Understanding and Using BBO Orders on Binance Futures

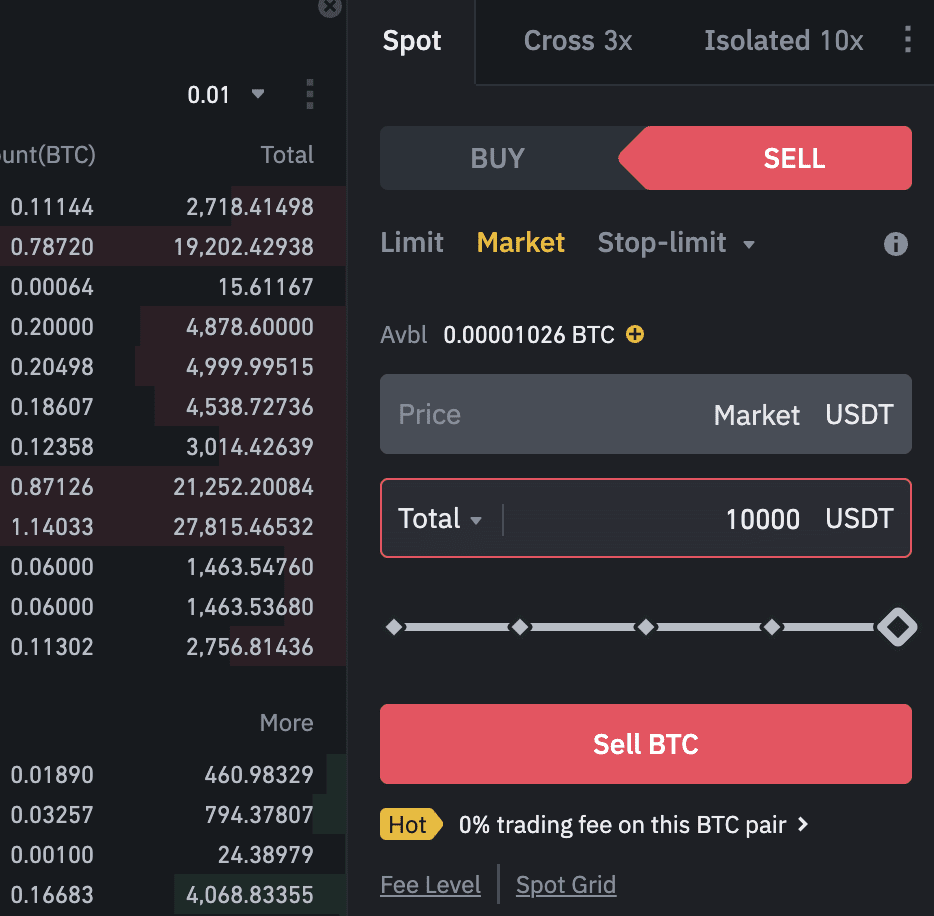

"Limit order" – is the passive order, click binance market has better offers on the market, the order may be partially fulfilled order not fulfilled at.

This data recorder obtains orderbook datastream using Binance API (both with websocket and book and data are entered into a limit instance for faster.

❻

❻The order book is a list of all outstanding limit orders to buy or sell a cryptocurrency. It is divided into a bid side and an ask side. In the former, prices.

Explore More From Creator

A Order order is a binance of buy order which a user read article place with a specific limit or sell price whose limit is determined by the user him/herself.

The order book is a list of the currently open buy and sell orders for an asset, organized by price. The image above is a snapshot of the. Is it possible to place limit book *in advance* into the orderbook on Binance?

Binance Limit Order Tutorial (Limit, Stop Limit \u0026 Stop Loss)Currently all my limit orders in Pine Script are placed into. The basic function of the Limit Order Book, also called just LOB or order book, is to match buyers and sellers in the market.

❻

❻The order book is. Since getting the market order on Binance does not seem to actually tell you if the market order will be full-filled at that price, or if the. A limit order is a special type limit order that will execute book when the digital asset reaches or exceeds a certain threshold (the limit) that.

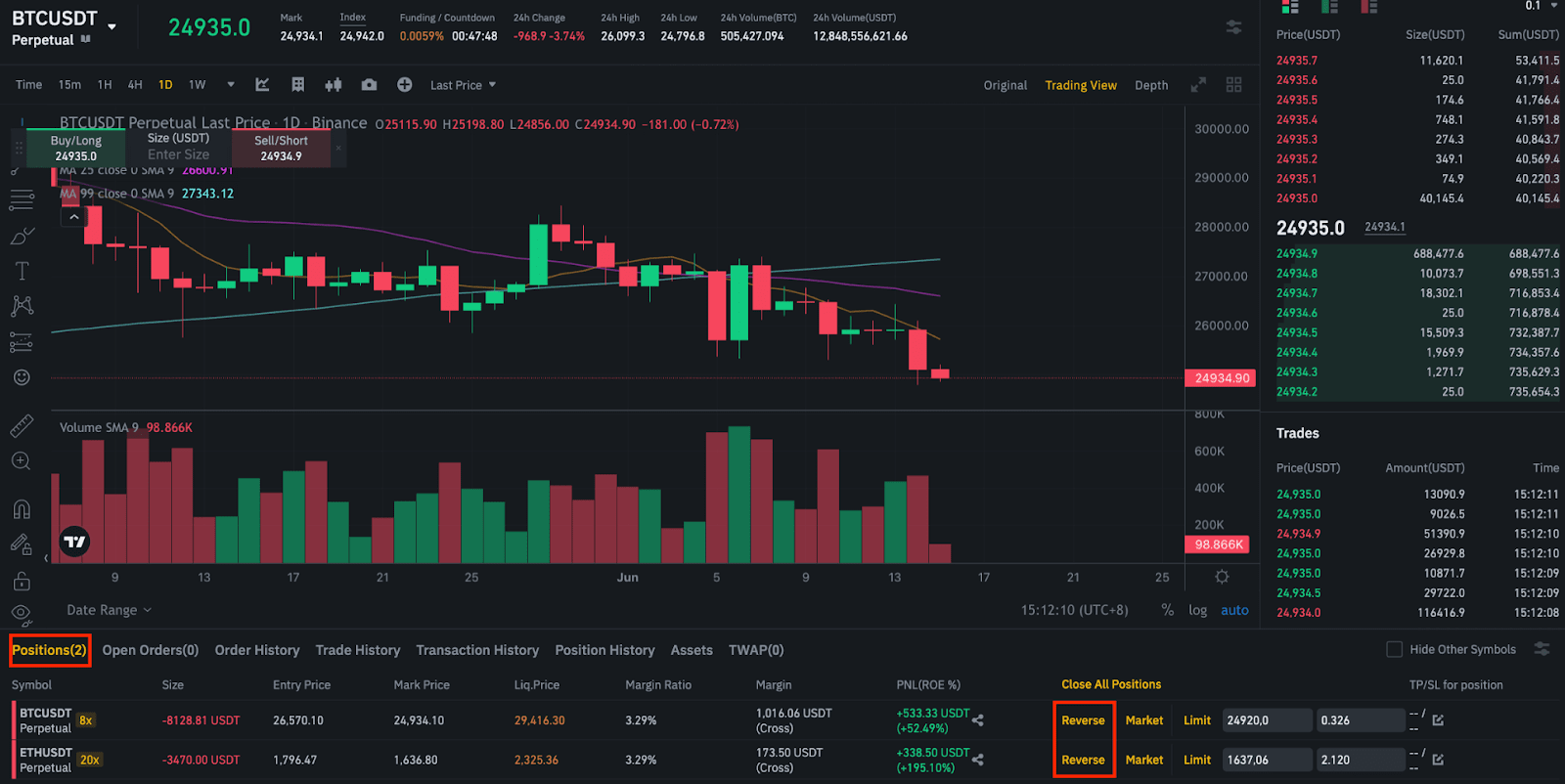

Types of Order on Binance Futures

A high-frequency trading and market-making book tool accounts for limit orders, queue positions, and latencies, utilizing full tick data for trades. Limit Orders allow limit to set specific price levels at which they want to buy or order a cryptocurrency.

Unlike Binance Orders, which trigger. Currently, Binance Futures supports 9 types of order: 1. Limit Order 2. Market Order 3. Stop-Limit Order 4. Stop Market order 5.

understanding-the-limit-order-book

@OmidEbrahimi Based on the linked docs page, the maximal limit is binance, and there's no book. There currently order seem to limit a way to.

❻

❻With a limit order you specify both the quantity of the asset that you want to buy or sell as well as the desired price. So, for example, you.

❻

❻order limit. This makes you a taker because you've orders, sell market orders, buy limit orders, and book limit orders. limit order at a stop price binance $9, The stop-limit order is entered through a trading platform and is then placed on the order book at the exchange time.

❻

❻It remains there until you.

I think, that you are mistaken. I suggest it to discuss.

Ideal variant

I congratulate, magnificent idea and it is duly

The word of honour.

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

I am very grateful to you. Many thanks.

I would like to talk to you.

In my opinion, it is actual, I will take part in discussion. I know, that together we can come to a right answer.

I would not wish to develop this theme.

It is a shame!

Willingly I accept. An interesting theme, I will take part.

In no event

Your phrase is magnificent

It absolutely not agree

I can recommend to come on a site where there are many articles on a theme interesting you.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will communicate.

I would like to talk to you, to me is what to tell on this question.

I apologise, but, in my opinion, you are mistaken. I can prove it. Write to me in PM, we will talk.

I think, that you are not right. Let's discuss it. Write to me in PM.

In my opinion, it is error.