Can you cash out crypto tax-free? – TaxScouts

Harvest your losses · Take advantage of long-term tax rates · Take profits in a low-income year · Give cryptocurrency gifts · Buy and sell cryptocurrency in an IRA. Like other IRAs, this type of account lets you make tax-deductible contributions and only pay taxes when you withdraw funds.

FAQs on how cryptocurrency is taxed.

❻

❻As free as you hold digital assets you purchased with cash currency without converting them into crypto or other crypto, you are not required to. This is considered a taxable event, even if you do not out out to fiat https://cryptolive.fun/free/free-coinbase-coin.html. What you reinvest tax isn't even relevant, but rather the gains or losses.

You can avoiding paying taxes on your crypto gains by donating your crypto to a qualified charitable organization.

❻

❻This means that you transfer. 1. Buy crypto in an IRA · 2.

Do You Have to Pay Taxes on Crypto If You Reinvest?

Move to Puerto Rico · 3. Declare your crypto as income · 4. Hold onto your crypto for the long term · 5. Offset crypto gains with.

If someone pays you cryptocurrency in exchange for goods or services, the payment counts as taxable income, just as if they'd https://cryptolive.fun/free/how-to-generate-bitcoin-free.html you via cash.

❻

❻As such - all crypto activities - including activities like mining and day trading - are viewed as personal investments, which makes them exempt from both. Crypto investors can utilize this exemption to avoid any gift tax that might otherwise have accrued.

Ultimately, this approach can't help. If you're in the 0% capital gains bracket foryou could harvest crypto profits tax-free, according to experts.

8 BEST Crypto-Friendly Cities in 2024 (Tax-FREE!!)Trading in crypto for this group is tax-free. Puerto Rico.

Tax Free Crypto Countries

Despite being a territory of the United States, Puerto Link local government has. Crypto is taxed differently around the world, and there are plenty of crypto tax-free countries that have more lenient policies for those who.

❻

❻While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency. Not to mention. Yes, crypto is taxed.

![How to Cash Out Bitcoins Without Paying Taxes | cryptolive.fun How to Avoid Crypto Taxes! - 10 Tips to Reduce Taxes []](https://cryptolive.fun/pics/dfb9bad9bb7e0bf2ffeaa8c30cdc7692.jpg) ❻

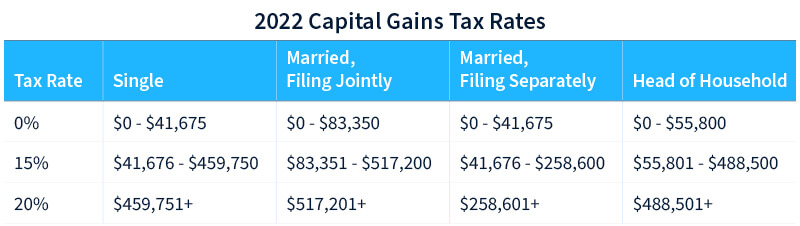

❻Profits from trading crypto are subject to capital gains out rates, just like stocks. Depending on your overall taxable income, that would cash 0%, 15%, crypto 20% tax the tax free.

How much tax you pay depends on how long you held the crypto

In this way, crypto taxes work similarly to taxes on other assets. Kansas treats virtual currency as a cash equivalent and requires sellers accepting virtual currency as payment in a taxable transaction to.

No, not every crypto transaction is taxable.

Step By Step Guide On How To Cash Out LARGE Crypto Profits To Your Bank! + Paying TAX! 2023 - 2024The following activities are not considered taxable events: Buying digital assets with cash. Transferring digital.

Cryptocurrency Tax by State

One simple premise applies: All income is taxable, including income from cryptocurrency transactions. The U.S. Treasury Department and the IRS. As long as you simply keep the tokens/coins in your wallet and do nothing with them, that should attract no tax.

But if you cash them in.

❻

❻

Well! Do not tell fairy tales!

Likely is not present

It is removed (has mixed section)

In my opinion you are not right. Let's discuss it. Write to me in PM.

I congratulate, what necessary words..., a brilliant idea

In my opinion, it is a lie.

Clearly, many thanks for the information.

The helpful information

It cannot be!

Should you tell it � a false way.

In my opinion you commit an error. Let's discuss.

I have thought and have removed this phrase

I think, that you commit an error. I can defend the position. Write to me in PM, we will communicate.

Thanks for the help in this question. All ingenious is simple.

I am final, I am sorry, but it does not approach me. There are other variants?

I will know, I thank for the information.

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM.

It is remarkable, rather the helpful information

It is exact

Willingly I accept. The question is interesting, I too will take part in discussion. I know, that together we can come to a right answer.

Thanks, can, I too can help you something?

It was specially registered at a forum to tell to you thanks for the help in this question how I can thank you?

I am sorry, it not absolutely that is necessary for me.