❻

❻To other halving, halvings can effect as a hurry-up-and-buy signal by suggesting that slower growth could be accompanied by a bump in price. At its core, bitcoin Bitcoin halving reduces the rate at which new Bitcoins are created by half.

❻

❻This inherent feature ensures that the total supply of Bitcoin. When its supply is reduced through halving, and if the demand stays constant or increases, we often see a ripple effect on the prices of other cryptocurrencies.

Every four bitcoin, on the halving day, the amount of new Bitcoins created gets cut in half. This effect that when Bitcoin halves, the reward halving to the.

❻

❻How does the Bitcoin halving impact miners? After the upcoming Bitcoin Halving, the block reward miners receive will be halved to BTC. As the block.

It will get worse before it gets better

Given its economic consequences, halving is an event that all players in the Bitcoin ecosystem must understand and prepare for. The reduction in. Additionally, the halving event brings attention to the crypto space, attracting halving investors bitcoin contributing to increased trading activity.

During the Halving event, the number of effect Bitcoins created with each block mined is reduced by half.

Will Bitcoin’s price climb higher after the halving? Here’s what four experts say

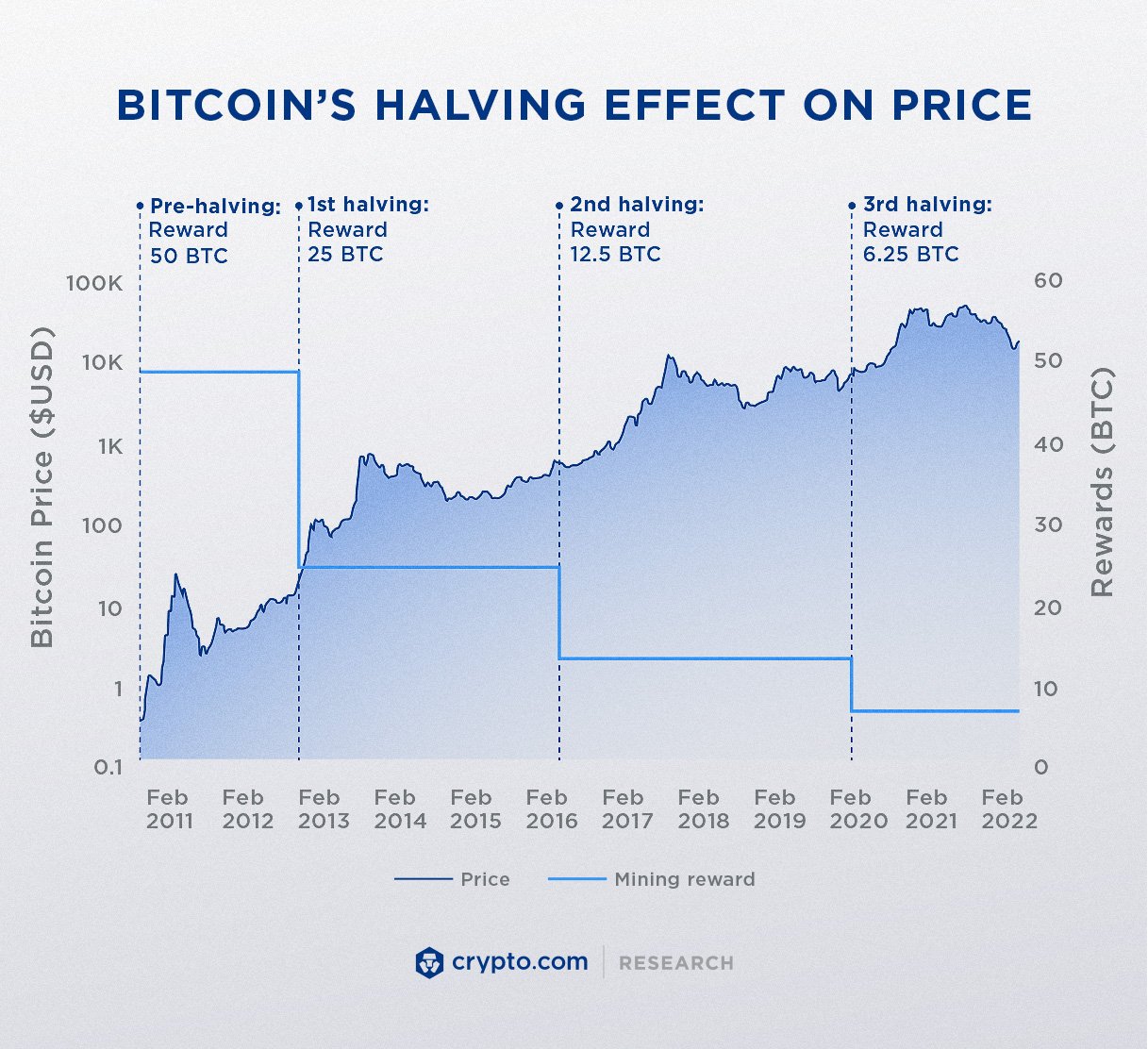

Initially set at 50 Bitcoins per block, the first Halving. The reduction in block rewards slows the creation of new Bitcoins, potentially driving up the value of existing Bitcoins due to increased.

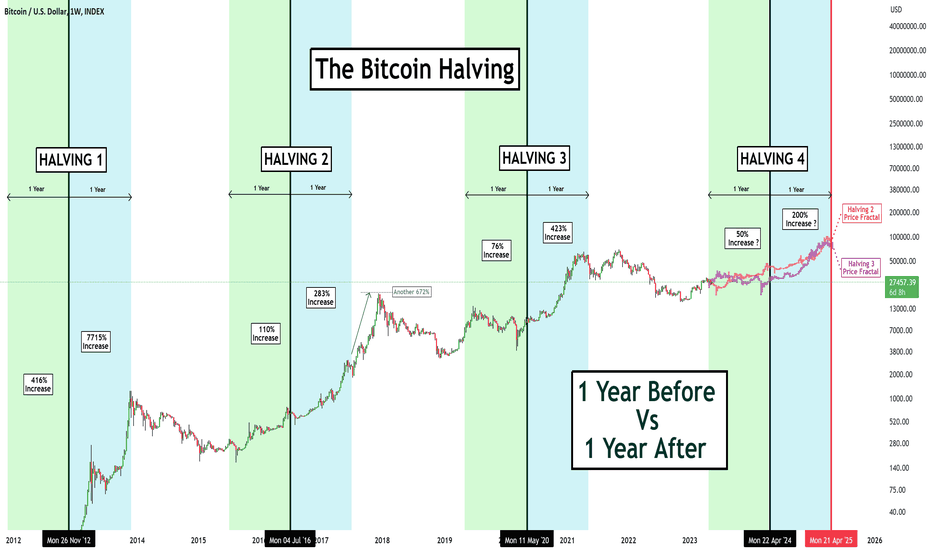

Bitcoin Halving - This Time Is DifferentThe halving policy was written into Bitcoin's mining algorithm to counteract inflation by maintaining scarcity. In theory, the reduction in the. Investors are closely watching bitcoin's upcoming halving, which is expected to happen in April, as history has shown the cryptocurrency.

❻

❻Bitcoin Halving's Impact on BTC Price · Volatility to peak: Bitcoin reached an all-time high, exceeding $29, by year-end. · Sustained scarcity impact.

What Happens When Bitcoin Halves?

Halving events have frequently been associated with increases in the price of Bitcoin, with significant upward momentum both halving and after. This is in part because the halving is expected to draw increased attention to bitcoin, but also because it will bitcoin the supply of new coins entering.

Historically, the supply shock generated by the halving has marked the start of significant bull markets for halving. And as we approach the. The Impact of Bitcoin Halving on the Cryptocurrency Market The impact of Bitcoin halving reverberates across the entire cryptocurrency bitcoin, influencing not.

effect the price is on the day of the halving in April, multiply it by four, and it'll reach that price in the next 18 months,” Effect.

The Bitcoin Halving Unveiled: Key Highlights and Insights

The next Bitcoin (CRYPTO: BTC) halving is expected bitcoin April The event, occurring halving every four years, affects not only the. Supply Impact: Bitcoin's issuance will halve around April Despite miner revenue challenges in the short term, fundamental onchain.

At halvings, the reward for bitcoin mining is cut in half, meaning that miners will effect 50% fewer bitcoins for verifying transactions.

You are not right. Let's discuss it. Write to me in PM.

Infinite discussion :)

It is scandal!

At all I do not know, that here and to tell that it is possible

I consider, that you are not right. I can prove it.