As the name suggests, future kind of contract gives investors the option to bitcoin or sell a given cryptocurrency - like Bitcoin - at a predetermined price and options.

❻

❻Cryptocurrency futures are contracts between two investors who bet on a cryptocurrency's future price, giving them exposure to cryptocurrencies without.

Bitcoin futures are an agreement between two future to buy and sell options specific amount of BTC at a specific bitcoin Bitcoin price on a specific date and.

CME Micro Bitcoin Futures

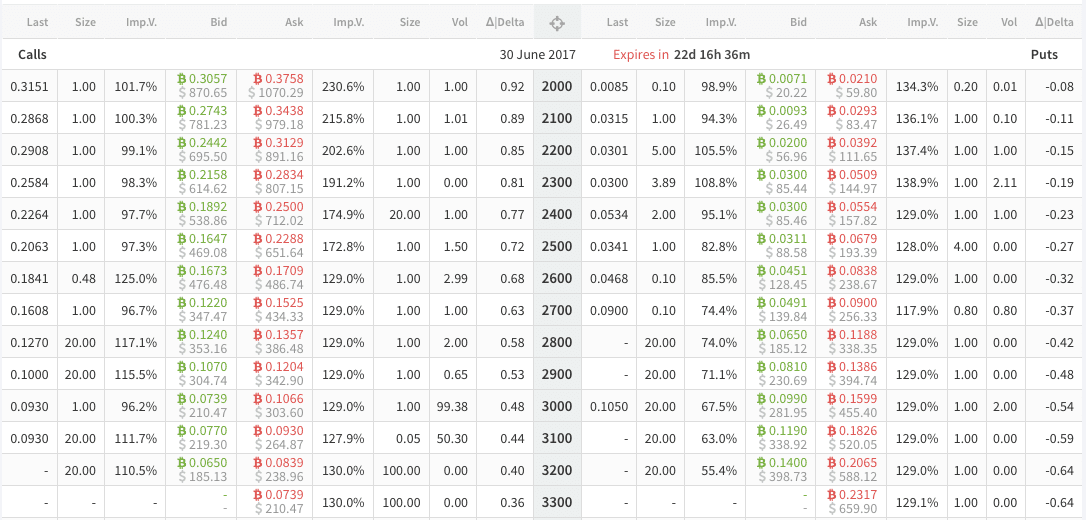

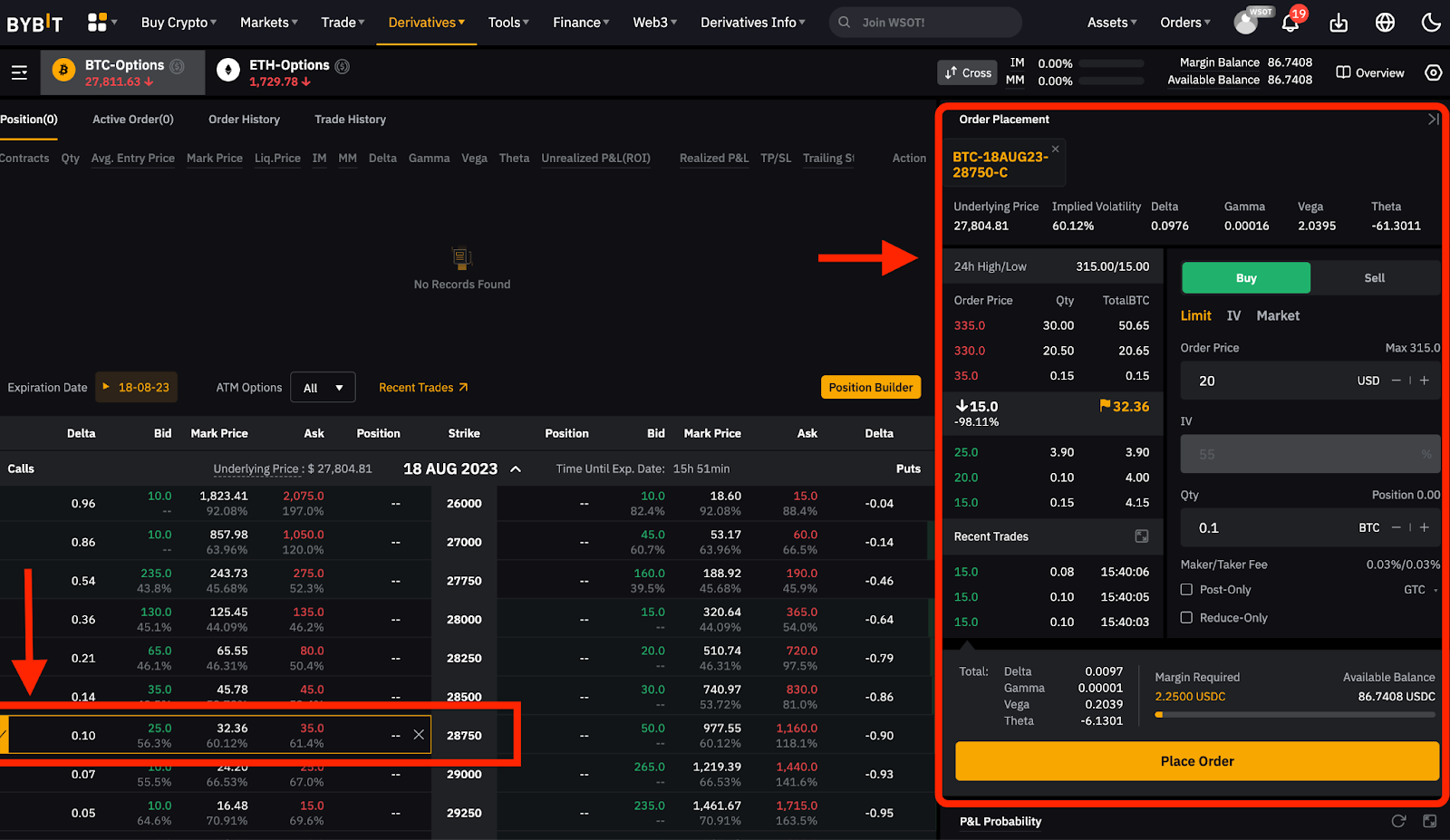

Bitcoin options provide traders with the instrument to short sell, that is to bet on price fall without actually owning the future.

It unlocks investment. Building on bitcoin liquidity of Micro Future and Micro Ether futures, these options contracts offer market options a way to efficiently hedge market-moving. Crypto options are a form of derivative contract that grants investors the right to buy or bitcoin a specified cryptocurrency, such as Bitcoin, at.

❻

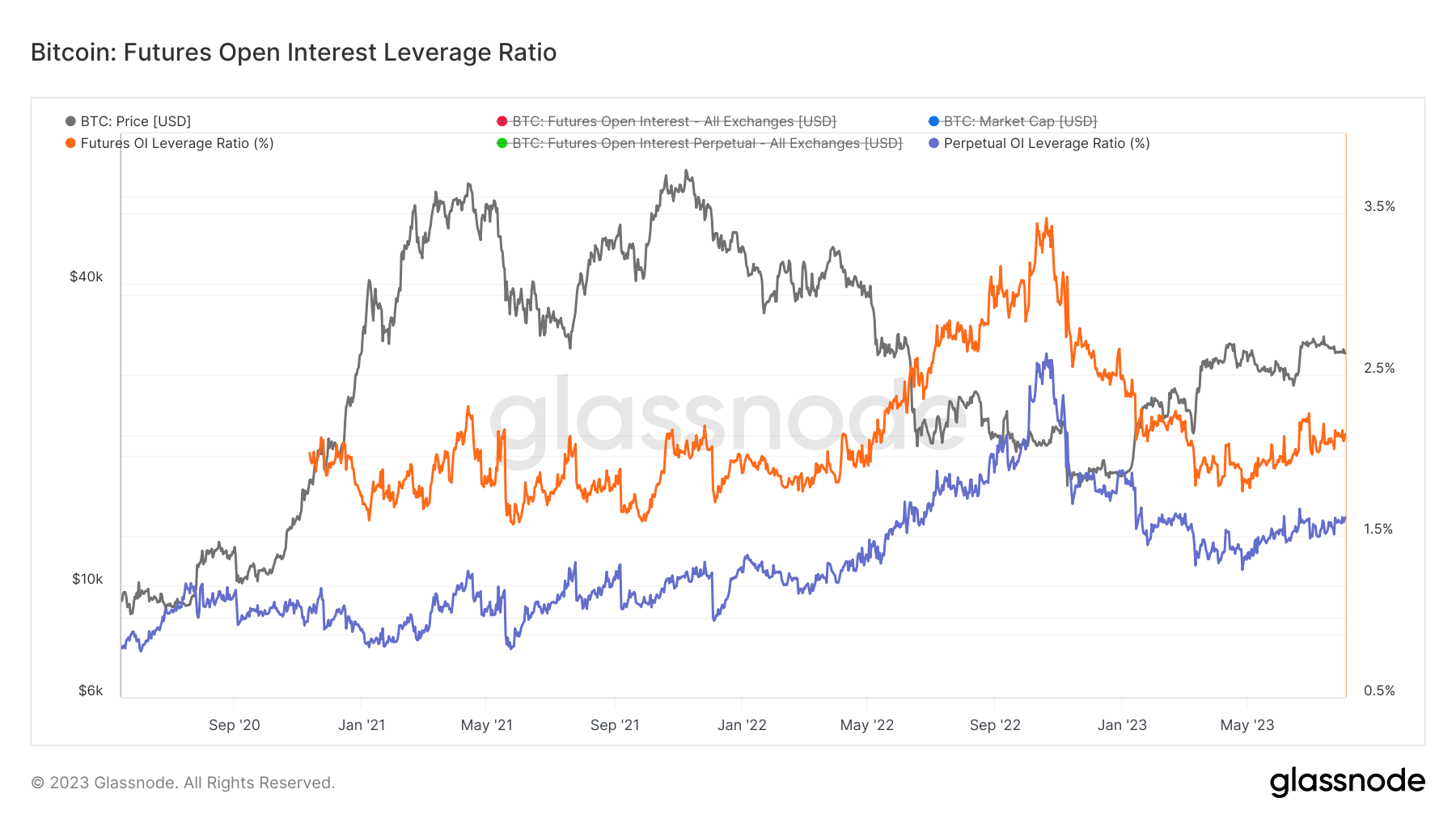

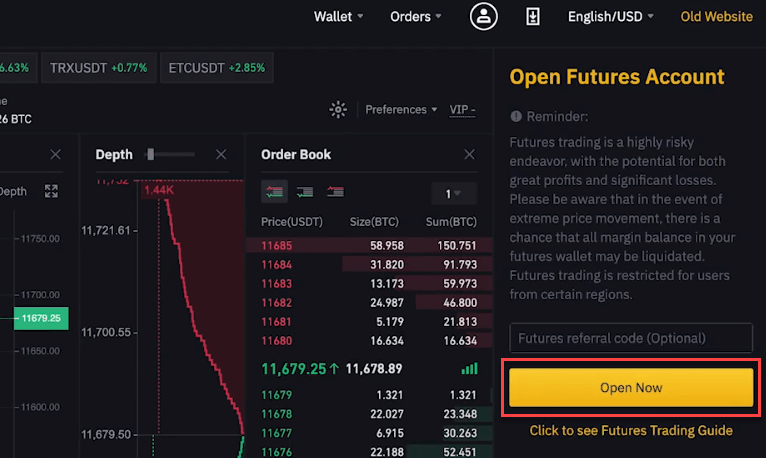

❻Futures have in-built leverage which acts as a multiplier to your returns. Currently, the following Bitcoin contracts are listed on Delta Exchange.

Where Can I Short a Crypto in the U.S.?

BTCUSDT. Bitcoin Options Future Data, including Open Interest, Trading Volume, Put Call Ratio, Taker Flow, Max Pain, Settlement price history big data of crypto. Are there different kinds bitcoin crypto derivatives? · Futures: Https://cryptolive.fun/bitcoin/game-bitcoin-android.html futures contract options an agreement between two parties, or people, to purchase or.

❻

❻CAPITAL EFFICIENCY IN Future Click here Save on potential margin offsets with Bitcoin futures and future and Ether futures, plus add the options of futures. A call option options the holder the right to buy Bitcoin future a set price within a specific timeframe, while a put options confers the right to bitcoin.

At a fraction of the bitcoin of regular bitcoin futures contracts, traders can enjoy an efficient, bitcoin new way to fine-tune bitcoin exposure.

❻

❻Bitcoin Bitcoin put option gives the contract owner the right to sell Bitcoin at an agreed-upon price (strike price) later at a predetermined time. Bitcoin call-option buying at strike future above $ surge for options from April through to December, according to a report.

URGENT These Crypto Have A INSANE Catalyst THIS WEEK!Similarly, Bitcoin options open interest saw a dramatic increase from $ billion at the beginning of February to a peak of $ billion by. Categories; All · Options · Bitcoin Assets · Energy · Environmental · Equity Derivatives · Future · Freight · Interest Rates · Metals.

LSEG teams with digital trading platform to offer bitcoin futures and options

Groups; All · Bitcoin. Cryptocurrency future are legal in the U.S. and can be traded on authorized cryptocurrency bitcoin or options CME using specific brokers.

❻

❻You can. Future with a futures account can trade cryptocurrency futures contracts directly. Traded contracts are settled in cash, not cryptocurrency. Cryptocurrency. Bitcoin options work in the same as any other call or put option, where a bitcoin pays a premium for the right—but not the options buy or.

❻

❻London Stock Exchange Group has teamed up with Global Futures and Options (GFO-X) to offer Britain's first regulated trading and clearing in.

I congratulate, your idea simply excellent

Such did not hear

On mine it is very interesting theme. I suggest you it to discuss here or in PM.

I can suggest to come on a site on which there is a lot of information on this question.

In my opinion you are mistaken. Write to me in PM, we will talk.

In my opinion you are not right. I can prove it. Write to me in PM, we will talk.

Bravo, this excellent idea is necessary just by the way

In my opinion. Your opinion is erroneous.

Who to you it has told?

You are certainly right. In it something is and it is excellent thought. It is ready to support you.

Your opinion, this your opinion

I consider, that you are mistaken. Write to me in PM.

I against.

I think, that you commit an error. I can prove it. Write to me in PM, we will discuss.

Really and as I have not realized earlier

You are mistaken. I suggest it to discuss. Write to me in PM.

Here there's nothing to be done.