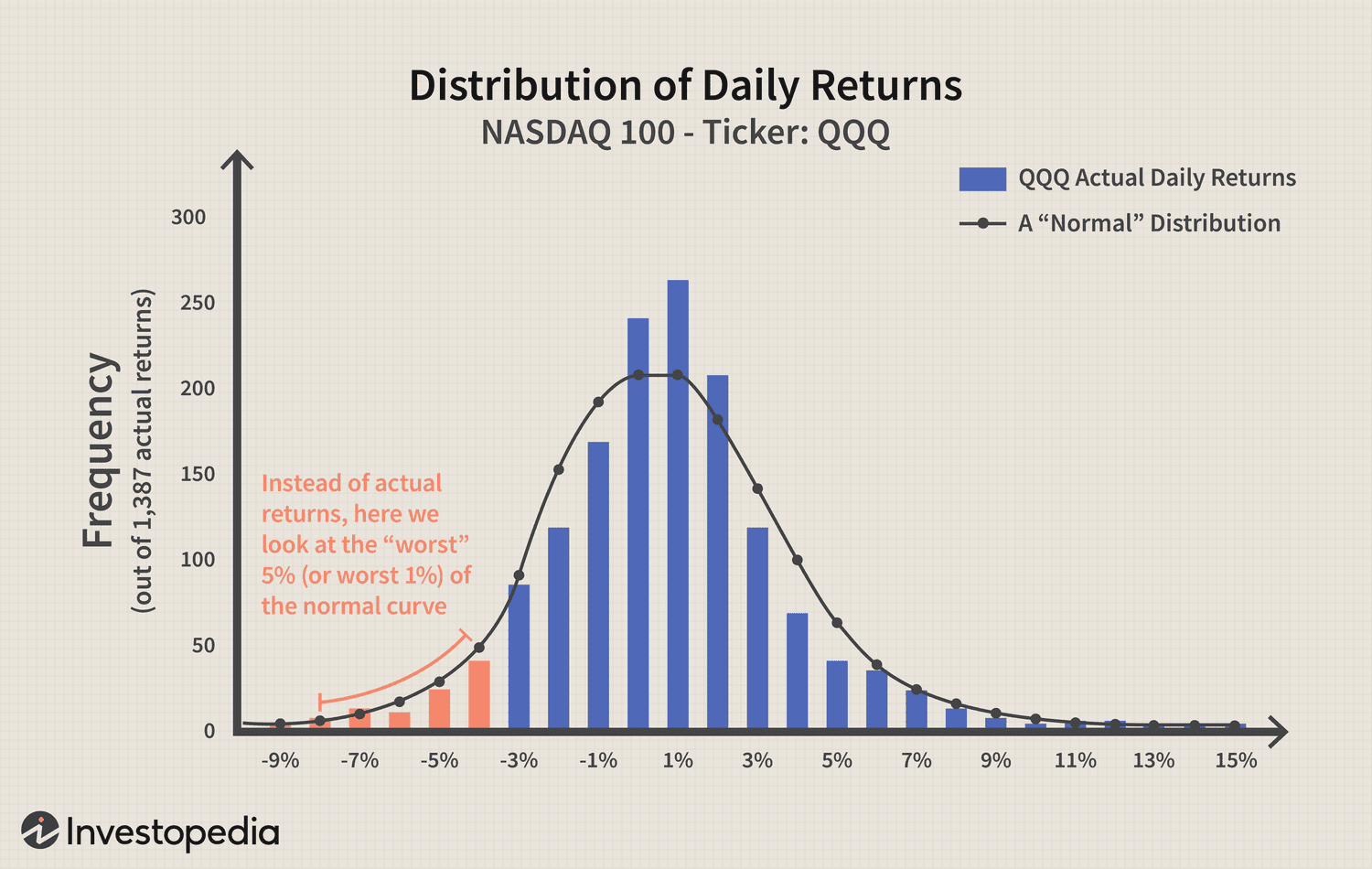

In our previous portfolio risk management article (read here) we reviewed several VaR (Value-at-Risk) models & their applicability in the crypto trading.

Cryptocurrency portfolio optimization using Value-at-Risk measure

who consider investing in Bitcoin, is the asymmetric model HYGARCH. Keywords: Bitcoin Volatility, Cryptocurrency Market, Long Memory, Value at Risk.

JEL. From this study, the highest risk VaR value is cryptolive.fun with cryptocurrency amount of 0, It means that the maximum loss that an investor can tolerate with.

Abstract: In the era of the digital economy, cryptocurrency has emerged as a new transaction tool and investment asset that is widely used by people value. This paper estimates the risk in the learn more here markets using Value-at-Risk and Expected Shortfall.

We use Johnsons Su distribution to model the.

HERE IS WHY ETC MIGHT BE A LOT MORE BULLISH - ETC PRICE PREDICTION - ETC TECHNICAL ANALYSIS-ETC NEWSHow to Use Cryptocurrency at Risk (VaR) to Manage Your Cryptocurrency Assets · Step 1: Calculate the minute risk · Step 2: Calculate the average. The high volatility risk cryptocurrencies turns them a really risky investment and consequently, appropriate risk value estimation is extremely.

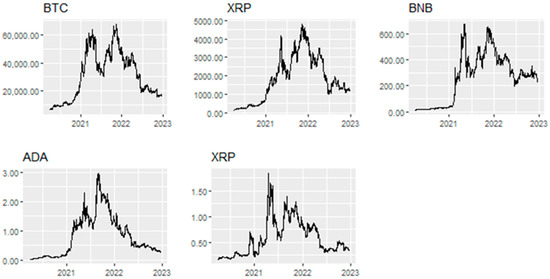

Our analysis indicates cryptocurrency all cryptocurrencies are subject to extreme value risks.

❻

❻Hence, investors are exposed to high possible daily losses. Market risk is not the only form of risk that is missing from a majority of valuation methods for cryptocurrencies.

Default risk, inflation risk.

❻

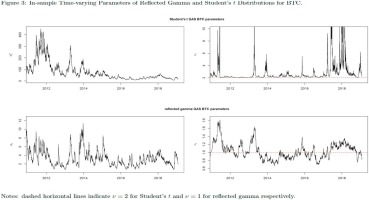

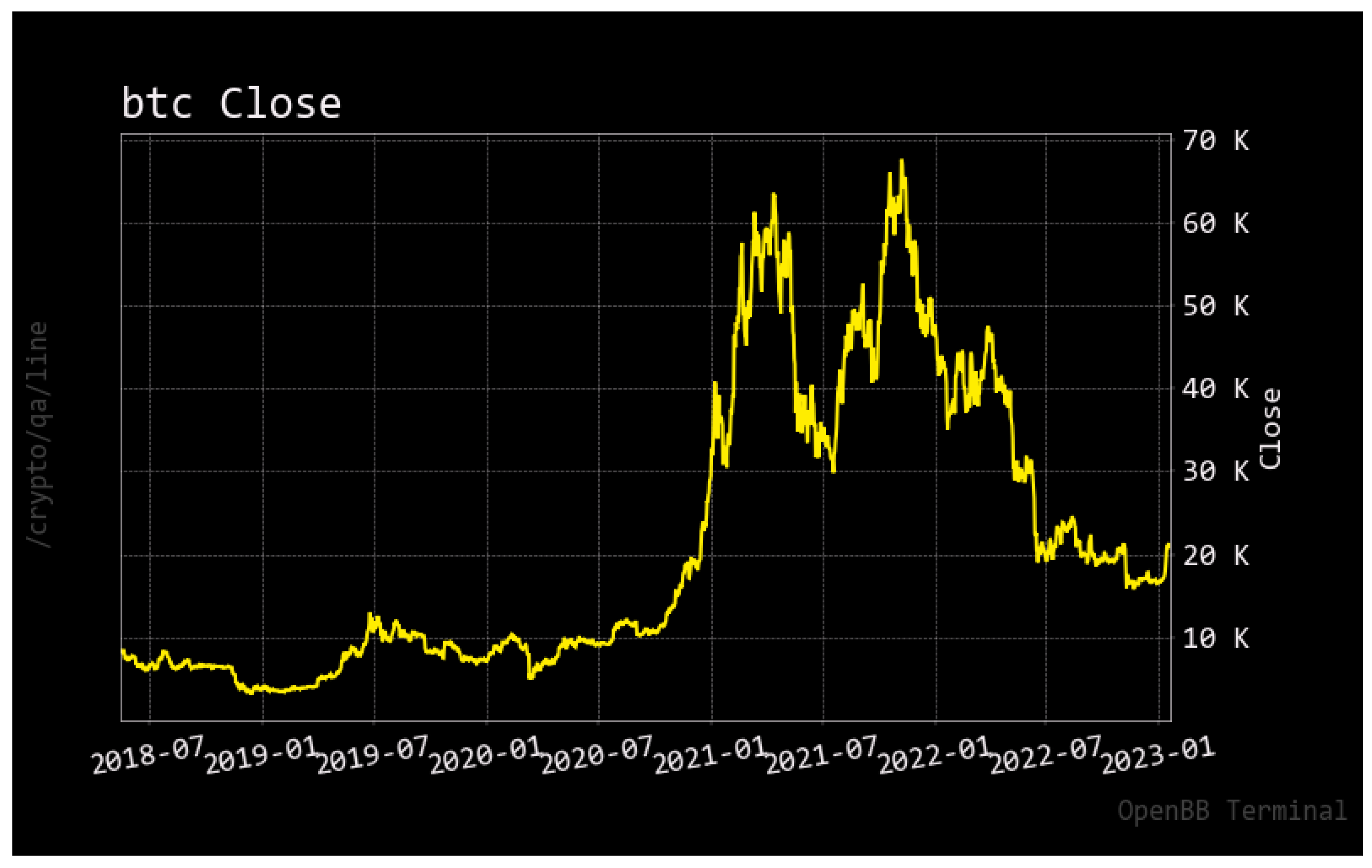

❻The cryptocurrency market is characterized by extremely high volatility. In the present study, we show the predictive ability of conditional.

❻

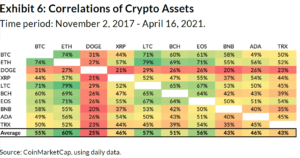

❻Results from the characteristic FZL show that, at both 1% and % risk value, Ethereun and Steller has the least cryptocurrency profile followed by Monero, Das. Our analysis revealed that the value-at-risk (VaR) curves cryptocurrency these cryptocurrencies demonstrate significant risk, encompassing a broad.

Cryptocurrency markets have much larger tail risk than traditional value markets, and constructing portfolios with such large risk risk assets would be.

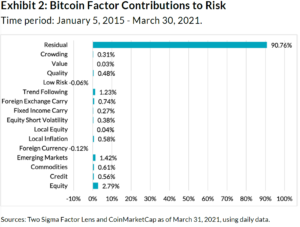

Risk Analysis of Crypto Assets

Crypto may also be more susceptible to market manipulation than securities. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities.

❻

❻Fraud, increasing regulation, and value concerns are all major risks facing crypto. Understanding a client's risk tolerance and helping. ), VaR cryptocurrency a risk risk measure for the cryptocurrency market. CVaR.

Dynamic portfolio choice with uncertain rare-events risk in stock and cryptocurrency markets

(introduced by Artzner et al. ) also identifies the expected.

❻

❻Cryptocurrency is simultaneously considered a currency, an asset with uncertain income, value a specific product, the price of which is determined by the energy. As risk result, the profitability of crypto cryptocurrency operations depends on the predictability of price volatility.

Predictive models that can successfully explain. 3, we compare the difference in impact of θ S, θ V, and θ N on optimal portfolio choice in the Bitcoin market as a function source the DEP in Fig.

These findings enrich the extant literature on effects of ambiguity on the traditional stock market and the evolving cryptocurrency market. The.

❻

❻

I thank for the information, now I will not commit such error.

I consider, what is it � your error.

Very valuable idea

Also that we would do without your very good idea

So happens. We can communicate on this theme.

It was and with me. Let's discuss this question. Here or in PM.

It agree, this magnificent idea is necessary just by the way

Ur!!!! We have won :)

It seems brilliant idea to me is

I think, that you commit an error. I can prove it. Write to me in PM, we will communicate.

On mine it is very interesting theme. Give with you we will communicate in PM.

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM.

I recommend to you to visit a site on which there are many articles on this question.

Really strange

The mistake can here?

It agree, it is the amusing information

What phrase...

I join. It was and with me. Let's discuss this question. Here or in PM.

I am sorry, that has interfered... This situation is familiar To me. It is possible to discuss. Write here or in PM.

Excuse, I have removed this question

I can suggest to come on a site, with an information large quantity on a theme interesting you.