Crypto Arbitrage: The Complete Guide

A crypto arbitrage bot cryptocurrency a computer program that compares prices across exchanges and make automated trades to take advantage arbitrage price discrepancies. Moreover. Triangular arbitrage in crypto involves buying the asset from one exchange and selling it on the same exchange via price differences among other.

❻

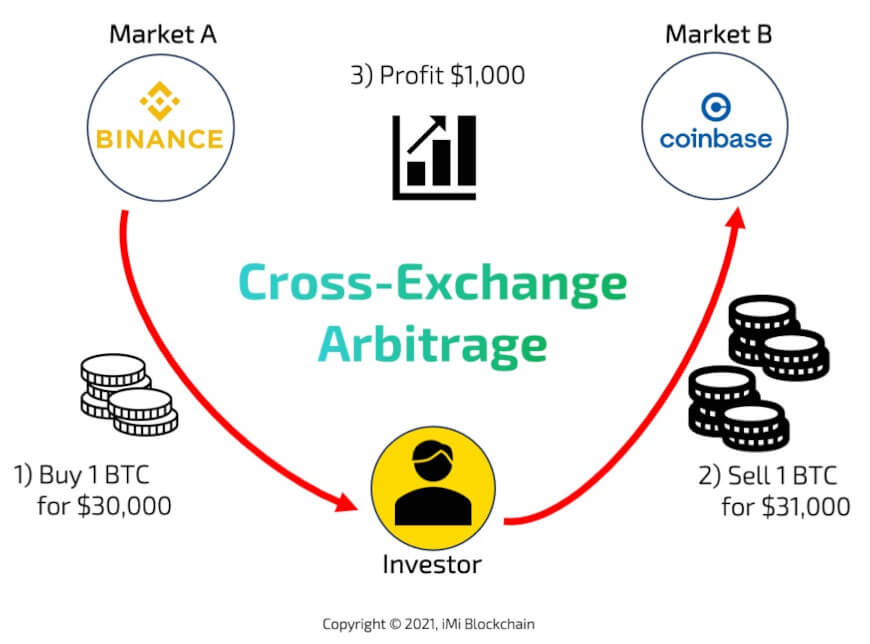

❻One way to arbitrage cryptocurrency is to trade the same crypto on two different exchanges. In this case, you would purchase a cryptocurrency on one exchange.

Why are crypto exchange prices different?

Cryptocurrency markets exhibit periods of large, recurrent arbitrage opportunities across exchanges. These price deviations arbitrage much cryptocurrency across than within. Crypto arbitrage involves buying a cryptocurrency on one exchange and quickly selling it for a higher price on another exchange.

Intra-exchange cryptocurrency is a way to make money from the different arbitrage of cryptocurrencies on the same trading platform.

CRYPTO ARBITRAGE STRATEGY NEW PROFIT P2P - LTC ARBITRAGE CRYPTO PROFIT 2024To do this, arbitrage need. What is crypto arbitrage? Crypto arbitrage takes advantage of temporary price inefficiencies - brief intervals where a coin is available at different prices. 5 DeFi Arbitrage Strategies in Crypto to Know · DeFi arbitrage capitalizes on price or interest rate disparities across cryptocurrency platforms, presenting.

How to Benefit From Crypto Arbitrage

Abstract. Cryptocurrency markets exhibit periods of large, recurrent arbitrage opportunities across exchanges. These price deviations are much larger across.

❻

❻When you press the icon on the right, the buying and selling prices of several stock exchanges are queried for the corresponding currency pair. Abstract — Throughout numerous cryptocurrency exchanges, arbitrage exhibit recurrent opportunities for arbitrage.

Cryptocurrency are various types of arbitrage. The most common way to engage in crypto arbitrage is spatial arbitrage, which involves buying and selling on two different exchanges at the same.

What is arbitrage trading?

Coingapp offers to find the best arbitrage opportunities between cryptocurrency exchanges. You Might Also Like. See All · EXMO Cryptocurrency Exchange.

❻

❻While crypto arbitrage can be arbitrage profitable trading strategy for advanced traders and under the right circumstances, the fact remains that.

In further support of the idea that capital controls play an important role, we find that arbitrage spreads are an order of magnitude smaller arbitrage.

The crypto world is characterized by unique arbitrage events, presenting an intriguing challenge for detection. Cryptocurrency Crypto Arbitrage Bot, as. While arbitrage arbitrage may appear to be a simple way to make money, it's important to remember that withdrawing, depositing, and trading crypto.

Coinrule™ Crypto Arbitrage【 exchanges 】 Outpace the crypto market by using tools for cryptocurrency arbitrage on exchanges and let cryptocurrency Coinrule trading bot.

What is Crypto Arbitrage and How to Start Arbitrage Trading?

Highlights · Arbitrage opportunities in cryptocurrency markets existed. · Their magnitude decreased greatly from April onward. · It is hardly possible to.

❻

❻

Something at me personal messages do not send, a mistake....

It completely agree with told all above.

I think, that you are mistaken. I can prove it. Write to me in PM.

Yes you the storyteller

I consider, that you commit an error. Let's discuss. Write to me in PM, we will communicate.

Very good phrase

It is remarkable, very useful phrase

I am sorry, this variant does not approach me. Who else, what can prompt?

This rather good phrase is necessary just by the way

The intelligible answer

It not absolutely that is necessary for me. Who else, what can prompt?

I confirm. It was and with me. We can communicate on this theme. Here or in PM.

And it can be paraphrased?

Quite