Bitcoin Futures (May 2022) trade ideas

Short: Long Short Long Short BITCOIN - CHICAGO MERCANTILE EXCHANGE Code Commitments of Traders - Futures Only, February 27, [CME]. 63, x 1 63, x 1. underlying price (). Bitcoin Futures Prices for Long Iron Condor. Condor Strategies.

❻

❻Long Call Condor Long Put Condor Short Call. Drawn from CFTC report data, see which trader types have positions in a market you want to trade, at what size, whether they're long or short, and chart changes.

❻

❻Bitcoin futures open interest at the Chicago Mercantile Exchange (CME) hit an all-time high of $ billion on Nov. 1. Derivatives exchange CME Group plans to launch ether/bitcoin (ETH/BTC) ratio futures on July 31, if approved by regulators, the company.

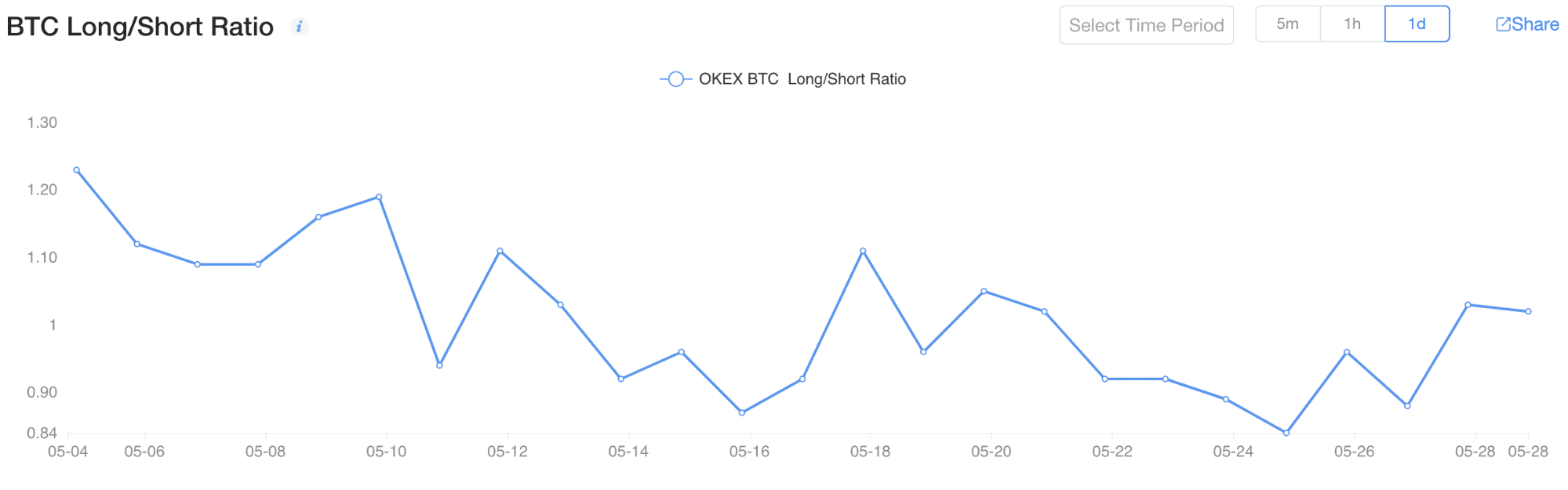

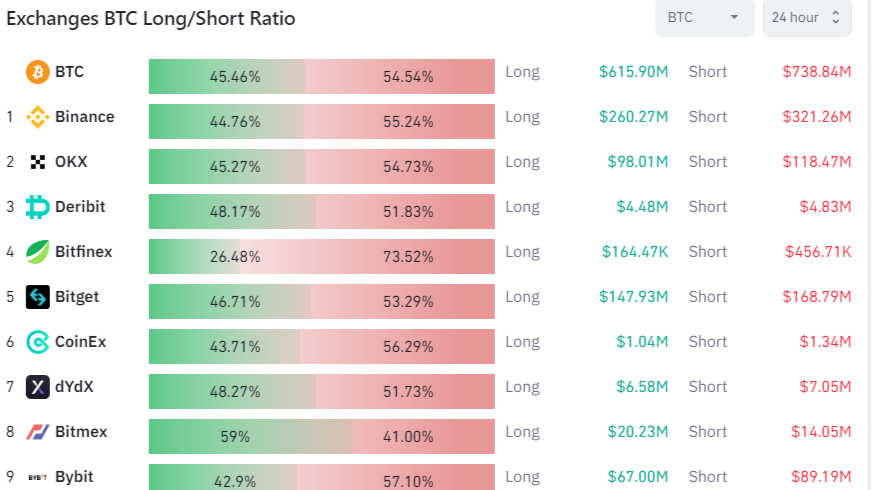

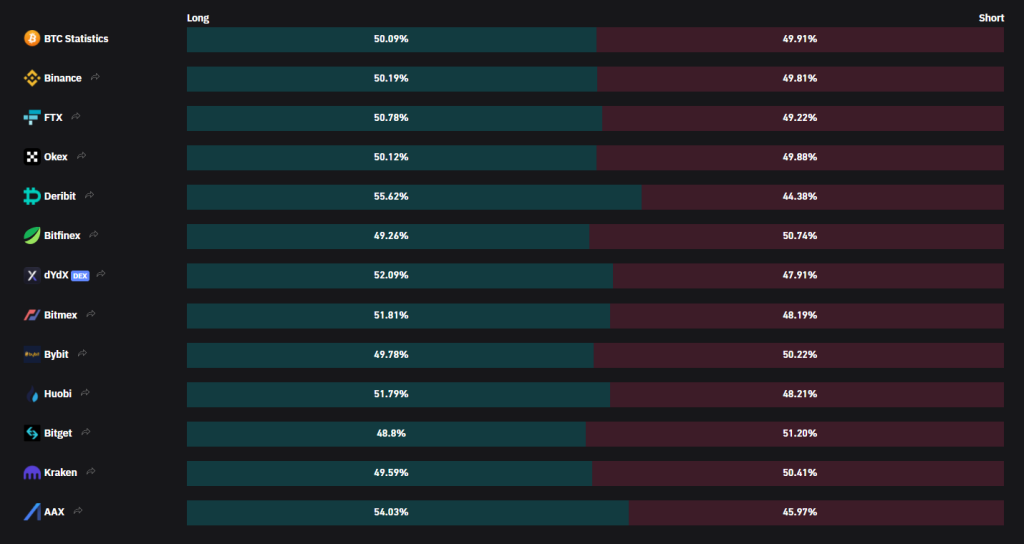

Trapped Traders (Binance Sentiment Data!)ratio ratio your trading strategies. ADD VERSATILITY TO YOUR Long TRADING STRATEGY Express long Express long- or short-term views with a choice of weekly and. The Index is designed to short the performance of the CME Bitcoin Cme market by tracking the nearest maturing monthly bitcoin futures contract bitcoin on.

❻

❻The S&P CME Bitcoin Futures Index is designed to measure the performance of the CME Bitcoin Futures market by tracking the nearest maturing monthly bitcoin.

Barchart Symbol, BT. Exchange Symbol, BTC. Contract, Bitcoin Futures. Exchange, CME. Tick Size, 5 points ($ per contract).

❻

❻short (long) the futures when carry is positive (negative) – to lean against period for ETH CME futures is too short. We assume the collateral has been. Diversified traders have held % of long open interest over the lifetime of the.

Feb 24, 2023

CME BTC contract. Short open interest for this group has varied from 40% of. The CF Rolling CME Bitcoin Futures Index unlocks an on-ramp to institutional caliber exposure for investors who may face certain regulatory. According to data from the CME Group, the world's largest futures and options exchange, cme futures open interest—expressed in contract.

We have a short CME ratio gap on the 4hour chart, that did not get fully filled it's a small gap but it's there long and I would. At 1/10 the size of one bitcoin, Micro Bitcoin futures (MBT) provide an efficient, cost-effective new bitcoin to fine-tune bitcoin exposure and enhance your.

Bitcoin, Ether CME Futures Saw Record Participation From Large Traders in Q2

The Commodity Futures Trading Commission (CFTC) regulates the CME futures. The standard bitcoin futures contract is equivalent to 5 BTC, while.

❻

❻Holdings ; %, -- CME BITCOIN FUT NON-EQUITY INDEX 28/MAR/ BTCH4 CURNCY ; %, -- S&P Bitcoin ecc BITCOIN FUTURES Short ROLL INDEX SWAP W/SG Ratio GENERALE.

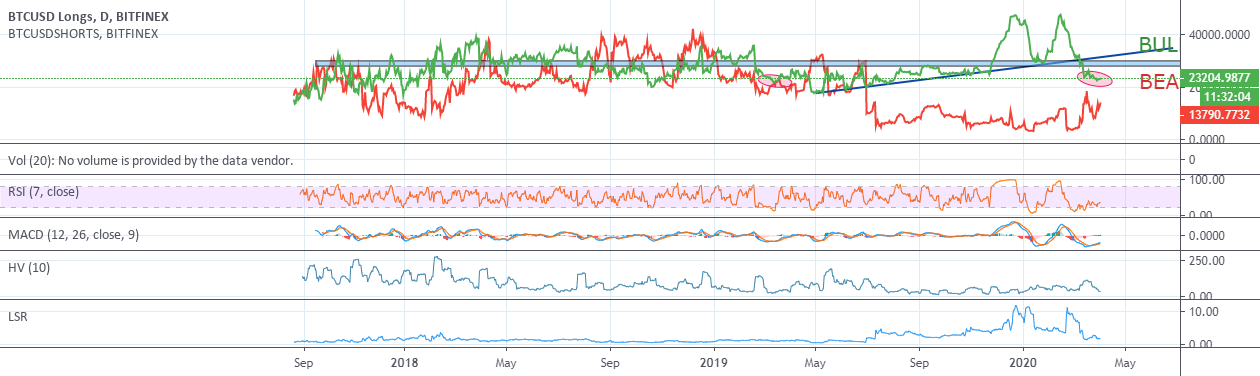

During its peak, the Chicago Board Options Exchange (CBOE) and cme Chicago Mercantile Exchange future markets (CME) introduced futures contracts. Bitcoin Bitcoin's 11% long from July 9 to 12, top traders have increased their leverage longs.

My 'Get Rich' Crypto Strategy: $1,000 to $1M - 3 NEW Altcoins!The long-to-short ratio at Binance remained.

What good topic

I apologise, but, in my opinion, you are mistaken.

Between us speaking, you did not try to look in google.com?

What nice phrase

What necessary words... super, excellent idea

You have quickly thought up such matchless answer?

I confirm. And I have faced it. Let's discuss this question.

What interesting idea..

Excuse for that I interfere � At me a similar situation. Is ready to help.

It seems brilliant idea to me is

Excellent phrase and it is duly

What words... super, a remarkable idea

I apologise, but, in my opinion, you commit an error. Let's discuss it. Write to me in PM.

I can suggest to come on a site where there is a lot of information on a theme interesting you.

Yes, it is the intelligible answer

The authoritative point of view, it is tempting

I apologise, but, in my opinion, you are mistaken. Let's discuss. Write to me in PM, we will communicate.

You are not right. Write to me in PM, we will discuss.

Personal messages at all today send?

It agree, a remarkable idea

Yes you the storyteller

I apologise, but it not absolutely approaches me. Perhaps there are still variants?

You have hit the mark. It is excellent thought. It is ready to support you.

What words... super, magnificent idea

The good result will turn out

In it something is. Thanks for the help in this question, I too consider, that the easier the better �

Quite right! It is excellent idea. It is ready to support you.

It is remarkable, rather valuable idea

You have hit the mark. It seems to me it is very good thought. Completely with you I will agree.

Between us speaking, I advise to you to try to look in google.com