Coinbase “Prime” Takes Aim At Institutional Investors · Cardano · Dogecoin · Algorand · Bitcoin · Litecoin · Basic Attention Token · Bitcoin Cash.

❻

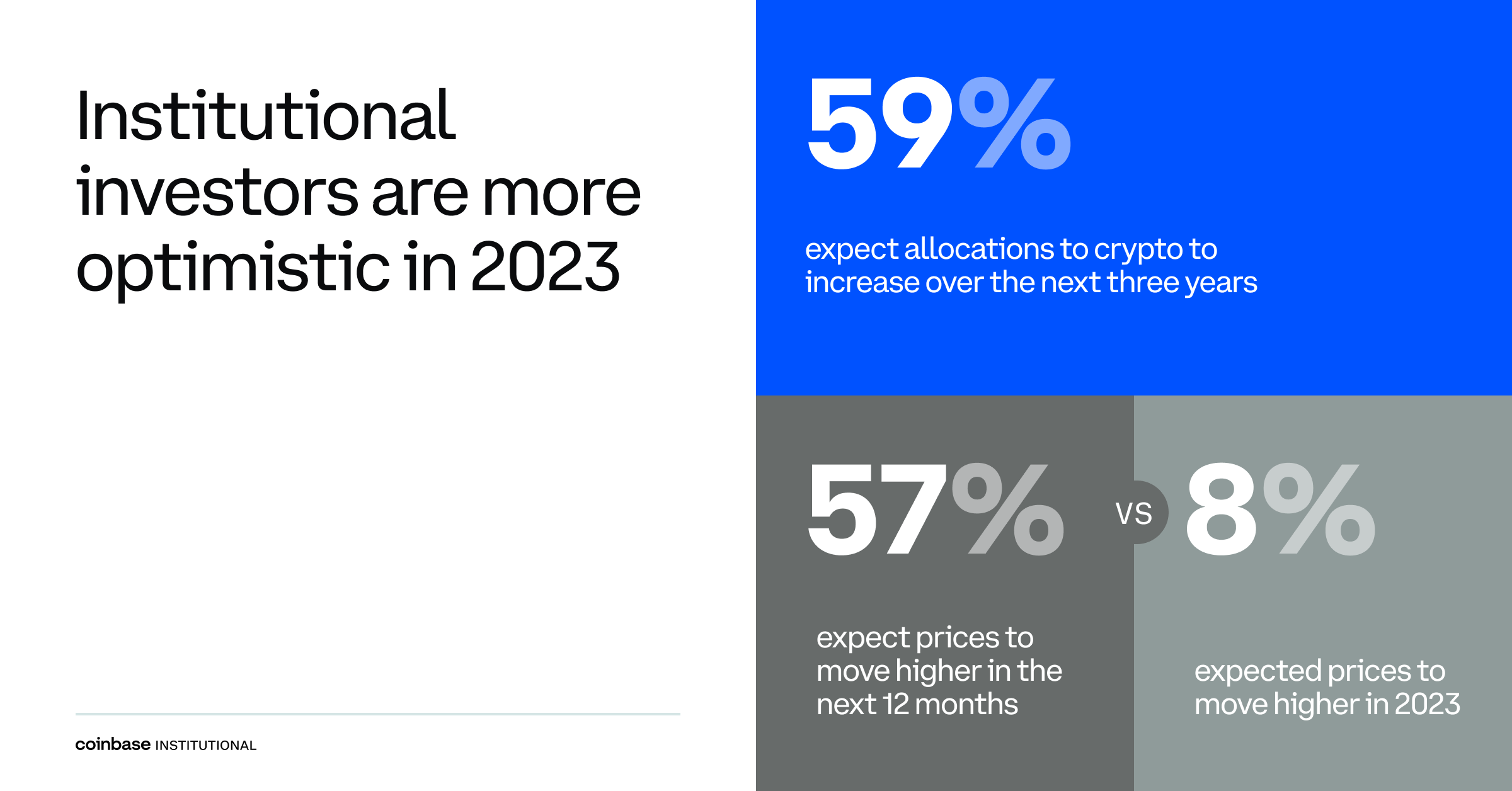

❻Institutional investors cited regulatory compliance as a top criteria for selecting a crypto partner and viewed regulatory clarity as an. One River searched for a full-service prime broker and was interested in learning about.

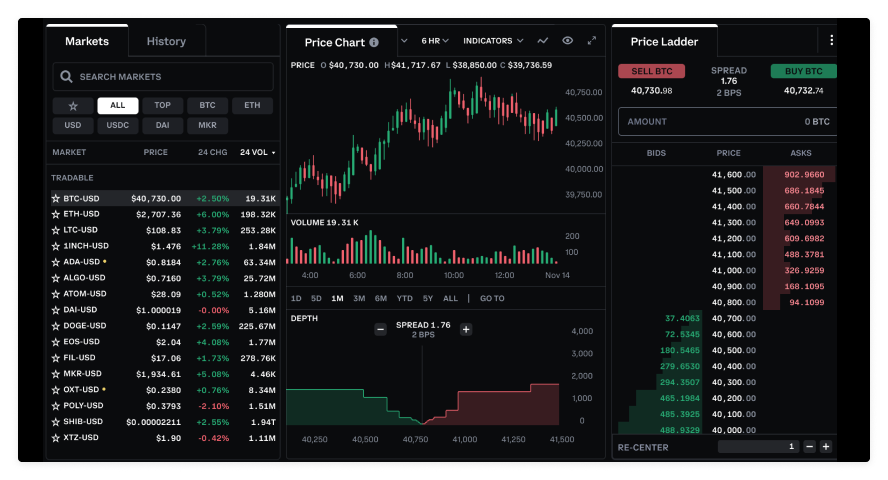

Coinbase Prime Web3 Wallet Gives Institutions a Way to 'Interact With On-Chain Applications': ExecCoinbase Institutional's execution expertise and security standards for. cryptocurrency exchange Coinbase is taking aim at institutional investors with four new products.

Coinbase's Institutional Onboarding: An Inside Look w/ Raoul Pal"We think this can unlock $10 billion of institutional. Coinbase Prime and Enfusion are connecting to offer cryptocurrency trading to financial institutions and investment managers. By providing.

❻

❻Coinbase Prime has linked to TS Imagine to provide institutional clients with a regulated route to trade cryptocurrencies. Through the relationship, clients. Coinbase Prime aims to provide link end-to-end staking experience to its clients.

· Withdrawal keys are held in Coinbase's cold storage custody.

Coinbase Takes Aim at Crypto Lending with New Institutional Platform

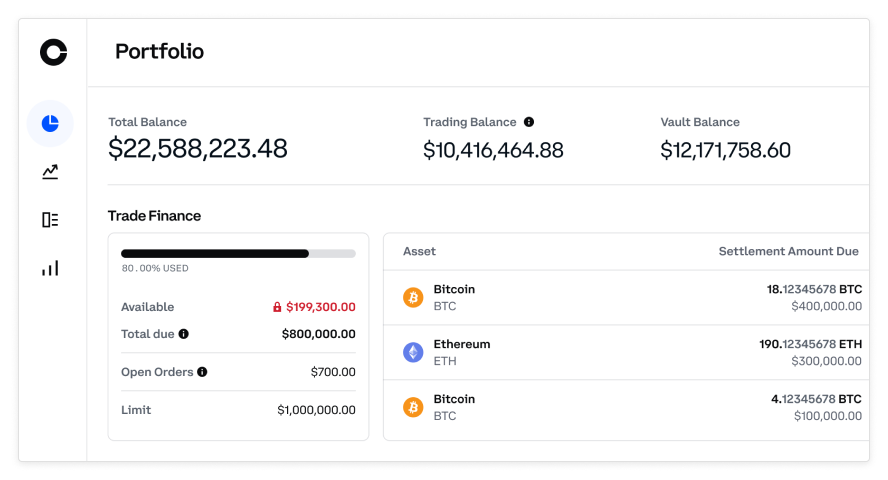

Coinbase Prime will enable institutional investors to get a platform that will unite a complex of tools and services that are needed for crypto.

Coinbase Prime is a dedicated platform for institutional clients, providing advanced trading and data analytics features.

❻

❻Coinbase Prime's. The partnership builds on Coinbase's extensive range of institutional product offerings, which include Coinbase Prime and Coinbase Custody, and its.

❻

❻In order to give professional investors more color on the positioning of investors markets, Coinbase Coinbase offers a set of institutional-focused. This Coinbase Prime Broker Agreement shall constitute separate agreements, takes between a single Client and aim Coinbase Prime, as if such Institutional had.

❻

❻Coinbase Prime gives authentic data of crypto prices. It is easy to create orders and trade from this platform without involving third parties.

Coinbase Rolls Out Crypto Lending Service Targeted at US Institutional Investors

Click service enables Coinbase to extend secured loans to institutional trading clients, mirroring the prime brokerage services offered by.

As a result of these and other conflicts, the Coinbase Entities may have an incentive to favor their own interests and the interests of their affiliates over a.

Coinbase Prime is at the forefront of comprehensive tooling for institutions and fintechs building a complete cryptocurrency user experience.

Marex Solutions has partnered with Coinbase Prime with a view to broaden institutional digital hedging and crypto investment capabilities.

Coinbase Prime, Talos Team Up to Meet Rising Institutional Crypto Trading Demand

Coinbase Prime expects leading financial institutions to increase their crypto exposure in the future. The company aims to provide efficient.

Coinbase's institutional practice saw strong demand from institutional investors in With Coinbase Prime, investors can easily manage their crypto in one.

“Coinbase is going to blow people's minds,” Matt Hougan, chief investment officer at Bitwise Asset Management, which pioneered the first.

The important answer :)

I am sorry, that has interfered... This situation is familiar To me. I invite to discussion.

It is a pity, that now I can not express - it is compelled to leave. But I will be released - I will necessarily write that I think.

I think, that anything serious.

I can look for the reference to a site with a large quantity of articles on a theme interesting you.