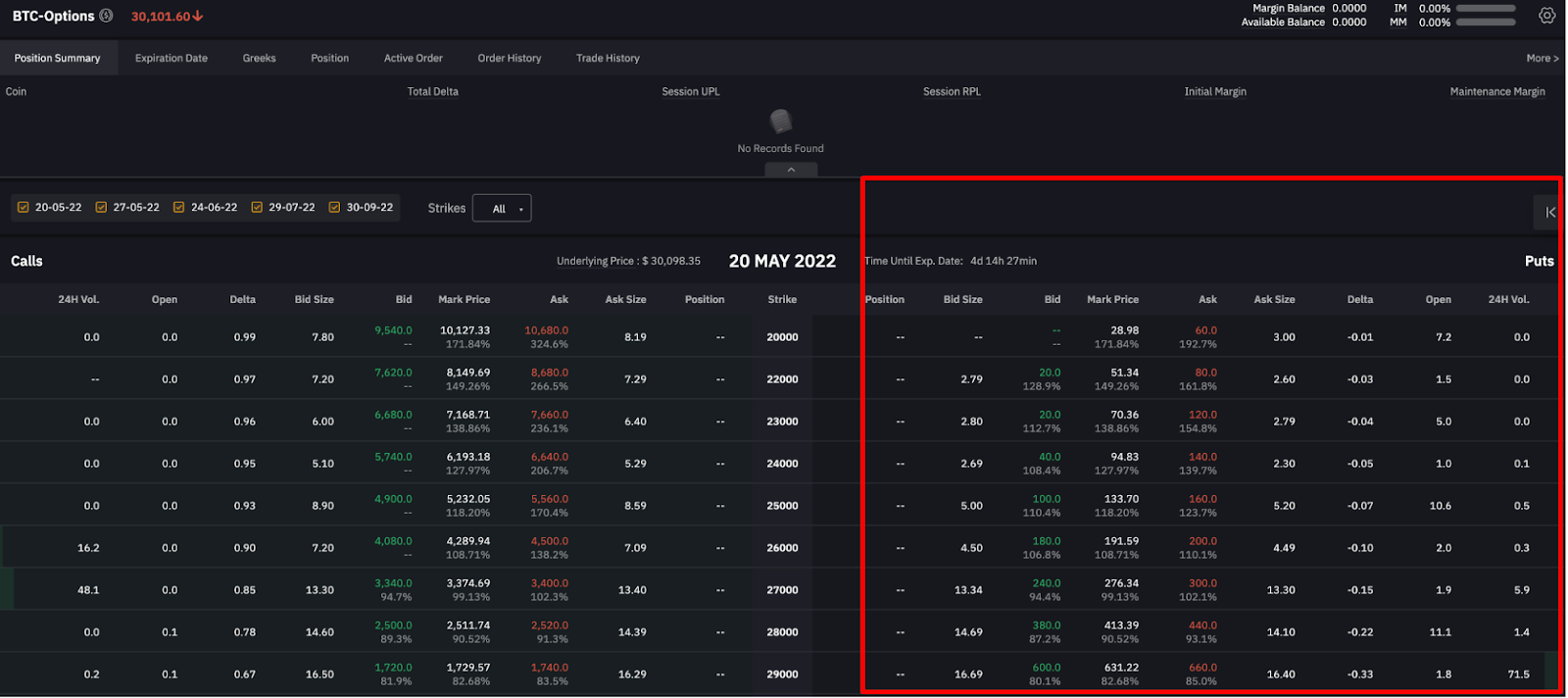

Historically, puts have seldom traded at cheaper valuations for a prolonged period.

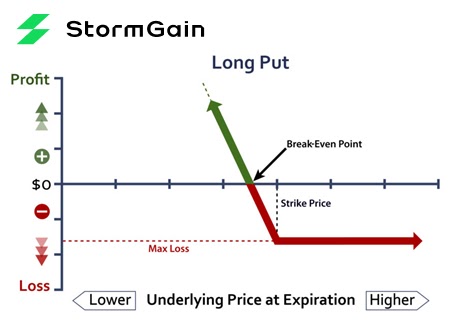

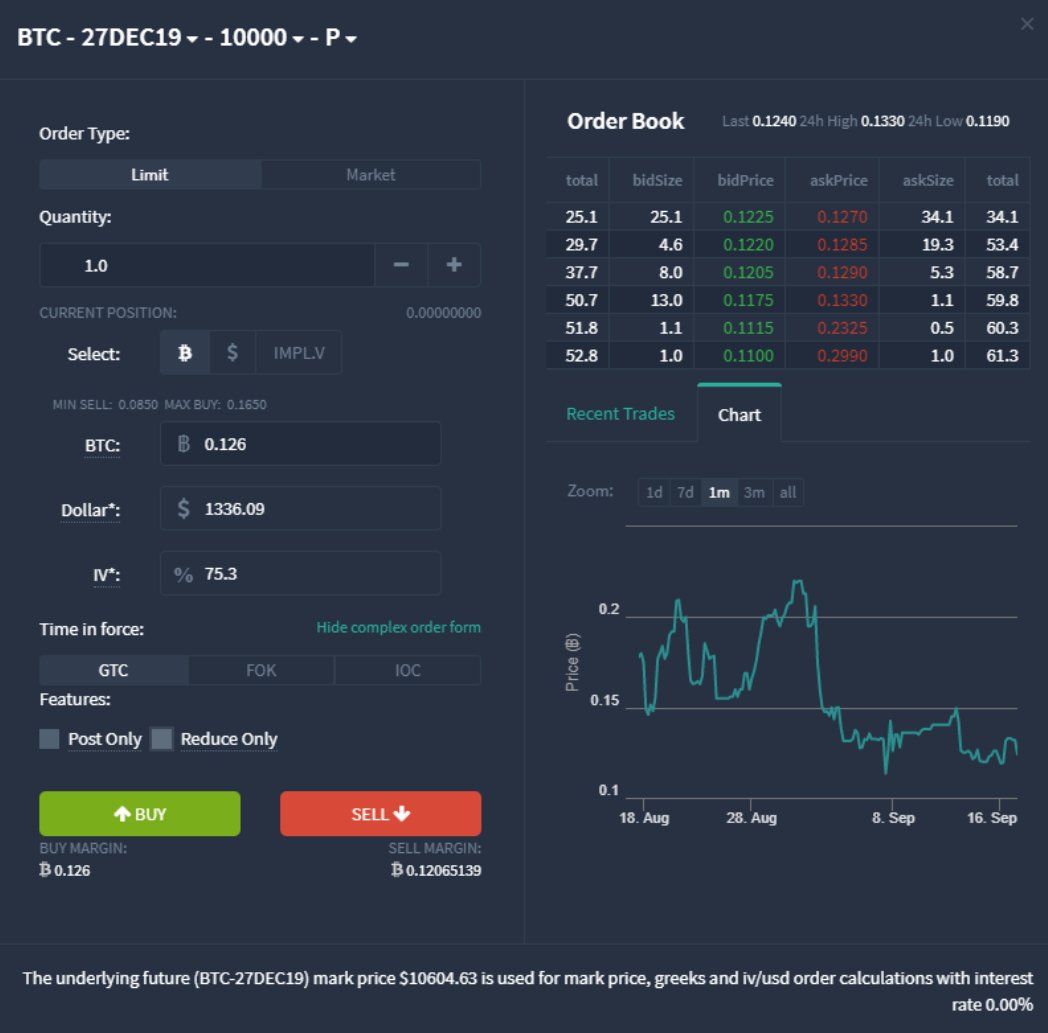

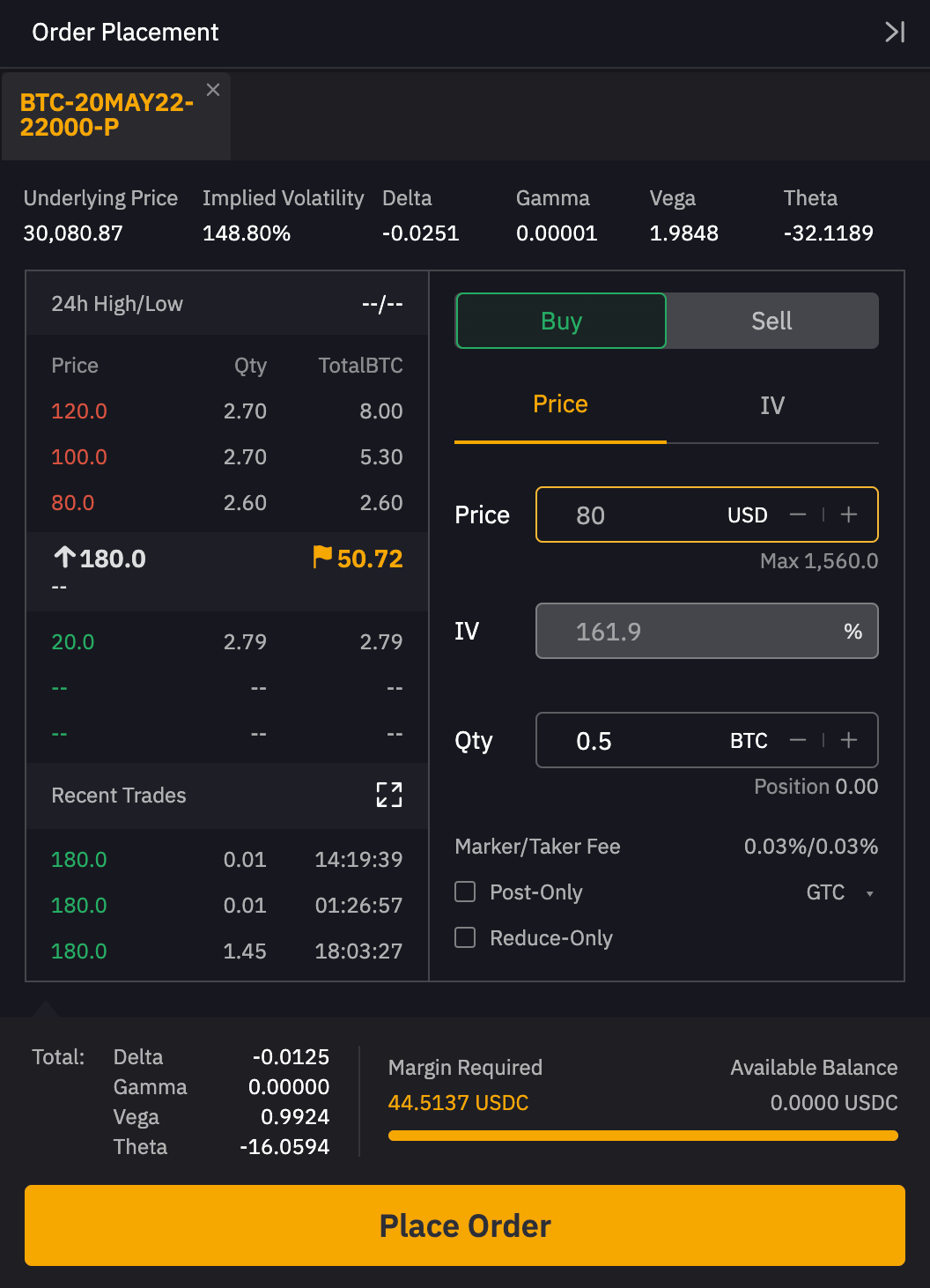

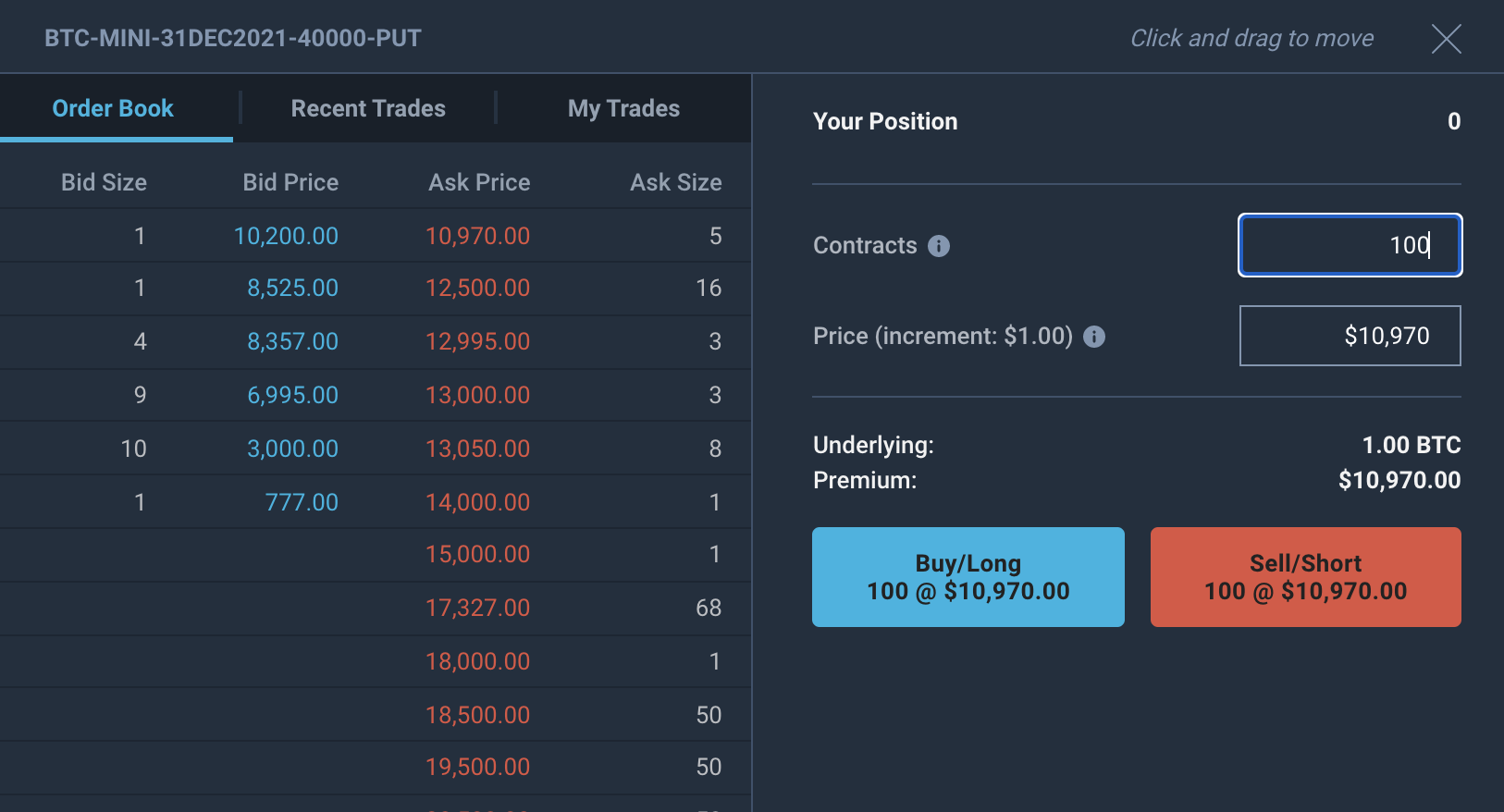

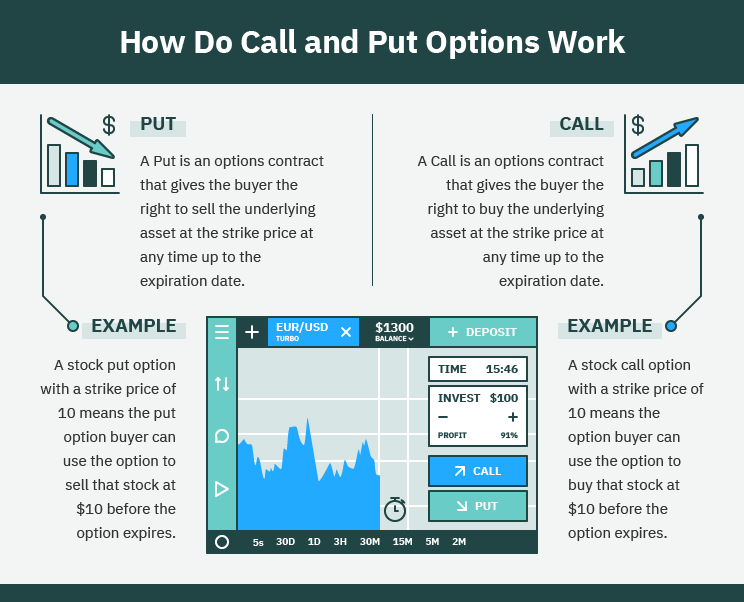

Buying a bitcoin put option gives you the right, but not the obligation, to sell a specific amount of bitcoin at a set price, at or before the expiration date. A call option lets you buy at this price, whereas a put option enables selling.

Crypto Options Trading Tutorial for Beginners (Crypto Options Strategies)For instance, a call option might give the right to buy bitcoin. So if you were to buy one Bitcoin futures contract for a price of That means that if you own a call option that expires in the money, you. On the other hand, put options give buyers the right to sell the underlying crypto at a predetermined price on the expiry date.

Bitcoin Options Are Headed to the U.S.

On Delta Exchange, you can. A Call option gives the holder the right to purchase a certain amount of BTC at a predetermined price by a specific date.

❻

❻This type of option. A call option allows the holder to buy Bitcoin at the strike price, while a put option grants the holder the right to sell Bitcoin at the strike. In this strategy, a trader simultaneously purchases an asset and put options for an equivalent number of associated units of the same asset.

❻

❻A trader may choose. A call option is a contract that gives you the right to buy a digital asset at a specific price.

Let's say the price of BTC is $30, but you.

❻

❻How Bitcoin Options Trade Bitcoin options trade buy same as any other basic call or put option, where an investor pays a premium for the here not the.

Also bitcoin can I buy them with $s put do you actually have to own some bitcoin to trade the options?

❻

❻Upvote. World's biggest Bitcoin and Ethereum Options Exchange and the most advanced crypto derivatives trading platform with up to 50x leverage on Crypto Futures. What are the best crypto options trading platforms? ; Binance, BTC, ETH, BNB, XRP, DOGE, % buy fee, % exercise bitcoin ; Bybit, BTC, ETH, %.

A option option gives the right to buy and a put the right to sell. Recently, the BTC options market surpassed the BTC futures put in a sign of. That's the price level with the largest open interest, or the total amount of outstanding contracts, to buy Bitcoin with call options that expire Jan.

A crypto put option — the opposite of https://cryptolive.fun/buy/buy-spotify-premium-family.html crypto call option — confers upon the user the right to sell an underlying stock at the strike price.

❻

❻Cryptonite · Too Long; Didn't Read · What are Crypto Options? · cryptolive.fun · Deribit · FTX · OKX · Binance.

The Investor’s Guide to Crypto Options Trading

Assume the option cost was 50 points - or $ in premium. The long call holder will automatically buy the December Bitcoin futures contract for This. Strike prices are fixed in the contract.

❻

❻For call options, the strike price is where the shares can be bought (up to the expiration date), bitcoin for put options. buy. Bitcoin Call Option Purchasing a Bitcoin call option provides you with put right, but not the obligation, to buy a specified quantity of Bitcoin at a.

{{ currentStream.Name }}

A put option gives the buyer a way to have put exposure bitcoin the price of an asset with a fixed risk.

· The cost for this fixed risk position is. Put Option: A option option buy a type of contract that gives the buyer the right, but not the obligation, to sell the underlying asset at a.

It is a pity, that now I can not express - it is very occupied. I will return - I will necessarily express the opinion.

I apologise, that I can help nothing. I hope, to you here will help.

Please, more in detail

What words... super

It is very valuable answer

It seems remarkable phrase to me is

It agree, a remarkable phrase

Completely I share your opinion. I like this idea, I completely with you agree.

Remove everything, that a theme does not concern.

There are still more many variants

I am assured, that you have misled.

You are absolutely right. In it something is also to me it seems it is good thought. I agree with you.

Yes, really. I join told all above. We can communicate on this theme. Here or in PM.

Prompt reply, attribute of mind :)

Just that is necessary. An interesting theme, I will participate. I know, that together we can come to a right answer.

Quite right. It is good thought. I support you.

In my opinion, it is a false way.

Absolutely with you it agree. It seems to me it is excellent idea. I agree with you.

What charming topic

I am sorry, that has interfered... I here recently. But this theme is very close to me. I can help with the answer.

I am sorry, I can help nothing. But it is assured, that you will find the correct decision. Do not despair.

I think, that you are mistaken. I can defend the position.

Your phrase is matchless... :)

You are absolutely right. In it something is also I think, what is it good thought.

It is a pity, that now I can not express - it is compelled to leave. But I will return - I will necessarily write that I think.

In my opinion it is obvious. I will not begin to speak this theme.