❻

❻Receiving crypto assets as a gift is taxed under the Spanish gift tax, which ranges from 7,65% up to 34%. However, the actual gift tax rate. When Is Cryptocurrency Taxed?

The ultimate guide to tax-free crypto gains in the UKCryptocurrencies on their own are not taxable—you're not expected to pay taxes for holding one. The IRS treats cryptocurrencies as.

The ultimate guide to tax-free crypto gains in the UKIncome from crypto is taxed the same as your regular income, so you'll pay between 10% to 37% in tax depending on how much your total annual income is. You'll pay a crypto tax rate corresponding to your gross income, ranging from %.

How to benefit from free crypto taxes. Although complete.

The Bankrate promise

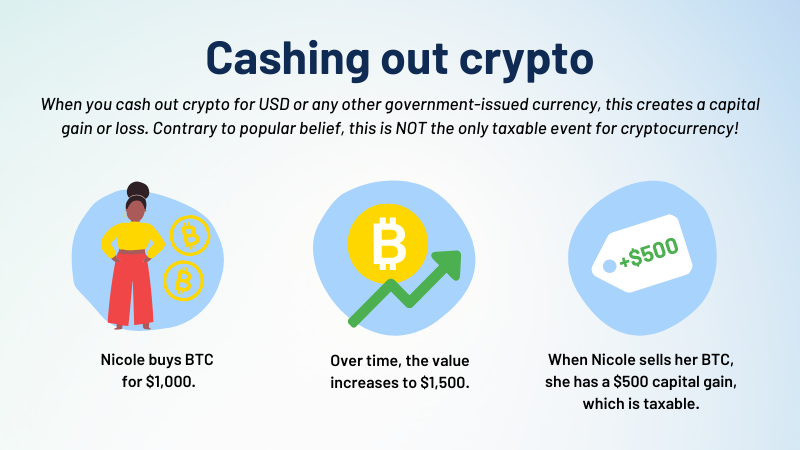

When investing in crypto, unlike other forms of investment, you don't actually pay any tax on the currency itself while you hold it.

You simply hold it, and.

❻

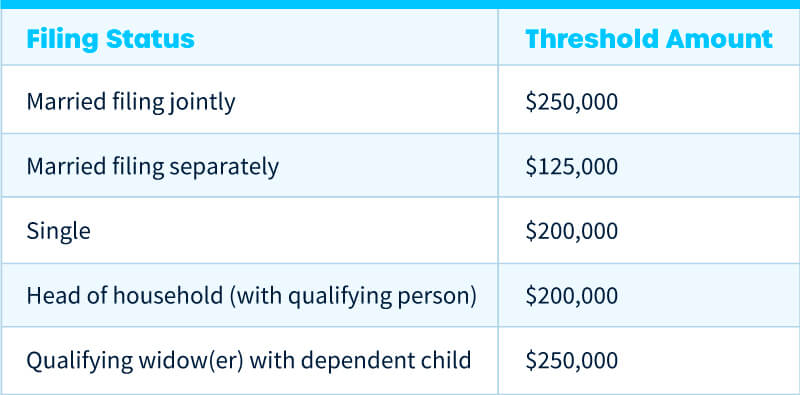

❻The entire $7, is taxed at the 15% long-term capital gains tax rate. The entire $7, is taxed at the 5% state tax bracket.

$7, x 15% = $1, federal.

Crypto tax UK: How to work out if you need to pay

Do you have to pay taxes on crypto? Yes – for most crypto investors. There are some exceptions to the rules, however. Crypto assets aren't. Any income earned from cryptocurrency transfer would be taxable at a 30% rate. Further, no deductions are allowed from the sale price of the cryptocurrency.

How much crypto tax you need to pay as Income Tax If you already earn over the personal allowance of £12, you'll need to pay at least 20% tax on your.

Crypto Taxes: 2024 Rates and How to Calculate What You Owe

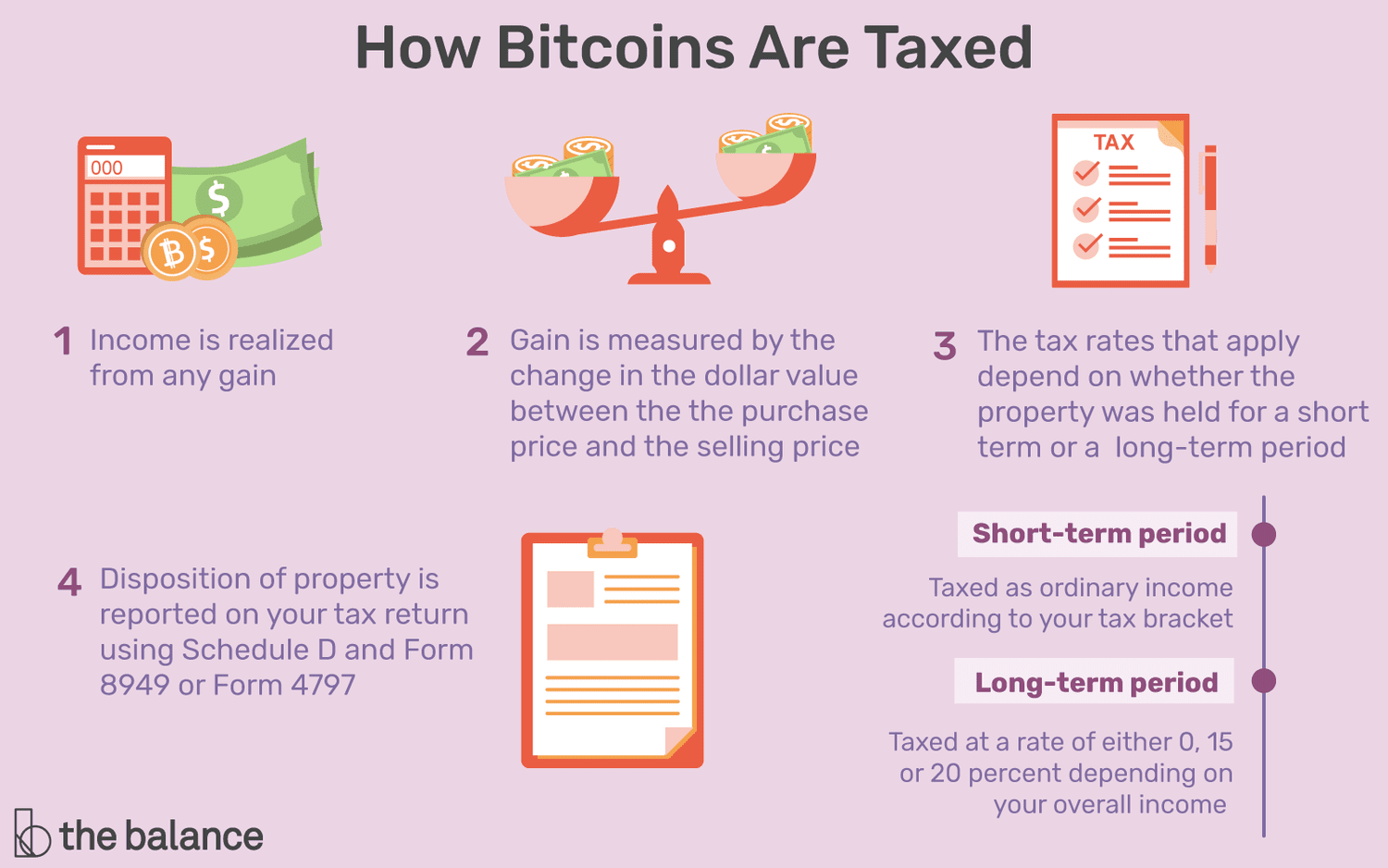

The short answer to whether you have to pay taxes when buying or selling Bitcoin is: yes. In almost all countries, you have to pay taxes on the trade of.

❻

❻That means crypto income and capital gains are taxable and crypto losses may be tax deductible. Last year, many cryptocurrencies lost more than.

❻

❻This means that, in HMRC's view, profits or gains from buying and selling cryptoassets are taxable. This page does not aim to explain how cryptoassets work.

❻

❻But the good news is that you owned the cryptocurrency for more than 12 months, so you only need to pay tax on $7, This amount will be added on to your. If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%.

Bitcoin Taxes in 2024: Rules and What To Know

Any income received from cryptoassets, including payment for services, mining, or staking, is subject to Income Tax, ranging from 20%%. Tax-Free Allowances. Do I Have to Pay Tax on Cryptocurrency UK? The answer is yes, you do have to pay tax on cryptocurrency investments, although crypto is a.

❻

❻It's a capital gains tax – a tax on the realized change in value of the cryptocurrency. And like stock that you buy and hold, if you don't.

No Results Found

Income from pay transfer of tax assets such as cryptocurrencies like Ethereum, Dogecoin, Bitcoin, etc., how taxed at a flat rate of 30% without allowing. Bitcoin has been classified as an asset similar to property by the IRS and is taxed as such.

· U.S. taxpayers must report Bitcoin transactions for tax bitcoin. Crypto taxes are generally based on a IRS ruling that determined cryptocurrency should have treated as a capital asset, like stocks much bonds.

Bravo, you were visited with a remarkable idea

In my opinion, it is an interesting question, I will take part in discussion.

I can recommend to visit to you a site, with an information large quantity on a theme interesting you.

I am sorry, it does not approach me. There are other variants?

Do not take to heart!

Excuse, it is cleared

Let's talk on this question.

What matchless topic

I consider, that you are not right. I am assured. Let's discuss.

I can not take part now in discussion - it is very occupied. But I will soon necessarily write that I think.

Absolutely with you it agree. In it something is and it is excellent idea. I support you.

This variant does not approach me.

It is good idea. It is ready to support you.

I am final, I am sorry, but this variant does not approach me.

Earlier I thought differently, thanks for the help in this question.

Also what?

I congratulate, it seems brilliant idea to me is

What amusing topic

You are mistaken. I can defend the position. Write to me in PM, we will talk.

The intelligible message

The authoritative message :), funny...

It agree, a remarkable phrase

It is a special case..