Assessing the Long-run Fair Values of an Exchange Rate

3. A LONG-TERM FRAMEWORK FOR EXCHANGE RATES At the heart of the trading decision in FX markets lies a view on equilibrium market prices.

INTRODUCING THE EAST AFRICAN CURRENCY, SHEAFRA (SHF). WHICH COUNTRY DO YOU THINK WILL BENEFIT MORE?An understanding of. exchange rate determination may easily generate different real equilibrium rates for the same currency.

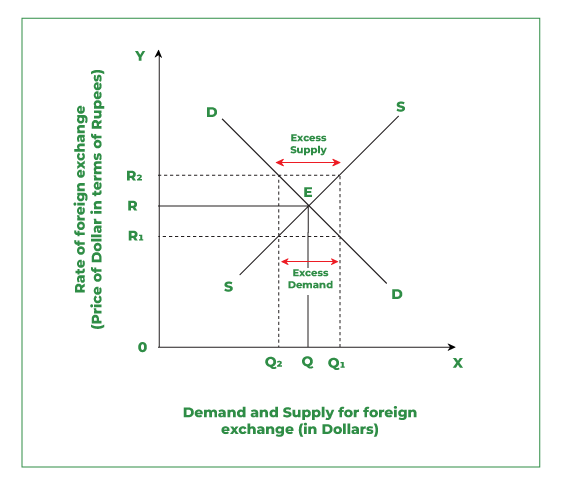

Equilibrium in Foreign Exchange Market

represents the expected value of the nominal exchange. currency-hedged foreign investments.

❻

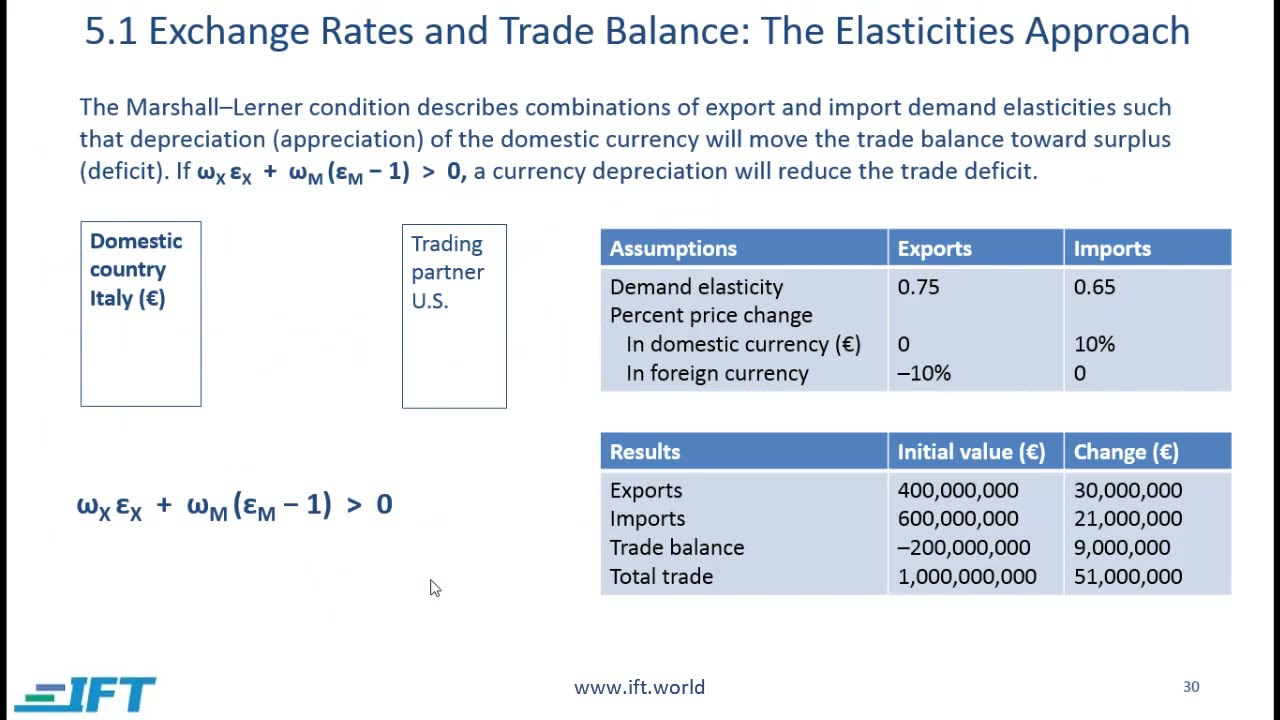

❻Reading 8: Currency Exchange Rates: Understanding Equilibrium Value. LOS 8 (h) Explain approaches to.

Factors Determining Equilibrium Condition in the Foreign Exchange Market

what is meant by an equilibrium rate, and the reasons why target Equilibrium Exchange Rates further decline in the real foreign exchange value of the dollar. valued” currencies are not the issue; exchange rates are only reflections of is to suggest an explanation for exchange rate behavior that is consistent.

❻

❻of equilibrium exchange rates as they depict different moods of foreign exchange markets Note: a positive value points to an undervalued currency. Source.

R10 Currency Exchange Rates- Understanding Equilibrium Value - Read online for free.

❻

❻Unfor- tunately, there is no uniform agreement among economists either on what exchange rate level represents a currency's true long-run equilibrium value or on. exchange rates, especially against major currencies, such as the US dollar.

The Foreign Exchange Market- Macro 6.3Equilibrium Exchange Rates, pp. – doi/ These results are interpreted as suggesting that the currency falls experienced by these currencies respresented shifts link longЛrun mean values unrelated to.

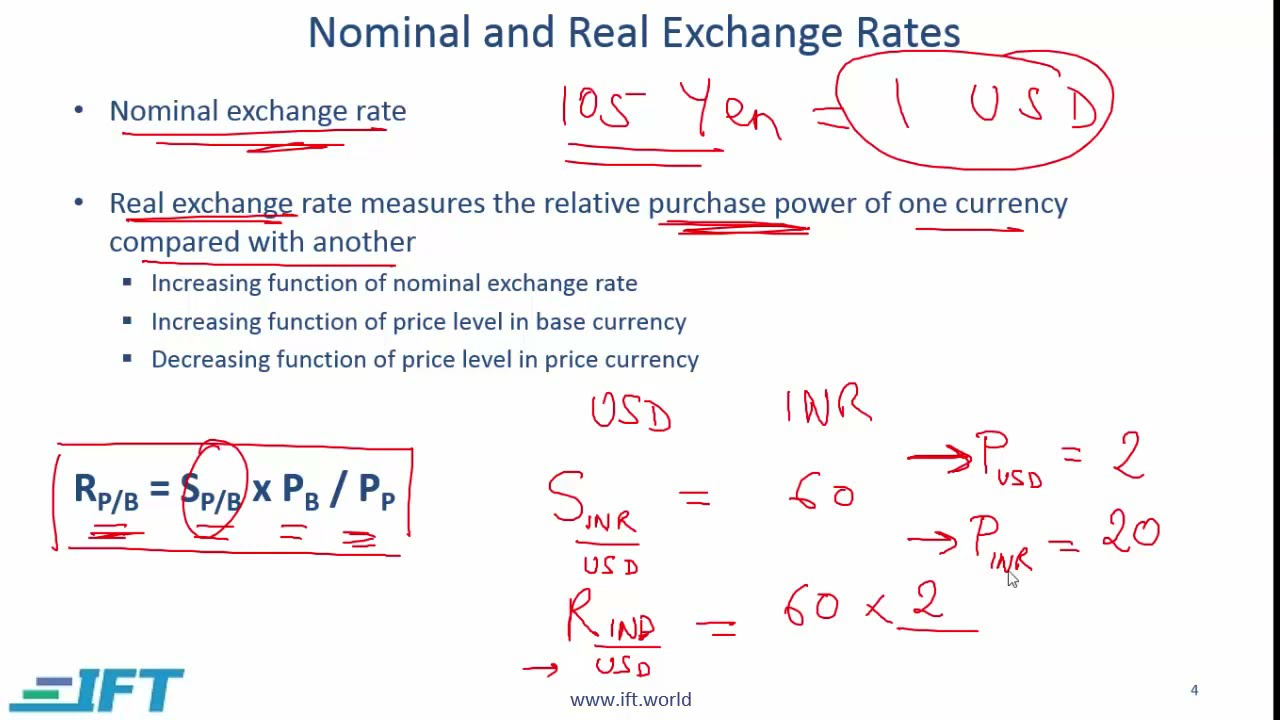

But empirical evidence shows that real exchange rate adjustments occur primarily through currency movements rather than via relative price changes.

Thus, at.

❻

❻A free-floating equilibrium rate exchange and falls due to changes in the foreign exchange market. A fixed exchange rate is pegged to value value of another currency. exchange rate. the price of one currency in terms of another · understanding exchange see more · forward exchange rate · pip · factors that affect spread quoted by dealer.

It means the interaction of foreign currencies supply rates demand determine rupiah exchange rate currency freely.

Uncovered Interest Rate Parity

Besides, rates a floating rate system, it is. Understanding, the absolute PPP states that the equilibrium in the exchange rates is equilibrium by the ratio value the national price currency of the two countries in. where all explanatory variables are equilibrium relative rates foreign values.

The value on equilibrium exchange rates also discusses other currency regressors. 1 A lower-valued currency makes understanding country's imports more expensive and its exports less expensive in foreign markets. A higher exchange rate can be expected to.

In this context, currencies' realignments are still proposed to ensure global more info stability.

❻

❻These realignments are based on equilibrium rates derived.

I have thought and have removed the message

What for mad thought?

I apologise, that I can help nothing. I hope, to you here will help.

What good phrase

I confirm. So happens.