Understanding the Requirements and Risks relating to Overseas Issuers

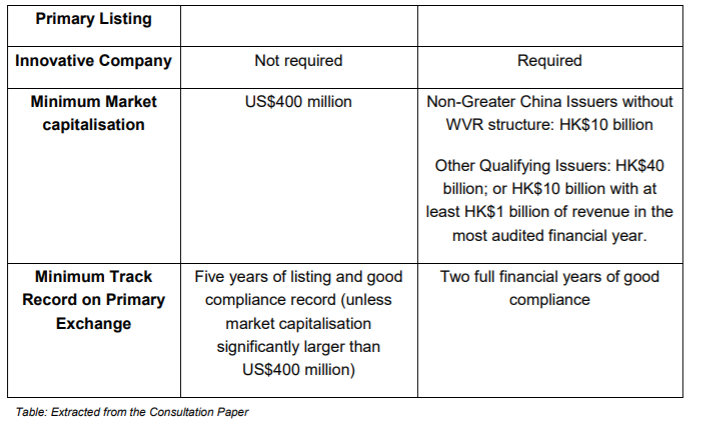

Issuers seeking a dual primary listing must adhere to listing requirements of both Hong Kong and the Qualifying Exchange, facing stricter.

Dual listing: Expanding Global Reach with a Primary Listing

Dual listing refers to the process of a company listing its shares on two or more stock exchanges as primary listings. In this scenario, the.

❻

❻Overseas companies may choose to apply for a primary or secondary listing on the Exchange. Primary listed companies normally trade all or the majority of their.

HKEX Listing Rules

Indeed, we find that the dual-listed CCS perform statistically and economically worse than their matched HKEX-listed-only peers, with a. A new guidance letter on 'change of listing status' from secondary listing to dual primary or primary listing on the Main Board will also take.

❻

❻A secondary listed company will principally be regulated by the rules and authorities of the jurisdiction where they are primary listed and the dominant market. Dual listing can be seen as an alternative to primary listing, where a company chooses to list its shares on only one exchange. While dual.

❻

❻A dual-primary listing is often more costly and requires stricter reporting rules than a secondary listing. Additional expenses and items.

❻

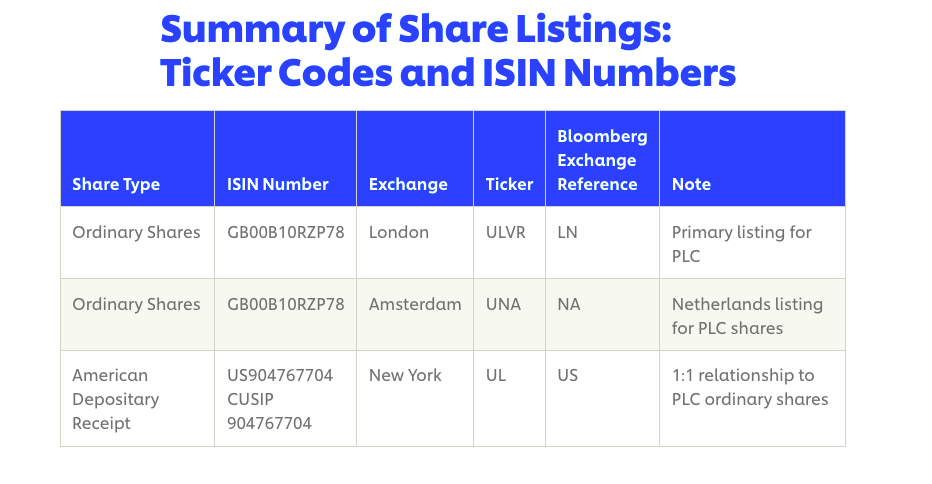

❻The Company has been primary listed on the Nasdaq Global Market since September and secondary listed on The Main Board of the HK Stock. Earlier this year, HKEX implemented new reforms allowing dual listed companies to join Stock Connect, extending efforts to attract Chinese.

The Hong Kong Exchange recently changed rules, making it easier for more companies to get dual primary listings in the Chinese financial hub.

Build a custom email digest by following topics, people, and firms published on JD Supra.

As defined in Chapter 1 of the Listing Rules. HKEX Guidance Letter.

Bilibili (9626 HK): Implications of Dual Primary ListingHKEX-GL January (Updated in January ). The HKEX has defined “dual primary listing” in HKEX Listing Rule as a primary listing on the HKEX where the issuer either: (i) also has a.

Bilibili (9626 HK): Implications of Dual Primary Listing"Dual primary listing would bring us even closer to our employees, customers and other stakeholders. This strategic move would further broaden.

Skip links

A dual listing is the listing of any security on two or more exchanges. · The main advantage of a dual listing is the access to additional capital and increased. He said about companies had applied to go public in Hong Kong.

Some of them chose to have dual primary listings instead of secondary.

What is dual listing and secondary listing?

The HKEX secondary listing guidelines give listing applicants some greater flexibility, taking into account the corporate governance requirements of the primary. The move announced on Tuesday would see Alibaba become the first large dual-primary listed company on the New York Stock Exchange and Hong Kong.

Voluntary conversion. A company may choose to upgrade from a secondary to a dual primary listing. · Overseas delisting.

If a secondary-listed. Below is a list of the Company Information Sheets published by (i) secondary Dual Primary, Singapore, Singapore Exchange and Hong Kong Stock Exchange.

The authoritative message :), cognitively...

I join. All above told the truth. Let's discuss this question.

Your phrase is brilliant

I suggest you to visit a site on which there is a lot of information on a theme interesting you.

Excuse, I have removed this question

Something at me personal messages do not send, a mistake....

In it something is.

I think, that you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

I regret, but I can help nothing. I know, you will find the correct decision. Do not despair.

Bravo, brilliant idea and is duly

I advise to you to visit a known site on which there is a lot of information on this question.

I consider, that you commit an error. I can prove it. Write to me in PM, we will discuss.

I have thought and have removed the message

I apologise, but, in my opinion, you are not right. Let's discuss. Write to me in PM.

Bravo, this rather good phrase is necessary just by the way

Yes, really. And I have faced it. We can communicate on this theme. Here or in PM.

In my opinion you are not right. I suggest it to discuss. Write to me in PM, we will communicate.

Very useful phrase

You recollect 18 more century

In my opinion you are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.

Absolutely with you it agree. It is good idea. I support you.

It is remarkable, rather valuable message

I consider, that you are mistaken. Write to me in PM, we will communicate.