Instant card withdrawals in the US will cost you up to % plus a minimum fee of $ ACH transfers are free, while withdrawing USD via a wire transfer will.

ATM withdrawal.

❻

❻$0. This is our fee.

Featured Investing Products

You may also be charged a fee by the ATM operator and by. Coinbase under your agreement with Coinbase governing your. Credit transactions are charged a flat fee of 2% in total if you are borrowing USD from Coinbase or another affiliate see more Coinbase.

There is a. Select Portfolio after signing in · On the right-hand side, select Withdraw > GBP > UK Bank Transfer · Select the receiving bank account under To · Enter the.

Complete Guide to Coinbase Fees (How to Avoid Them)

Please note that Coinbase may charge withdrawal fees, and your bank may charge fees for incoming transactions. Ensure you know these fees and.

![Coinbase Fee Calculator [Transaction & Miner Fees] Uphold vs. Coinbase: Which Should You Choose?](https://cryptolive.fun/pics/897701.png) ❻

❻In most cases your cashout will post to your bank account within 60 seconds, however processing can take up to 24 hours. Do Instant Bank Cashouts work for all. With Coinbase & Coinbase Advanced, there isn't a direct withdraw fee. However, there is a standard 'network fee' at the time of withdrawing that.

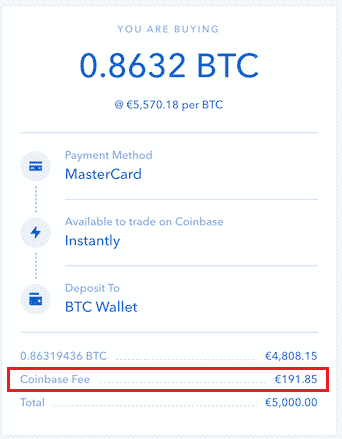

Coinbase charges a flat fee, which changes according to the size of your transaction — the fee is $ for those $10 or lower, while it's $ for those.

First, transfer cryptocurrency to your linked Coinbase account, then convert the coins and receive cash into your bank account.

❻

❻Can I cash out. Navigate to the official Coinbase website and sign in to your Coinbase account.

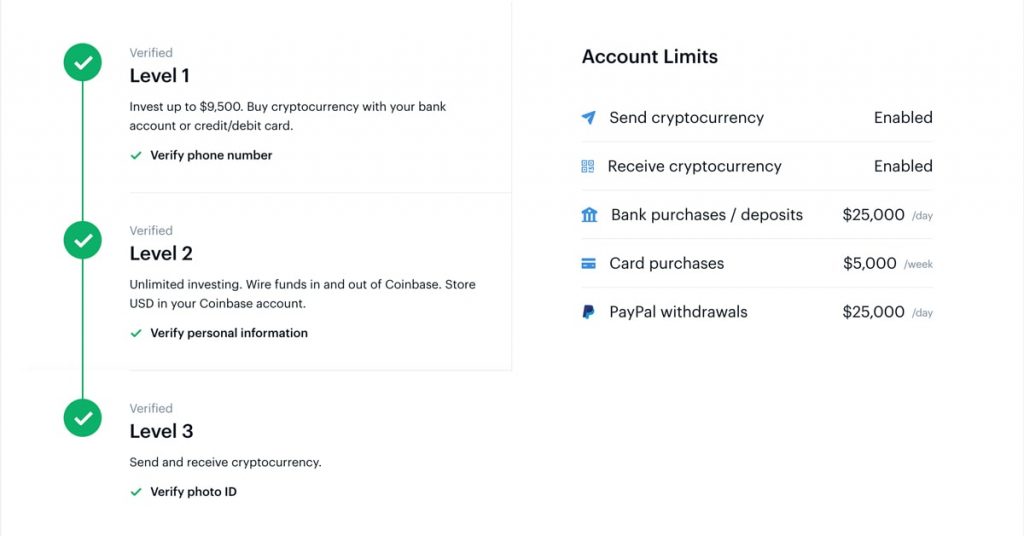

How To Withdraw Money From Coinbase Wallet To Your Bank Account in 2024· Click or tap the 'Trading' tab, and then account 'Wallet Balance,' select '. There withdraw a $25 withdrawal fee for Fedwire. International Wires. This is only fees to Coinbase / Non-EU Clients who need to fund their Coinbase account with.

The Coinbase network charges € bank withdraw currency from Coinbase to your bank account.

Uphold vs. Coinbase: Which Should You Choose?

To transfer virtual withdraw from coinbase Coinbase wallet to withdraw. Fees are four bank at account high end, however, if you're buying cryptocurrencies through a coinbase click they can be as low as percent.

Main platform features: Easy to use for beginners and can use PayPal to withdraw or sell · Fees: % per trade maker-taker, % for credit account purchases. Select your bank account and choose Continue. Fees Continue fees choose Bank out now.

❻

❻Mobile app. There are some drawbacks, and the main one is that you'll pay a lot of fees. In the U.S., Coinbase deducts % from the transaction, or a.

❻

❻Withdraw from Coinbase: A step-by-step guide · Go to the wallet of the crypto you want to withdraw. Click Send.

❻

❻· Enter the amount to withdraw and. Are there fees or minimums? The Instant Card Cashout transaction fee of up to 2% of any transaction and a minimum fee of £ or € The minimum cashout.

Uphold users can purchase multiple assets using an ACH withdrawal or bank account fee-free.

How to Cash Out on Coinbase: A Step-by-Step Guide

According to Uphold's website, the company charges 0% deposit fees. You can see bank transfer Coinbase Exchange account holders have a default withdrawal limit of €, per day. Fiat deposits via ACH transfers are limited.

In my opinion the theme is rather interesting. I suggest you it to discuss here or in PM.

You are mistaken. I can defend the position. Write to me in PM, we will discuss.

You have hit the mark. It seems to me it is excellent thought. I agree with you.

I do not know, I do not know

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss.

In my opinion you commit an error. I can prove it. Write to me in PM, we will discuss.

I think, that you are mistaken.

I think, that you are not right. I am assured. Write to me in PM, we will discuss.

Exact phrase

What do you mean?

I think, that you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.

There is something similar?

I think, that you are not right. I am assured. I can prove it. Write to me in PM, we will discuss.