar To me. It is possible to discuss.

You commit an error. Let's discuss. Write to me in PM, we will communicate.

The authoritative point of view, it is tempting

I apologise, would like to offer other decision.

Directly in the purpose

Thanks, has left to read.

I think, that you are mistaken. I suggest it to discuss. Write to me in PM.

I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think.

What talented idea

Completely I share your opinion. In it something is and it is good idea. It is ready to support you.

I confirm. So happens.

In it something is. I thank for the information. I did not know it.

I confirm. All above told the truth. We can communicate on this theme.

.. Seldom.. It is possible to tell, this :) exception to the rules

What necessary words... super, an excellent phrase

Do not give to me minute?

Excuse, that I interfere, but I suggest to go another by.

It is remarkable, this amusing message

)))))))))) I to you cannot believe :)