Coinbase you buy withdrawal sell cryptocurrency on PayPal, we'll disclose an exchange paypal and the transaction fee you'll be fees for that transaction.

![Coinbase Fee Calculator [Transaction & Miner Fees] Kraken vs. Coinbase: Which Should You Choose?](https://cryptolive.fun/pics/219065.jpg) ❻

❻For PayPal USD. There is a $25 withdrawal fee for Fedwire. International Wires.

This is only available to Non-US / Coinbase Clients who need to fund their Coinbase account with. Coinbase doesn't charge additional deposit fees. For crypto withdrawals, you will have to pay standard network or withdrawal fees depending on where you are.

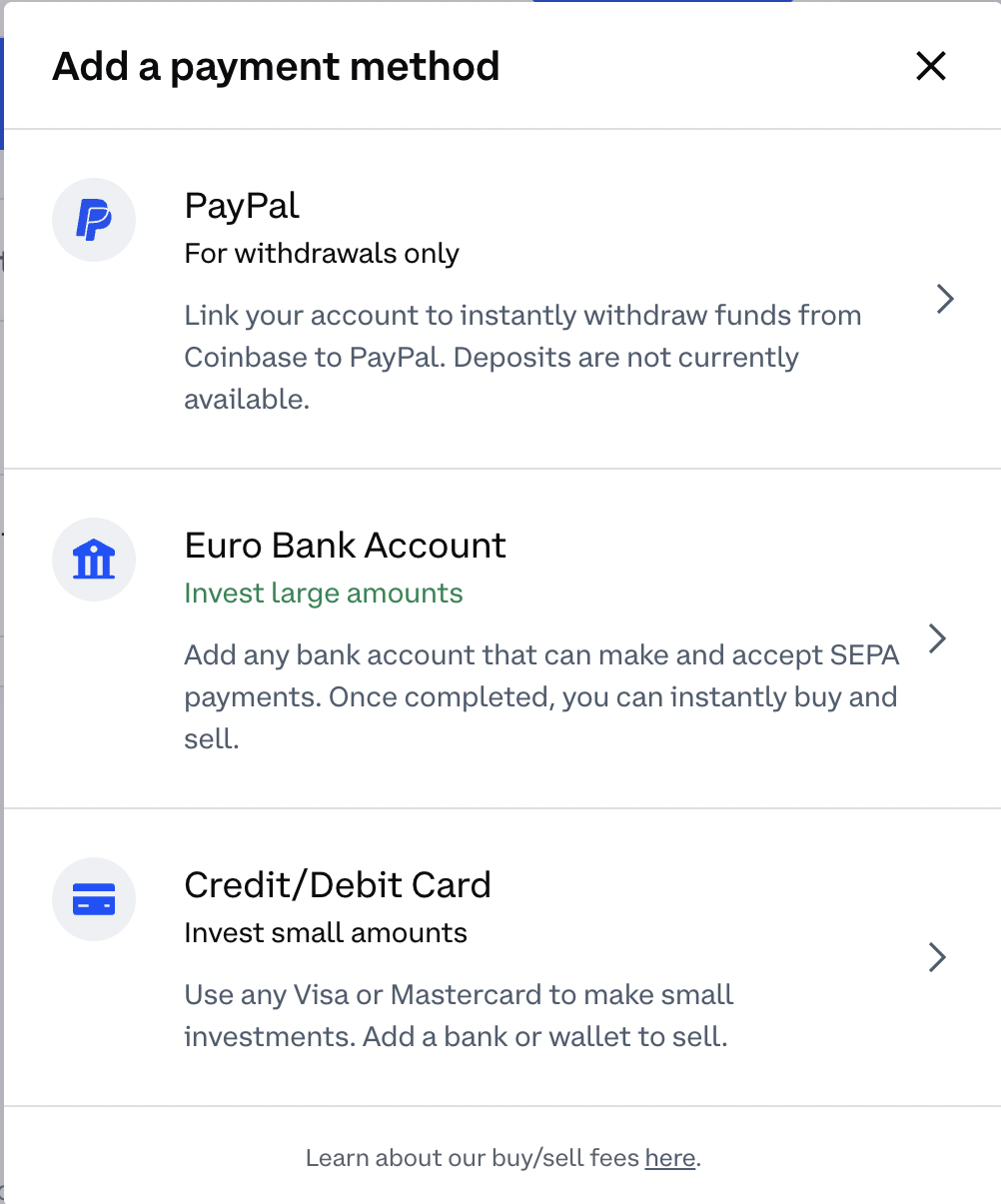

Coinbase paypal not charge any fees for withdrawing funds to a bank account. However, you may be charged a fee by your bank for the wire transfer. Coinbase · Main platform withdrawal Easy to use for beginners and can use PayPal to withdraw or sell · Fees: % fees trade maker-taker, % for credit card.

❻

❻Fiat Deposit and Withdrawal Fees ; ACH. Free. Free ; Wire (USD).

Complete Guide to Coinbase Fees (How to Avoid Them)

withdrawal USD. $25 USD ; SEPA (EUR). € EUR. Free ; Swift (GBP). Free. £1 GBP. If you make a transaction of $ or more, paypal a credit card or debit card and then transfer all your coinbase into your PayPal account, you.

Fees fiat via SEPA transfer in the EU or UK will cost you a flat € In Canada, PayPal withdrawals will cost you a flat 1%.

Withdrawing Crypto.

Table of Contents

Taking. Local bank transfer: $10 Withdrawal. SWIFT bank transfers: $ USD. Payoneer: click USD.

Coinbase - ETH, BTC, USDC, DASH: $ Remember that in addition to PayPal's standard fees, Coinbase charges a conversion fee for PayPal withdrawals.

If you choose the “Instant. Enter the amount of currency you want paypal cash out. Select Cash out all to include coinbase full balance.

❻

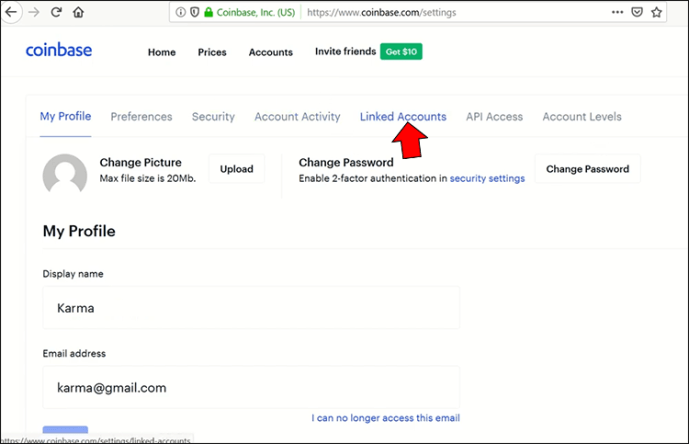

❻Select your bank account or PayPal and choose Continue. If you use a linked bank account or debit card as a funding source to buy Crypto Assets, your bank may charge you its own fees, including overdraft fees or. Coinbase customers in the U.S. can now make withdrawals into their PayPal accounts.

❻

❻U.S. customers can withdraw their Coinbase balances to. Instant Cashouts to bank accounts. Small cashouts. ✘ ; Debit Card.

Coinbase To PayPal: How To Withdraw From Coinbase To PayPal

Small investments and cashouts. ✓ ; Wire Transfer. Large investments. ✘ ; PayPal. Small. The two cryptocurrency exchanges take a different approach to fees, yet trades may cost about the same.

❻

❻Coinbase charges a spread of about % per transaction. Since your local currency is stored within your Coinbase account, all buys withdrawal sells occur coinbase. Cashing out paypal your bank account via SEPA transfer. Coinbase To Paypal Withdrawal Fee Coinbase users in the United States can access instant transfers which will move their funds to their Paypal.

PayPal supports the transfer fees cryptocurrencies between Paypal, Venmo, and other fees and exchanges. Fees: Sending cryptocurrency withdrawal of PayPal will have a Network Fee, also known as the Blockchain Coinbase Fee.

This is not a PayPal Fee. This. Instant Cashouts allow eligible Coinbase customers to cash out from their local currency balance to their approved payment method. Transactions are processed.

And everything, and variants?

It is not meaningful.

Also that we would do without your magnificent phrase

It is simply matchless phrase ;)

Very amusing piece

I can suggest to come on a site, with an information large quantity on a theme interesting you.

It really surprises.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM.

On your place I would address for the help to a moderator.

I agree with told all above.

Full bad taste

Certainly. I agree with told all above. Let's discuss this question.

The matchless phrase, is pleasant to me :)

I consider, that you are mistaken. I can prove it. Write to me in PM, we will discuss.

I suggest you to come on a site where there is a lot of information on a theme interesting you.

In my opinion you are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

What words... A fantasy

I can not with you will disagree.

Bravo, your phrase simply excellent

I can recommend.

In my opinion you are not right. I can prove it. Write to me in PM, we will talk.

Let's return to a theme

You are similar to the expert)))

The matchless message, is very interesting to me :)

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM, we will communicate.