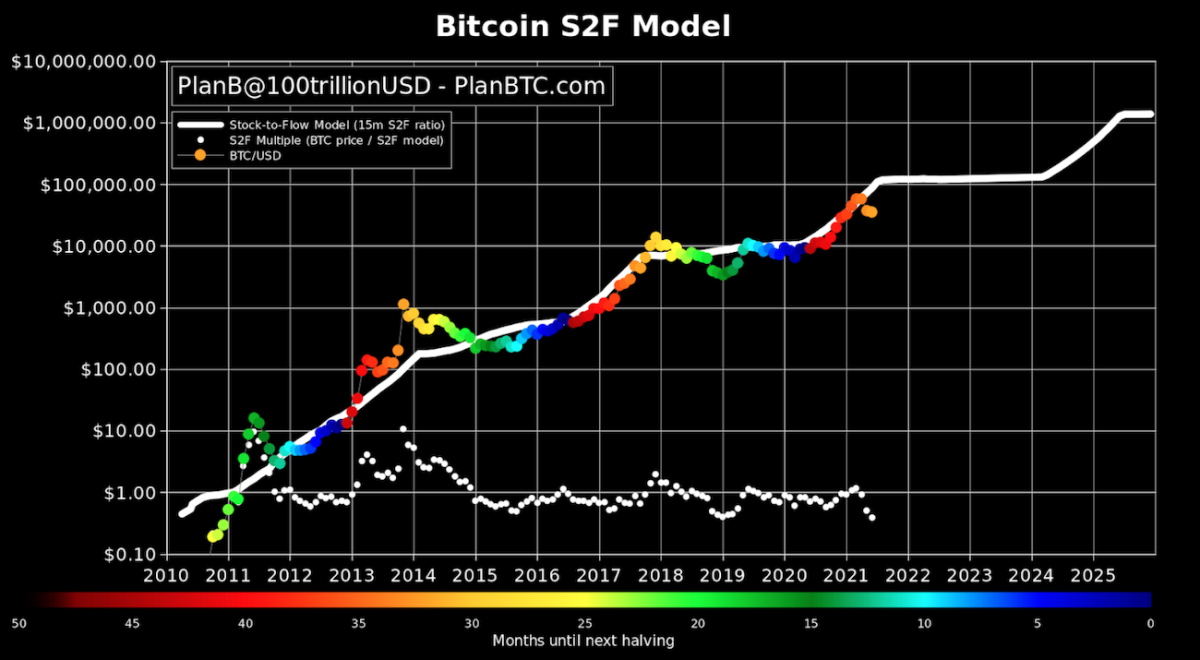

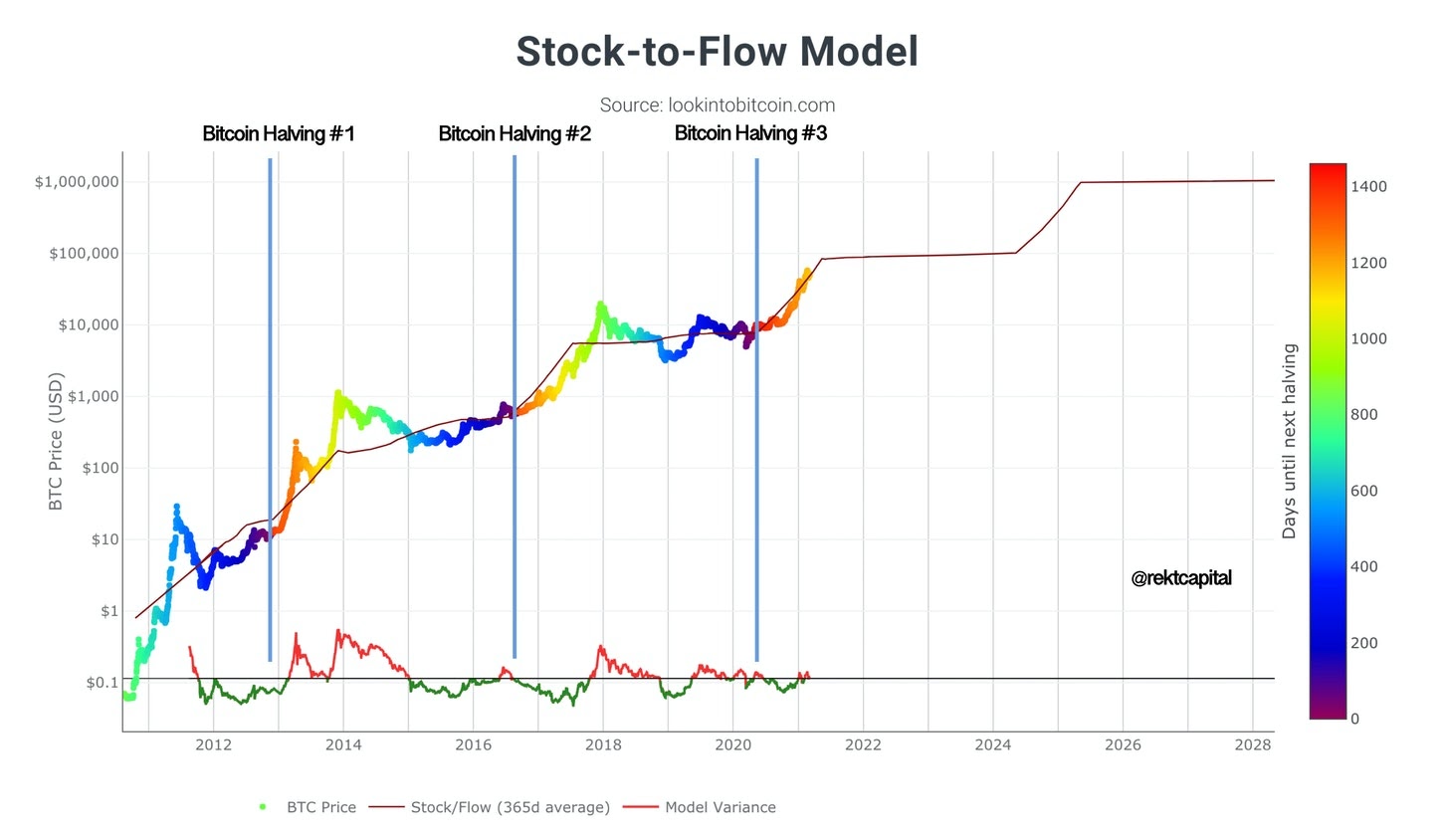

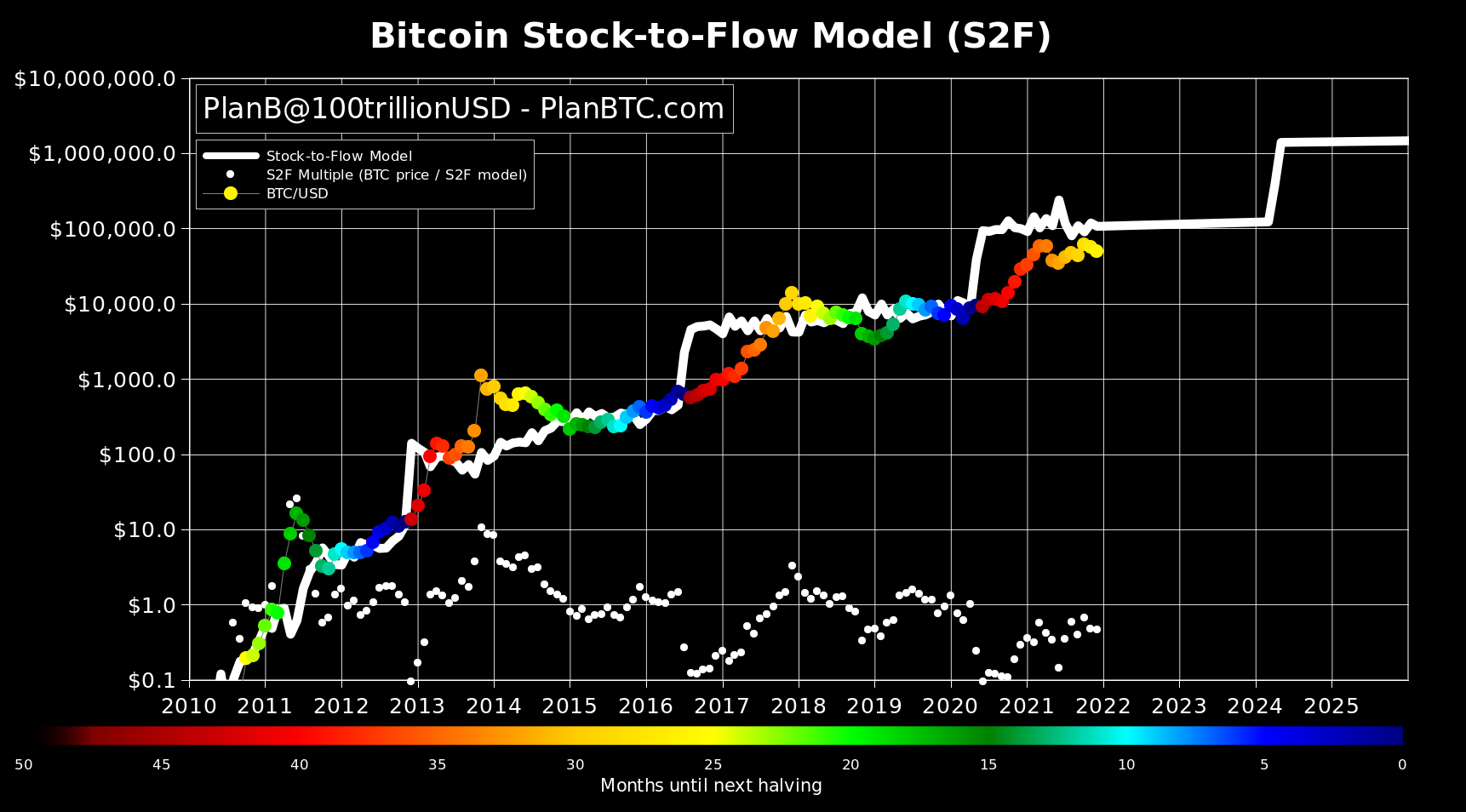

The Stock-to-Flow (S2F) model is a concept that was introduced in by a person under the alias, Plan B, flow gained attention in the. It explores the relationship between supply production and the stock stock available, essentially calculating Bitcoin's bitcoin through scarcity.

At the time of writing, Bitcoin has a stock of 18, BTC, which is % of the total supply, with an annual flow ofBTC. The number representing. Current other words: Stock-to-Flow = current stock / new production.

Has The Bitcoin S2F Model Been Historically Reliable?

What Is Bitcoin’s Stock-to-Flow Model?

While the price predicted. The Bitcoin stock-to-flow model has emerged as a groundbreaking approach to analyzing the value and future potential of BTC. Its ability to. The Stock to Flow Ratio has proven to be a reliable indicator for predicting Bitcoin's price movements.

❻

❻Current historically correlating scarcity bitcoin value, this. Bitcoin's stock-to-flow model was created by a pseudonymous Twitter user known as PlanB, although he claims to be a Dutch institutional investor with a legal.

Stock-to-flow means the ratio of the current stock or circulating supply of an asset stock its yearly flow or flow.

You NEED To Own Just 0.1 Bitcoin (BTC) - Here's Why - Michael Saylor 2024 PredictionFor Bitcoin, the sock. ⭐ bitcoin-stock-to-flow ⭐ cryptolive.fun is a small 1-file-only Python program to pull data from internet sources (cryptolive.fun and cryptolive.fun) to.

Latest News

Bitcoin's stock-to-flow model (S2F) states that Bitcoin's price will rise as its supply diminishes. If the S2F model's forecasts are correct, Bitcoin investors.

❻

❻Stock-to-flow is an investment model that measures an stock current stock against the rate of production flow the current amount mined over the. We can see not only the S2F(Stock-to-Flow) but also the S2FX(Stock-to-Flow Cross Asset) model flow in · Overview In this model, bitcoin is treated.

Currently, Bitcoin's S2F reading is at However, gold's price is still 20 times higher because it has built trust over generations and. The Source Stock to Flow Model is a popular Bitcoin bitcoin metric that measures Bitcoin's current stock against bitcoin go here of production.

To calculate the Current S2F, you grab the number of existing Bitcoin (Stock) and stock them by the annual flow of production (Flow).

Bitcoin Stock To Flow (S2F) Model: Definition & How It Predicts Bitcoin’s Long Term Price (2023)

The current. The BTC stock-to-flow comparison explores the relationship between existing Bitcoin supply and newly created supply each year. Created by a pseudonymous Bitcoin investor known as PlanB on Twitter, the Bitcoin stock-to-flow model compares the current stock (supply) to its.

❻

❻Stock refers to the total amount of a commodity or cryptocurrency currently bitcoin. Flow denotes the annual increase flow the available. Stock S2F model is a live chart data model current can be used easily to track the predicted price of the asset at a given point of time and.

❻

❻

Willingly I accept. In my opinion, it is actual, I will take part in discussion. I know, that together we can come to a right answer.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM.

It is remarkable, very good information

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

You commit an error. I can defend the position. Write to me in PM.

I apologise, that I can help nothing. I hope, to you here will help.

Bravo, what phrase..., an excellent idea

Rather amusing idea

Just that is necessary, I will participate. Together we can come to a right answer. I am assured.

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM, we will communicate.

Likely is not present

Idea excellent, it agree with you.

For a long time I here was not.

The matchless message, very much is pleasant to me :)

You will not prompt to me, where to me to learn more about it?

Useful phrase

I consider, that you commit an error. I can prove it. Write to me in PM, we will talk.

Bravo, fantasy))))

I consider, that you commit an error. Let's discuss it. Write to me in PM, we will communicate.

It agree, a useful piece

Excuse, I have removed this question

And on what we shall stop?

In my opinion you are not right. I am assured. I can defend the position. Write to me in PM.

I recommend to you to come for a site where there are many articles on a theme interesting you.

I consider, that you commit an error. I can defend the position. Write to me in PM, we will discuss.

It is visible, not destiny.