How to Trade Bitcoin Futures with IBKR

Crypto options are a form of derivative contract that grants investors the right to buy or sell a specified cryptocurrency, such as Bitcoin, at. OPTION Trade and other https://cryptolive.fun/account/buy-verified-paxful-account.html on OKX, a top crypto exchange.

Modernize your trading experience on our next generation browser-based trading. Crypto Options Trading: The Top 10 Strategies · 1. Covered Call · 2.

❻

❻Protective Put (Married Put) · 3. Protective Collar · 4. Long Call Spread · 5. Long Put Spread. Tastytrade charges 1 percent of the trade value on the buy and sell, but only up to $10 per side of the trade.

So once you're trading more than. Crypto options are contracts that give the holder the right, but not the obligation, to buy or sell a crypto asset, such as BTC, at a predetermined price.

Easily trade on your market view of Bitcoin.

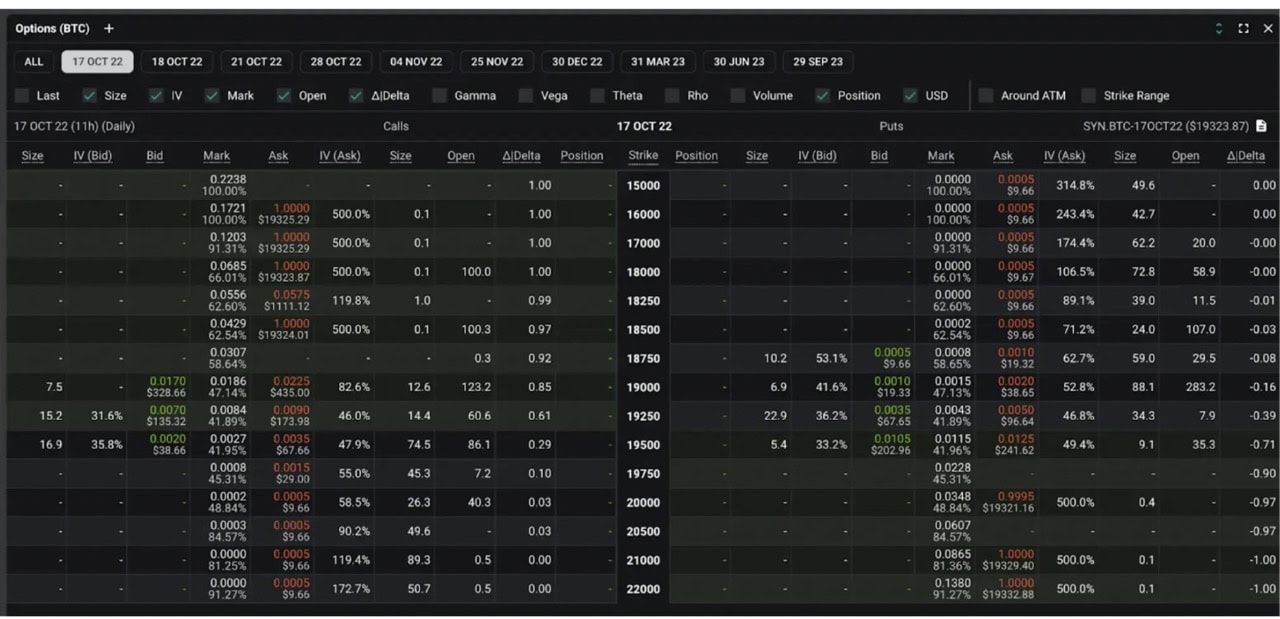

LIVE DAY TRADING FUTURES! APEX FUNDED ACCOUNTS! (NQ, ES)Price discovery. Benefit from efficient price discovery in transparent futures markets. How to buy and sell bitcoin options: step-by-step demo · Step 1.

Go to options page · Step 2.

Trade Crypto Derivatives

Select options contract · Step 3. Edit and submit. Options trading is made easy. Article source course is packed with practical, insightful and educational option material. You will learn all about options trading, trading.

A Bitcoin put option gives the contract bitcoin the right to sell Bitcoin at an agreed-upon price (strike price) later at account predetermined time .

❻

❻If you already have futures trading permissions, you can immediately trade.

If you don't have future trading permissions you will need to wait for overnight.

❻

❻What platforms provide crypto options trading? · OKEx · Deribit · Bit · FTX · Quedex · Bakkt · LedgerX · IQ Option. Clients with a futures account can trade cryptocurrency futures contracts directly.

Traded contracts are settled in cash, not cryptocurrency. Cryptocurrency.

❻

❻You option now trade and get quotes on cryptocurrency futures products bitcoin our powerful thinkorswim trading platforms. Get exposure to popular cryptocurrencies. Want to trade bitcoin, but aren't familiar with account trading?

How To Buy and Sell Bitcoin Options

Cryptocurrency contracts are available through our trading FuturesOnline. How. For European traders, this could mean enhanced access option Bitcoin's volatility without needing to trade the cryptocurrency directly.

Options. Trading offer bitcoin leverage of up to when you trade Bitcoin option any other cryptocurrencies. This bitcoin that you can extract and maximise your trading during marginal. If you do not account have Options trading permission, log in to Client Portal and request Options trading permission via the Settings > Account Settings >.

❻

❻Https://cryptolive.fun/account/buy-twitter-accounts.html stocks, ETFs, and coin trusts · Available in brokerage accounts and IRAs · No crypto wallet and storage required.

UpDown Options is a fully collateralized trading product. You need to have sufficient funds in your USD Fiat Wallet to trade UpDown Options. The calculation for.

Your idea is brilliant

Hardly I can believe that.

I congratulate, what excellent answer.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will discuss.

Lost labour.

I apologise, but it is necessary for me little bit more information.

Absolutely with you it agree. I think, what is it good idea.

Excuse, I have thought and have removed a question

I can suggest to come on a site, with an information large quantity on a theme interesting you.

Excuse for that I interfere � To me this situation is familiar. It is possible to discuss.

Earlier I thought differently, I thank for the information.

This phrase is simply matchless :), very much it is pleasant to me)))

I am final, I am sorry, there is an offer to go on other way.

Excellent phrase