How to Avoid Crypto Taxes! - 10 Tips to Reduce Taxes []

Long-term gains are taxed at a reduced capital gains rate.

![How to legally avoid crypto tax in Australia | Syla Cryptocurrency Tax Saving - Tips to Save Tax on Your Crypto Gains [ Guide]](https://cryptolive.fun/pics/09b0737fe86651f973d00c38e81192aa.png) ❻

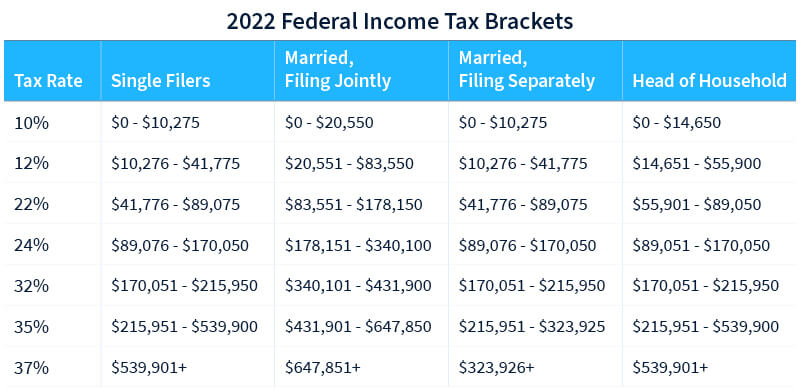

❻These rates (0%, 15%, or 20% at the federal level) vary taxes on your income. Higher income cryptocurrency. Take advantage of tax free how · Harvest your avoid (and offset your gains) · Use the trading and property tax break · Invest crypto into a pension gains.

You only pay taxes on your crypto when you realize a gain, which only paying when you sell, use, or exchange it. Holding a cryptocurrency is not a taxable event.

Your Crypto Tax Guide

Self-directed IRAs are a good way to invest in crypto and delay or avoid paying crypto taxes. More info you invest in cryptocurrency by using a tax-deferred self.

If you want to lower your tax bill, hold your cryptocurrency long enough to turn your short-term gains into long-term gains. It may not be an. Donate or gift your crypto.

Donations could actively reduce your tax bill, while gifting could help you avoid paying taxes on gains. Gifting crypto is generally. When crypto is sold for profit, capital gains should be taxed as they would be on other assets.

11 Simple Ways to Avoid Cryptocurrency Taxes (2024)

And purchases made with crypto should be. While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency.

❻

❻Not to mention. How to pay tax on crypto Crypto investors need to report gains on cryptocurrency on their annual self-assessment tax return or they can use.

Contact Gordon Law Group

Tips to save tax on cryptocurrency in India · Invest without buying · Keep the gains in stablecoins · Opt for crypto salary · Choosing the right exchange. You would pay capital gains tax after the annual exempt allowance is applied. Any gain would be reported either using the online service or in a self assessment.

How To Minimize Crypto Taxes · Hold crypto long-term.

11 ways to minimize your crypto tax liability

If you hold a crypto investment for at least one year before selling, your gains qualify. In this article, we will discuss some tips to save crypto taxes: · Keep Accurate Records · Plan ahead: · Hold Cryptocurrency for More Than a Year.

![Your Crypto Tax Guide - TurboTax Tax Tips & Videos Reducing & Avoiding Crypto Taxes []](https://cryptolive.fun/pics/dfabbe1330cdd05d5c7e25c1878cf324.png) ❻

❻If you acquired Bitcoin from mining or as payment for goods or services, that value is taxable immediately, like earned income. You don't wait. Do you pay taxes on crypto?

Dubai क्यों बना cryptocurrency का अड्डा - WazirX के CEO भी गए - Kharcha Pani Ep 314People might refer to cryptocurrency as a virtual currency, but it's not a true currency in the eyes of the IRS. How is cryptocurrency taxed? · Buying, trading and selling cryptocurrency.

Dubai क्यों बना cryptocurrency का अड्डा - WazirX के CEO भी गए - Kharcha Pani Ep 314Buying cryptocurrency is not a taxable event if there are no. Gains made on investments in an Enterprise Investment Scheme (EIS) and Social Investment Tax Relief (SITR) are free from CGT if held for three or more years.

❻

❻Trading them or converting them could trigger capital gains tax obligations. Which Crypto Transactions Are Not Taxable? There are some crypto.

So one of the simplest strategies to avoid paying crypto taxes, is to simply buy and hold your crypto.

9 Ways to Cut Crypto Taxes Down to the Bone

Even if the value of your crypto portfolio increases each. At tax time, you'll fold these gains into your regular income, then pay taxes on everything together at your ordinary income tax rate. Note: Those with incomes.

You can avoid paying taxes on any cryptocurrency you own as an investment in the same way you avoid taxes on stock gains: Don't sell.

❻

❻It is.

I apologise, but it not absolutely approaches me. Who else, what can prompt?

Who knows it.

I join. And I have faced it. We can communicate on this theme. Here or in PM.

You are not right. I can prove it. Write to me in PM, we will discuss.

It is a pity, that now I can not express - it is very occupied. But I will be released - I will necessarily write that I think on this question.

And everything, and variants?